India’s Open Banking Landscape Thrives on the Back of Digital Public Infrastructure

by Fintech News Singapore March 15, 2021Pioneered by banking incumbents, India’s open banking ecosystem has grown to become part of the Indian financial landscape and is now among one of the most advanced in the world. The development of open banking in India has been facilitated by the digital public infrastructure put in place by the government.

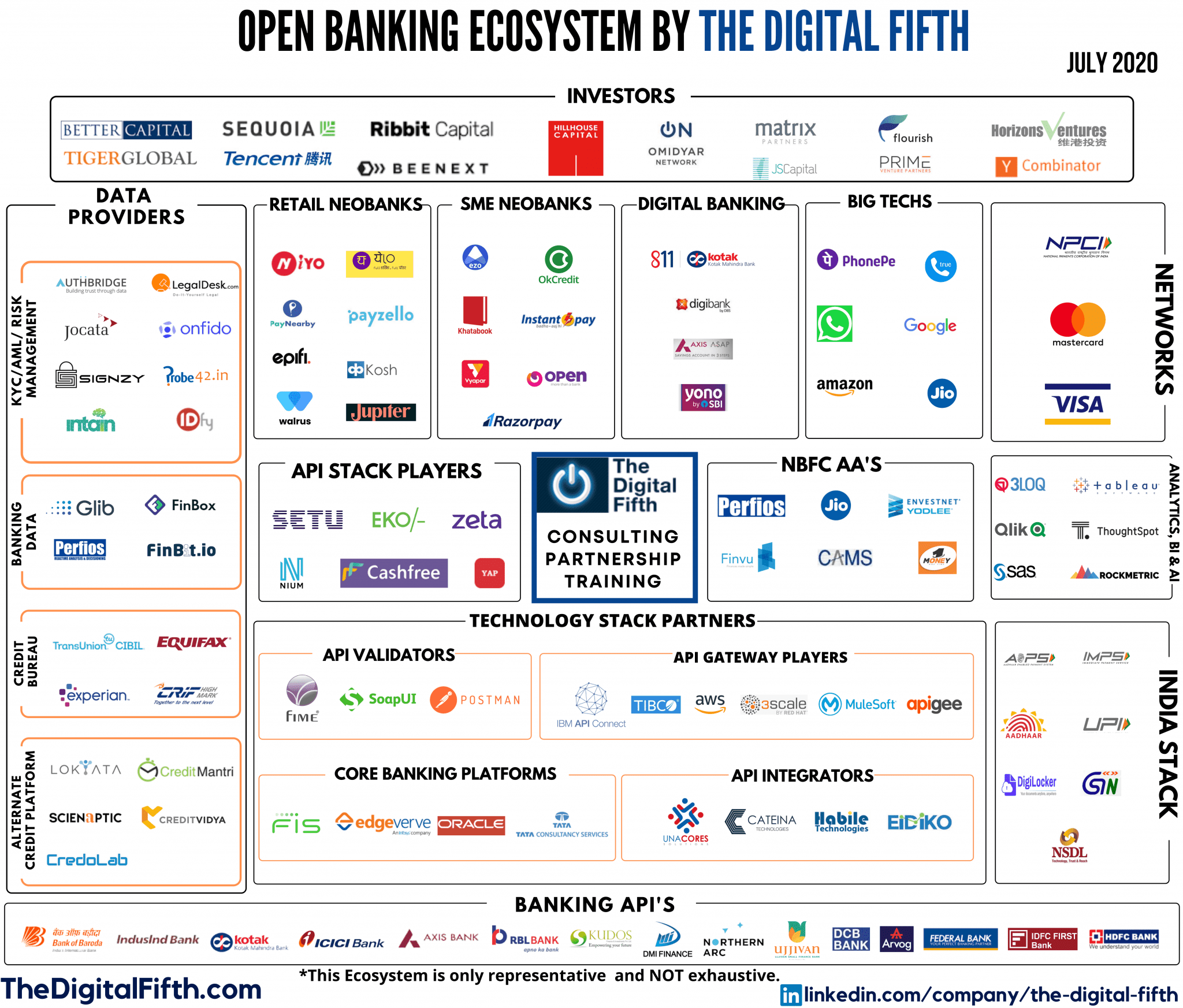

Sameer Singh Jaini and Shashank Shekhar from Indian fintech consulting and advisory firm The Digital Fifth, identify five key layers in the India open banking ecosystem as: the banking layer, the technology layer enablers at banks, the third-party API layer, the customer layer, and the enabling layer.

Banks and non-banking financial companies make up the bottom layer of the ecosystem as they provide the APIs to perform services including payments, lending, and collections. This layer is powered and supported by technology stack partners such as API integrators and API gateway players, as well as data validation and analytics specialists.

The next layer comprises the creators and providers of new solutions around and/or leveraging open banking. These include neobanks, digital banks, and bigtechs that use bank APIs for their underlying operations as well as to provide customers with specialized and tailored services.

Finally, the enabling layer comprises the investors as well the digital public infrastructure used by banks themselves and financial services providers to onboard customer seamlessly and conduct business efficiently.

India’s Open Banking Ecosystem, The Digital Fifth, July 20

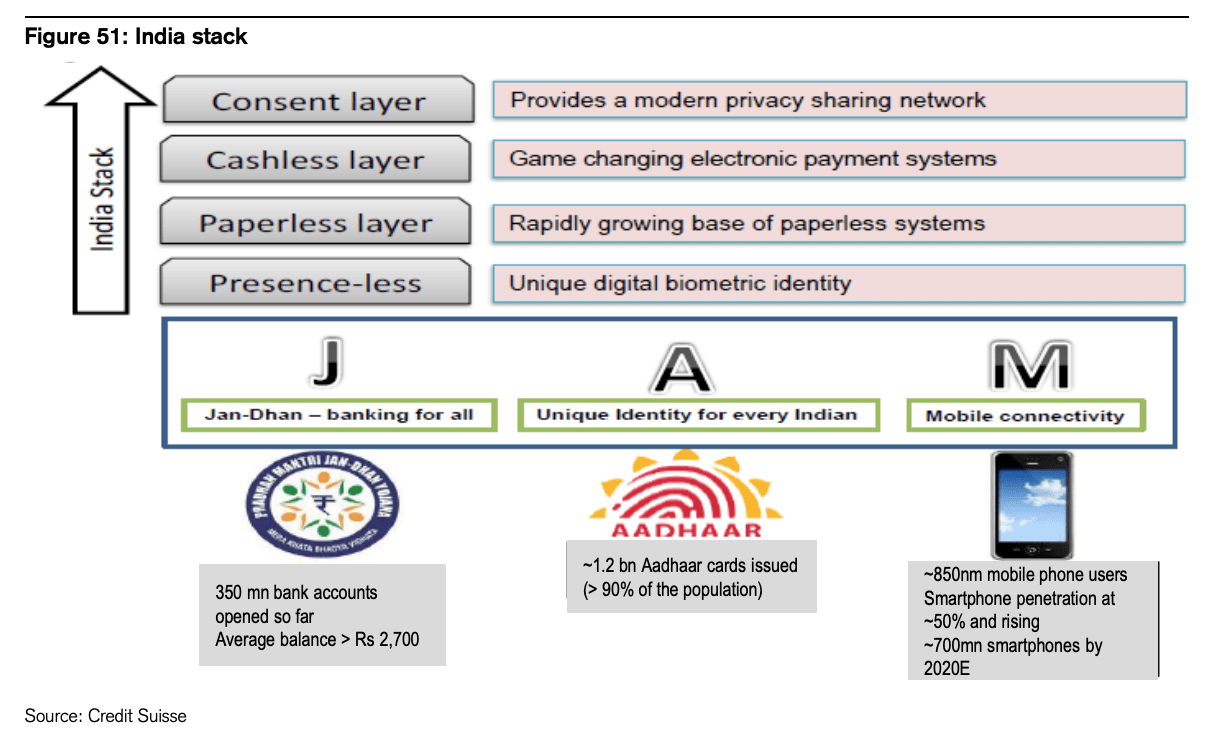

The India Stack as the foundation for open banking

Jurisdictions like the UK and Australia have adopted a regulatory-driven approach to open banking, while in countries including the US and Japan, open banking development has been driven by the market.

India on the other hand has opted for a hybrid approach where both the market and government take active roles in the ecosystem’s development. In particular, the development of the digital infrastructure known as the India Stack is often praised for being a key enabler of India’s booming open banking ecosystem.

The India Stack, an initiative introduced more than ten years ago, aims to create a unified software platform for governments, businesses, startups and developers. The initiative seeks to promote financial inclusion through increased access to financial services, improve the delivery of public services and benefits, and increase competition in the Indian financial sector.

Several APIs currently make up the India Stack. The Unified Payment Interface (UPI) is a system launched in 2016 that allows individuals to access their bank accounts from registered apps such as mobile wallets to make transactions to any other bank.

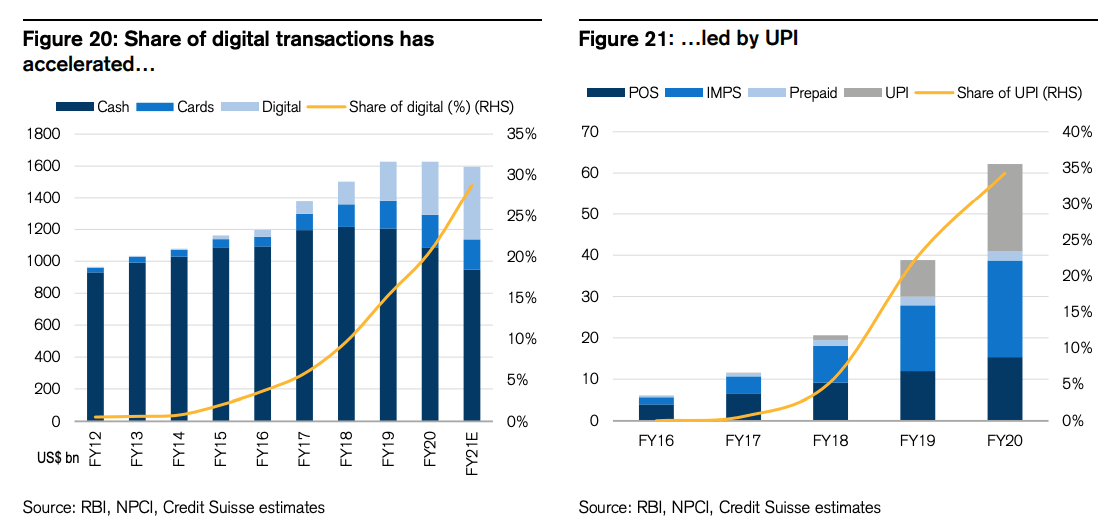

The UPI has been a major driver of accelerated payment digitalization in India, which, over the past five years has grown about 10.5 times to now constituting about 30% of retail transactions, according to a new report by Credit Suisse.

Share of digital transactions in India, Source: India Fintech Sector: A Guide to the Galaxy, Credit Suisse

The Aadhaar identification system is another key initiative by the government that has helped accelerate digital finance and open banking. Aadhaar is a 12-digit unique identity card launched by the government in 2010 to promote digital transformation. It can be used to digitally authenticated individuals for a variety of public and private services, enabling biometric checks to reliably verify the identity of the holder.

The Aadhaar system has been extended to enable electronic know-your-customer (eKYC), allowing banks to digitally onboard customers and drastically reduce operational costs of verifying the identity of customers.

Aadhaar is reportedly the world’s largest biometric identity system, crossing the 1.25 billion mark in 2019.

Other APIs available include eSign, an online electronic signature service to facilitate an Aadhaar holder to digitally sign a document, and DigiLocker, a digital locker facility for documents.

In September 2020, the government released a draft policy, titled the Data Empowerment and Protection Architecture (DEPA). The proposed framework aims to build a consent-based data sharing infrastructure to accelerate financial inclusion.

These systems are the four layers of the India Stack: the first is the “presenceless layer,” featuring the Aadhaar digital identity system; the second is the “cashless layer” built on the UPI system; the third is the “paperless layer” with eSign and DigiLocker; and the fourth is the “consent layer” that’s now being built.

India Stack, Source- Source: India Fintech Sector: A Guide to the Galaxy, Credit Suisse, Feb 2021