Only 5% of The World Challenger Banks Are Profitable, Most of Them Are From Asia

by Fintech News Singapore June 30, 2021Out of the 50 digital challenger banks operating in Asia Pacific (APAC), just ten operators are profitable. These providers are primarily located in China and Japan, indicating that the two nations offer the most mature and developed digital banking landscapes in the region, according to a new analysis by the Boston Consulting Group (BCG).

In a new report titled Emerging Challengers and Incumbent Operators Battle for Asia Pacific’s Digital Banking Opportunity, BCG looks at the neobanking and digital banking landscape, and explores why Southeast Asia and India are emerging as the next growth markets.

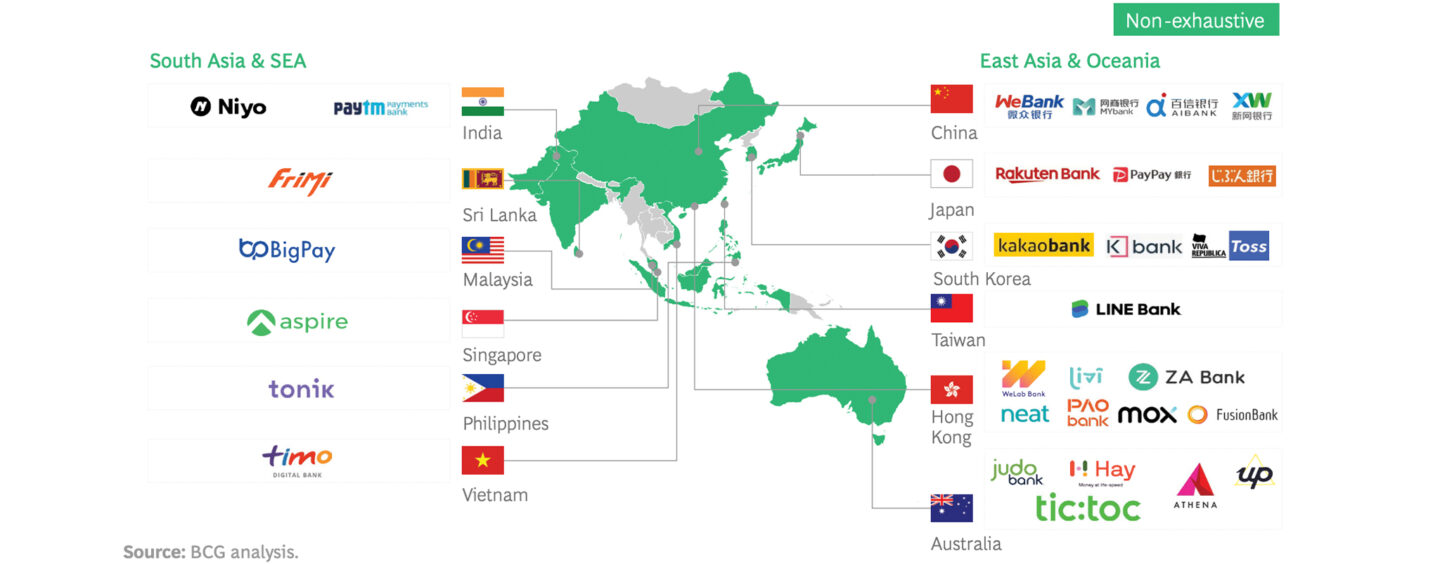

50 Digital Challenger Banks in APAC, Source: Emerging Challengers and Incumbent Operators Battle for Asia Pacific’s Digital Banking Opportunity, BCG, June 2021

APAC’s most successful digital challenger banks

Globally, BCG identified 249 digital challenger banks as of the end of 2020. Despite witnessing significant growth over the past years, the route to profitability remains to this day challenging for operators.

Globally, just 13 digital challenger banks, or less than 5% of the total, have achieved break-even, and ten of these players are located in APAC, offering an encouraging outlook for the region’s digital banking landscape.

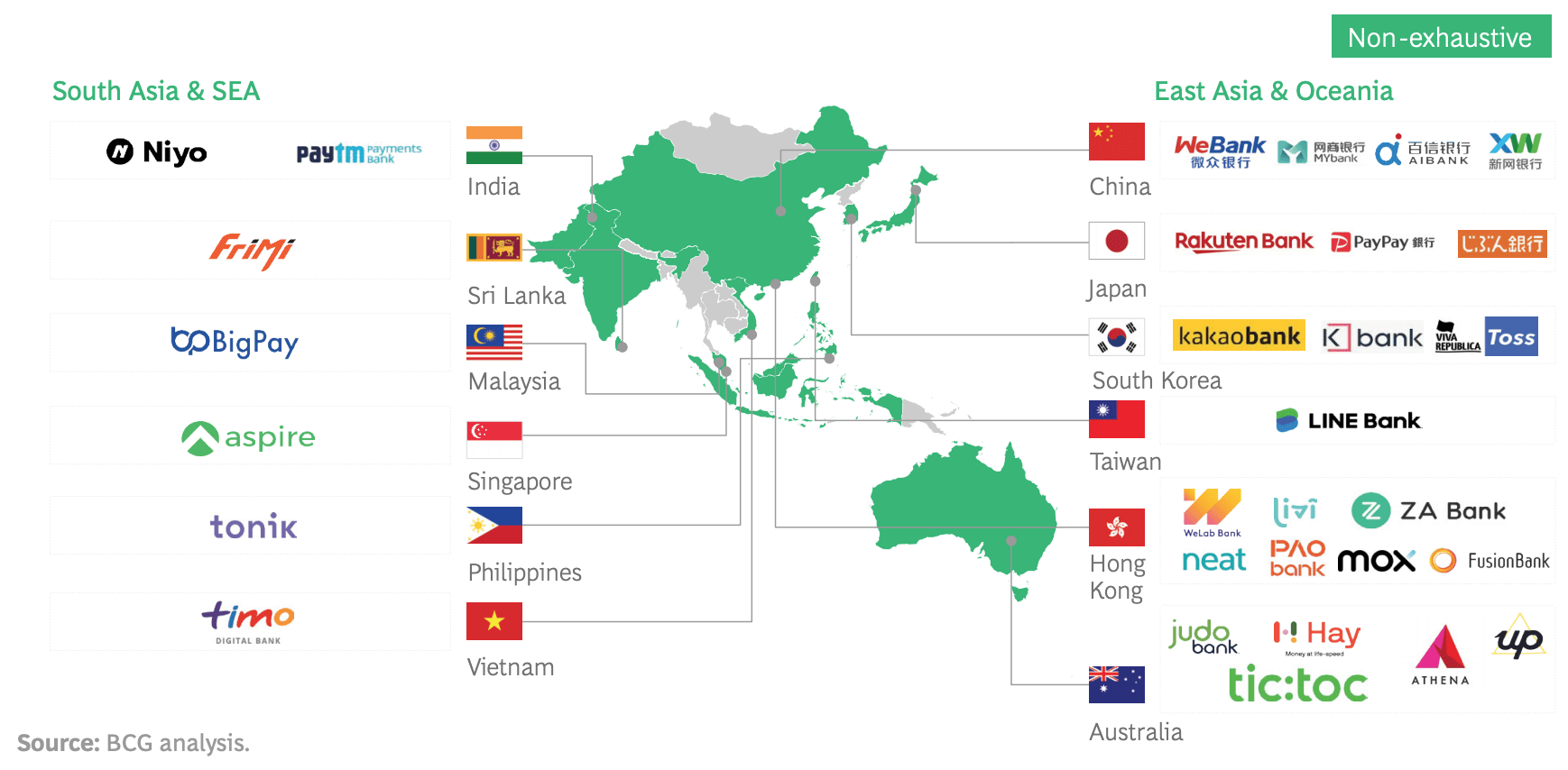

Breaking down APAC’s profitable digital challenger banks, four are located in China (WeBank, MYbank, Aibank and XW Bank), four in Japan (Rakuten Bank, Sony Bank, Jibun Bank and PayPay Bank), one in India (Paytm), and one in South Korea (KakaoBank).

WeBank and Aibank are APAC’s biggest digital challenger banks by number of users, combining about 2.2 billion users as of 2020. Overall, China’s profitable digital challenger banks served about 3 billion customers. In Japan, Rakuten Bank is the largest digital challenger bank, counting about 100 million users as of 2020.

Ecosystem of profitable Digital Challenger Banks, Source: Emerging Challengers and Incumbent Operators Battle for Asia Pacific’s Digital Banking Opportunity, BCG, June 2021

Despite these digital challenger banks being leaders in their respective markets, none of these banks have captured a market share greater than 2% in terms of total value of deposits and loans of their target segments, whether that’s retail customers and small and medium-sized enterprises (SMEs), according to the BCG research.

Southeast Asia and India as APAC digital banking leaders’ next growth markets

Southeast Asia and India are now emerging as these leaders’ next expansion markets in APAC, the report says. In Southeast Asia, Malaysia, the Philippines, Indonesia, Vietnam, and Thailand are showing encouraging signs for these digital challenger banks, including positive market liberalization and attractive market demographics.

Malaysia boasts a digitally-savvy population, and despite high banking penetration, there is still room for significant growth, particularly in the area of underserved individuals and SMEs. Malaysia recently opened up applications for digital banking licenses.

Indonesia, Southeast Asia’s most populous nation where half the population is aged 30 or younger, offers a huge market opportunity. The country demonstrates a growing appetite for digital financial services solutions, and boasts the second highest e-payment penetration in Southeast Asia, next to Singapore. Regulation for digital-only banks is currently under revision.

The Philippines, the second-most populous country in Southeast Asia, has encouraging demographics around the potential for digital banking adoption, including a young and digitally-engaged population. So far, the central bank has awarded three digital banking licenses to Tonik Digital Bank, UNObank and state-backed Overseas Filipino Bank.

Meanwhile, Vietnam has one of the fastest growing economies and a rapidly expanding banking sector. More than 40% of the population is now banked and bank cards are seeing accelerating penetration as well. Many banks are digitizing but no clear dominant winner in the digital banking space has emerged yet.

Vietnam banks digitizing, Source: Emerging Challengers and Incumbent Operators Battle for Asia Pacific’s Digital Banking Opportunity, BCG, June 2021

Finally, Thailand offers a steady and more mature economy, with relatively high banking penetration. It’s also one of Southeast Asia’s most receptive markets to digital challenger banks.

After Southeast Asia, India also offers huge potential for digital challenger banks, boasting a massive potential addressable market, encouraging demographics, a significant underserved population, and strong technology foundations, the report says.

Although these characteristics echo many of the opportunities in Southeast Asia, in terms of revenue pool, India is an order of magnitude that’s larger than Southeast Asian markets, it says.