Indonesia’s Incumbent BRI Pushes BRImo Mobile App as Part of Its Digital Banking Drive

by Fintech News Singapore May 10, 2022Bank Rakyat Indonesia (BRI), one of Indonesia’s oldest and largest financial institutions, has embarked on a major digital transformation plan by embracing data, innovative technology and industry partnerships to address changing customer expectations.

BRI’s big digital push takes the form of a mobile banking app called BRImo that promises convenience, accessibility, and a full remote, borderless experience.

It leverages artificial intelligence (AI) and partnerships with fintechs to tackle consumers’ rising demand for superior digital experiences, personalisation and seamless omnichannel engagement, a strategy that has so far proven successful.

According to Catur Budi Harto, Vice President Director of BRI, the platform has witnessed strong traction, reaching 11.7 million users by the end of July 2021, up 86.7% year-on-year.

The BRImo mobile platform

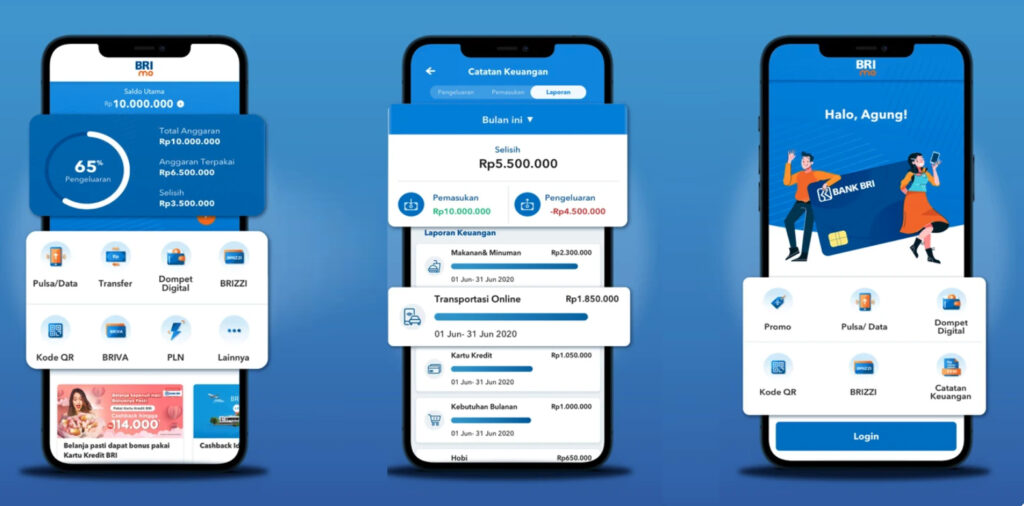

BRImo allows users to transact, make QR code payments, cardless cash withdrawals, as well as tap advanced security features for their Internet and SMS-based banking capabilities to serve their daily needs.

It’s available to both consumers and merchants, enabling, for instance, physical stores to accept cashless payments.

The app supports full remote onboarding, requiring users to only perform e-KYC, eliminating the need to physically visit a branch.

BRImo also comes with an advanced personal financial management (PFM) feature that allows customers to get a full view of their finances and gain insights into their income and expenses made through the bank’s channels.

Customers will also gain access to an extensive array of services provided by BRI’s partner companies.

Bank Rakyat Indonesia (BRI) BRImo mobile app, Source: Bri.co.id

Leveraging partnerships

For its BRImo mobile banking app, BRI is relying on an aggressive partnership strategy which focuses on building an extensive list of products and services that customers can choose from.

This strategy aims to gradually build an ecosystem within the mobile app to increase stickiness, an approach that has allowed some of the region’s tech startups to become digital leaders.

So-called superapps like Kakao from South Korea, Grab from Singapore and GoJek from Indonesia are providing an array of functionality accessible within a single app ranging from payments to online shopping to ride sharing and social media.

This tactic has allowed them to drive huge daily usage and user engagement to a massive 52 million monthly active users for Kakao, 24.7 million monthly transacting users for Grab, and more than 38 million monthly active users for GoJek.

So far, BRI has inked partnerships with players such as API platform Tokopedia, Traveloka Ayoconnect and several other fintechs.

It aims to have BRImo integrated with products from the broader banking group as well as major e-commerce platforms and fintech solutions by the end of the year.

A data-driven approach

Data and AI are other huge components of the strategy behind BRImo and BRI’s broader digitalisation plan.

BRImo uses data to provide personalisation and tailored products and services.

Separately, the bank has launched several initiatives including an AI-based virtual assistant called Sabrina that was introduced in 2018, and BRIBrain, a solution leveraging big data and AI to record, process and consolidate all information from various sources.

Aptly named, BRIBrain aims to act as “the brain” for the bank to make well-informed business decisions to enhance the quality of products and services offered through its applications.

BRI’s digital banking efforts

BRImo is just one part of BRI’s broader digital strategy, which also includes BRISPOT, a mobile app for online loan applications, Indonesia Mall, a digital commerce service for micro, small and medium-sized enterprises (MSMEs), and CERIA, an online loan facility.

Separately, BRI’s subsidiary Bank Rakyat Indonesia Agroniaga (BRI Agro) is looking to become a full-fledged digital bank.

It recently rebranded to Bank Raya Indonesia (Bank Raya) to reflect this shift and its ambitions to become a financial services powerhouse for the country’s SMEs.

BRI Agro is currently one of the seven companies awaiting a digital banking license.

BRI’s digital banking push comes amid accelerated digitalisation efforts from Asia Pacific banks to keep up with the rising demand for seamless, digital experiences, and as a response to growing market competition.