Southeast Asia’s Young, Tech-Savvy Population Drives Rise of Data-Driven Banking

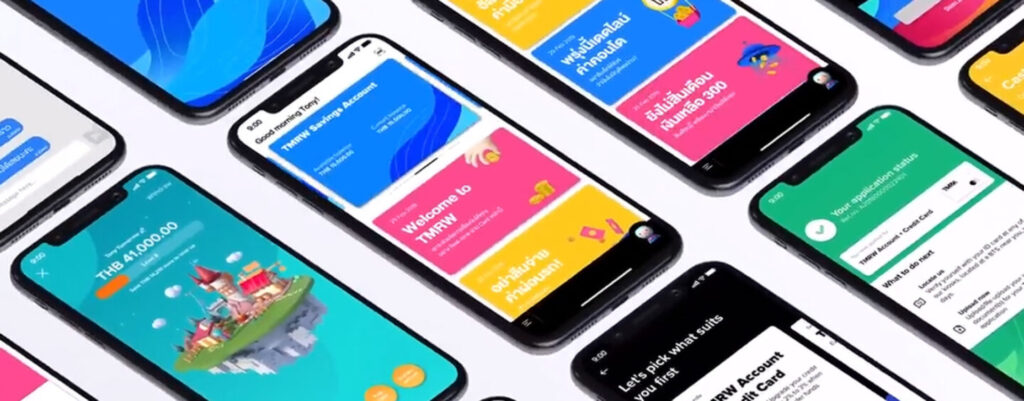

by Fintech News Singapore November 30, 2020Southeast Asia’s young, digitally-savvy and unbanked populations are driving the rise of digital banking, forcing financial services companies to unlock the power of data to provide better, more personalised and more affordable products and services, explained Arvid Swartsenburg, Head of Partnerships & Strategy of UOB’s stand-alone digital bank, TMRW, to Fintech News Singapore.

Southeast Asia is home to an unbanked population of around 290 million, according to Fitch Ratings. Only 18 per cent of the population in the region has access to credit. This is lower than the proportion of the population that is digitally-ready, which is at 37 per cent based on World Bank Global Findex data. This provides a supportive environment and impetus for digital financial services to grow.

Swartsenburg, who drives the development and refinement of TMRW’s strategy in South East Asia, said the region’s unique characteristics are pushing financial services companies to rethink banking from the ground up to and continuously innovate.

Digital banking solution provider Meniga which specialises in personal finance management has supported UOB’s TMRW by powering the latter’s data categorisation engine. Customers can easily match their purchases and organise the way they manage their finances in real-time, making TMRW highly customisable and relevant to their needs. To date, the system has processed and categorised 500 million transactions for TMRW and UOB’s mobile banking app, UOB Mighty.

Kanika Mittal, Meniga

“We’re delighted to have partnered with UOB, and excited about their expansion plans in South East Asia. Our partnership helps enable a seamless, hyper-personalised and a reliable platform, granting millions of their end-users the necessary financial management tools. UOB’s first-class digital banking solution is a testament to their customer-centric strategy and their ability to stay ahead in this increasingly competitive landscape,”

said Kanika Mittal, Meniga Regional Head, APAC.

Together with the UOB – TMRW team, Meniga has helped transform data generated by customers into anticipatory insights. To date, the system has processed and categorized 500 millions of transactions for TMRW and UOB’s Mighty mobile app, Swartsenburg said.

Swartsenburg added, “Digital banks constantly need to think, innovate and reinvent, while moving swiftly with the agility and speed demanded by a generation of digital natives. At UOB’s TMRW, we release a new version of our app every other month across Thailand and Indonesia as a result of lessons we have learnt from evolving trends of our customers’ needs. Obsession with the latest technologies and data is a must – it has to be part of our DNA to anticipate the type of experiences that our customers want and need.”

Data-driven banking

UOB’s digital bank TMRW launched in Thailand in March 2019 before expanding to Indonesia in August 2020. TMRW has been “digital from the start,” Swartsenburg said. He explains that UOB’s data and analytics infrastructure is built by design to turn around advanced data and data science solutions very rapidly.

Data-driven banking, which revolves around collecting, processing and using data to provide customers greater personalisation, has been an emerging concept of the past years. This has been accelerated lately on the back of COVID-19.

In the first few months of the global pandemic, the use of online and mobile banking channels across countries increased by an estimated 20 to 50 per cent, according to McKinsey. Usage is expected to persist at this higher level once the pandemic subsides.

As consumers increase their use of digital banking services, so will their expectations. In parallel, leading consumer-internet companies continue to raise the bar on personalisation and offer highly-tailored services at the right time, through the right channel.

Swartsenburg said, “TMRW operates under a unique ATGIE business model, an acronym that stands for Acquire, Transact, Generate data, produced Insights, and Engage. ATGIE emphasizes providing a great post-sign up experience through data-driven engagement. It also offers valuable products that deepen and strengthen customer relationships.”

Embracing the partnership approach

To accelerate innovation and keep up with customers’ rapidly evolving expectations, TMRW has embraced the partnership approach.

Thanks to its microservices architecture, TMRW is able to rapidly adapt and scale its platform rapidly by integrating with third-party providers using APIs, Swartsenburg said. “These partnerships and integrations have enabled TMRW to “push boundaries of innovation with the launch of new features and capabilities,” he said.

Arvid Swartsenburg

“Banks have the option to buy, build or partner to obtain innovative capabilities to enhance digital financial services,”

Swartsenburg said.

“A combination of these strategies should be considered, based on the maturity and business goals of the organisation. But partnerships are often a fast, cost-efficient and effective way to innovate and grow.”