Digital banks are proliferating in Asia on the back of favorable regulatory changes, market liberalization pushes by governments, and enhanced digital penetration by consumers.

In Singapore’s digital banking race, the Monetary Authority of Singapore granted 4 digital banking licenses with SEA Group and the Grab-Singtel consortium securing the full digital banking license.

Across the causeway, in Malaysia, roughly 40 parties have registered their interest in Bank Negara Malaysia’s digital banking license, the new regulatory framework is anticipated to spur massive funding rounds in Malaysia.

Just last month, Vietnamese ride-hailing company Be Group launched its digital banking offering Cake in partnership with VPBank. Integrated into the Be app, Cake provides products and services like a traditional bank, including a checking account and its accompanying debit card, money transfers, bill payments and savings accounts. With over 10 million customers, Be claims to account for nearly a third of the Vietnamese ride-hailing market.

In Indonesia, industry insiders expect 2021 to see several tech companies racing to launch their digital banking through partnerships and acquisition deals. Evidences suggest that next in line could be ride-hailing decacorn GoJek, Singaporean consumer Internet company the Sea Group, and e-commerce unicorn Bukalapak.

Competition heats in Asia’s Digital Banking Scene

These new players will be joining an increasingly competitive landscape where digital pure players and consortia are already fiercely competing against incumbents that are introducing digital offering at an accelerated pace.

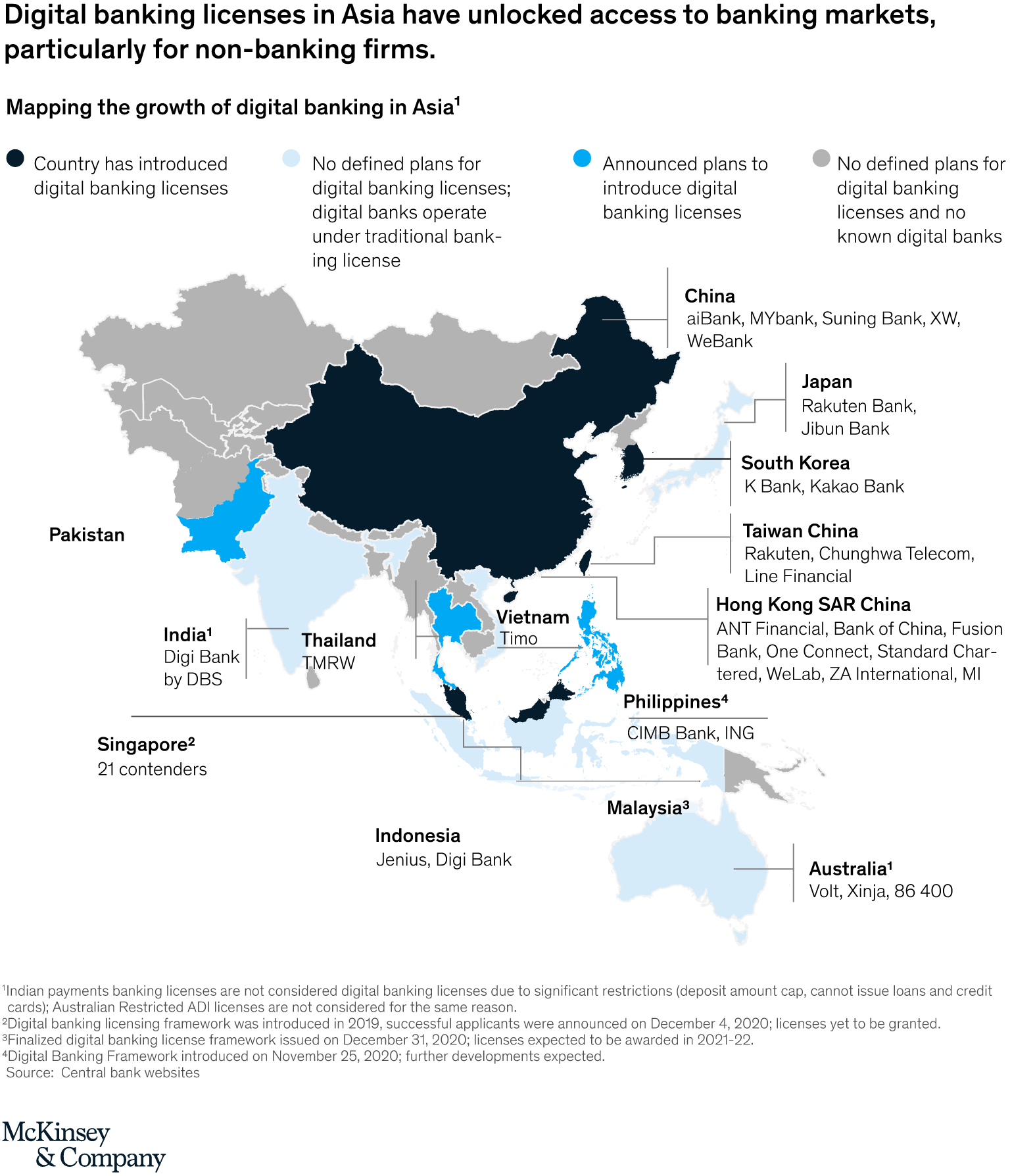

A McKinsey report released in January 2021 identified at least 30 digital banking offerings across Asia Pacific (APAC) in markets including China, Japan, South Korea, Taiwan, Hong Kong, India, Thailand, Vietnam, the Philippines, Indonesia, and Australia.

Digital banking in Asia, McKinsey, Jan 2021

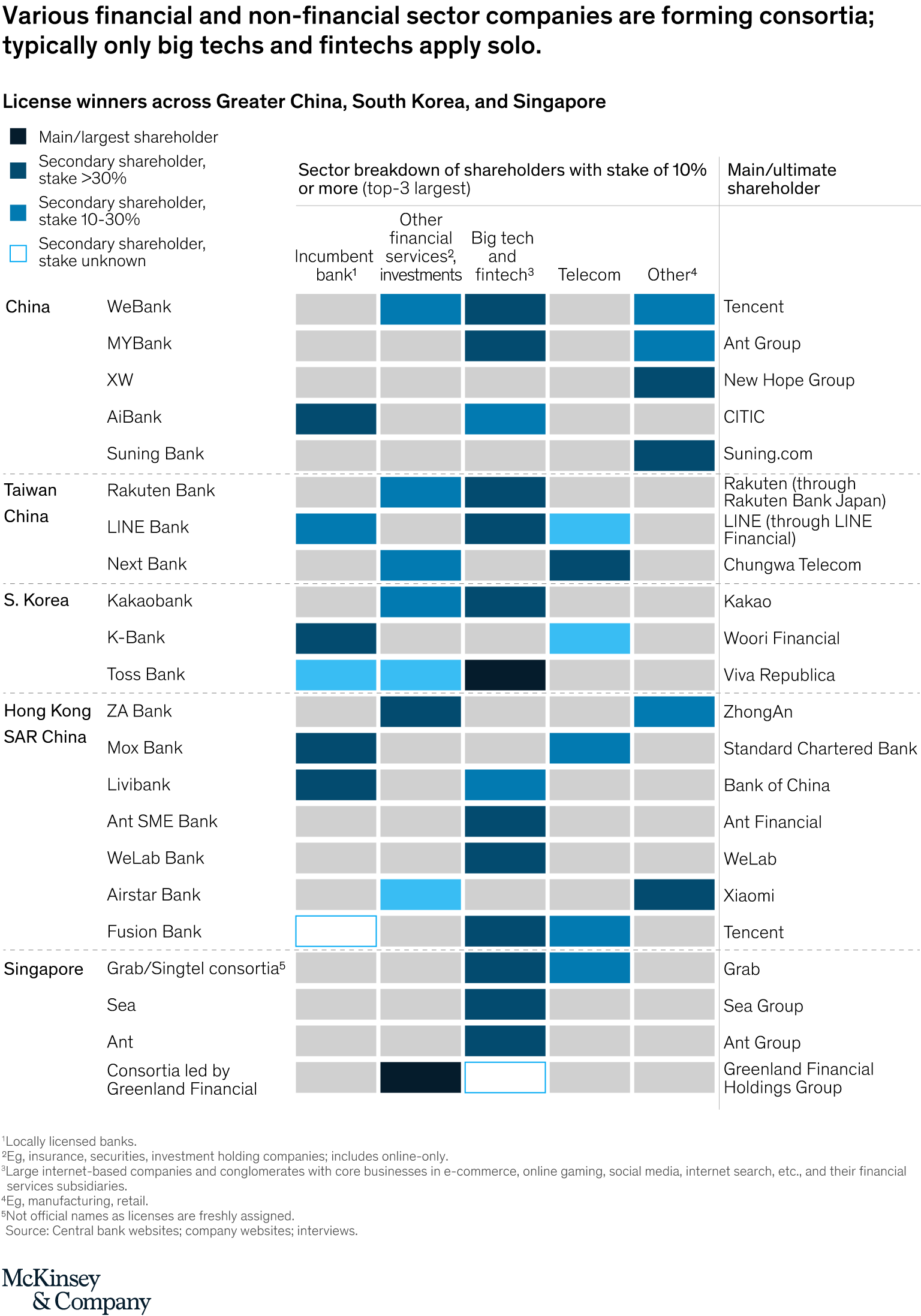

Successful digital banks in Asia often operate under a consortium business model which gives them a path to scaling relatively quickly, the report notes.

Examples include Tencent-backed WeBank, which serves some 200 million people, and Alibaba-supported MYbank, which counts more than 20 million small and medium-sized enterprise (SME) customers.

Not only that, but consortia have so far been awarded the highest number of licenses in recent licensing processes in Taiwan, South Korea and Hong Kong. In Hong Kong, five of the eight digital banking licenses were awarded to groups of companies, including Fusion Bank, which is led by Tencent and ICBC, and Standard Chartered-led Mox, which is backed by HKT, PCCW and online finance company CTrip Financial.

In South Korea, Toss Bank, a consortium led by fintech firm Viva Republica, was granted a preliminary license to operate an internet-only bank in December 2019, and plans to launch operations in mid-2021. Toss Bank would be the country’s third Internet-only bank.

In Singapore, two of the four nominees eventually awarded digital banking licenses were consortia: the Grab-Singtel tie-up, which bagged a digital full bank license; and a consortium comprising Greenland Financial Holdings, Linklogis Hong Kong, and Beijing Co-operative Equity Investment Fund Management, which was granted a digital wholesale bank license.

Digital banking consortia in Asia, McKinsey, Jan 2021

In other Southeast Asian countries, regulators are accelerating their legislative efforts to open up the banking industry, increase competition and facilitate innovation. In Malaysia, the central bank issued the much anticipated digital banking framework in December 2020, and is expected to issue up to five licenses by Q1 2022.

The Philippines, while being home to several digital banking offerings from incumbents including CIMB and ING, introduced its digital banking framework in November 2020. The central bank received its first application in January 2021 and four other parties have shown interest in the licensing regime.

And in Indonesia, the country’s financial watchdog is set to outline by the middle of this year how digital banks should operate, one of its top officials told The Straits Times earlier this month.

Banks and digital challengers to co-exist

These new market entrants are joining an increasingly competitive landscape where incumbents are rapidly digitalizing their offerings. The COVID-19 pandemic has forced customers to turn to digital channels and mobile banking, leading many of these incumbents to witness record growth levels over the past year.

In Singapore, customer sign-ups for DBS Bank’s Digibank mobile app rose by 216% between June and August 2020 compared to the same period the previous year. The bank hit a record of 3.5 million digital banking customers.

OCBC Bank, Singapore’s second largest bank after DBS Bank, reported that the number of new SME accounts opened online grew 2.4 times in Q1 2020 compared to the same period the previous year.

Similarly, UOB saw a 406% increase in the online purchase of its investment products in Q1 2020 compared to Q1 2019.

Digital banks have been praised for their potential to bring financial services to the large population of unbanked individuals and small businesses across the region, but with incumbents rapidly ramp up their digital efforts, it’s still hard to tell who will come out as the winner of Asia’s digital banking race.

Undoubtedly, there is still a place for incumbents and most consumers are still more comfortable with their money in a traditional bank. A recent Accenture survey found that customers were still very skeptical of digital challenger banks, with just 10% of UK respondents placing “a lot” of trust in neobanks to look after their data, compared to 41% for traditional banks.

But digital challenger banks still have a role to play too. Using advanced technologies, digital banks can use other criteria to ascertain credit worthiness and offer loans to customers who would typically be rejected by traditional banks. Digital banks can also offer lower fees and higher interest rates due to having far less overheads to contend with such as branch rentals and ATMs to maintain.

Some may even be able to waive the need for an account minimum, effectively opening up banking access to the most vulnerable members of the society.

If you are interested to learn more about the digital banking scene in Asia, check out our webinar playlist here where we discuss and dissect the scene with industry leaders