New Report Assesses Digital Lender Impact on Southeast Asian MSMEs

by Fintech News Singapore December 14, 2021In Southeast Asia, micro, small and medium-sized enterprises (MSMEs) are the backbone of the economy, making up for 97%-99% of the region’s total enterprises and contributing between 52% and 97% of total employment.

Yet, despite their centrality to national economies, MSMEs still face major barriers to obtaining the financing necessary to maintain and growth their businesses, according to a new report by SME digital financing platform Funding Societies.

Of the 73 million MSMEs that operate in the Association of Southeast Asia Nations (ASEAN), around 39 million (51%) are either unserved or underserved by traditional lenders. This is leading to a financing gap of US$272 billion which Funding Societies is striving to tap into.

The report, which draws on findings from a survey conducted amongst Funding Societies-linked MSMEs, delves into the social and economic impact of the company’s financing capabilities, and gives key insights into how these funds are being used.

Results from the survey show that Funding Societies has provided MSMEs with much needed working capital, facilitating the smoothing of cash flows, and has helped MSMEs fund their expansion plans and increase productivity.

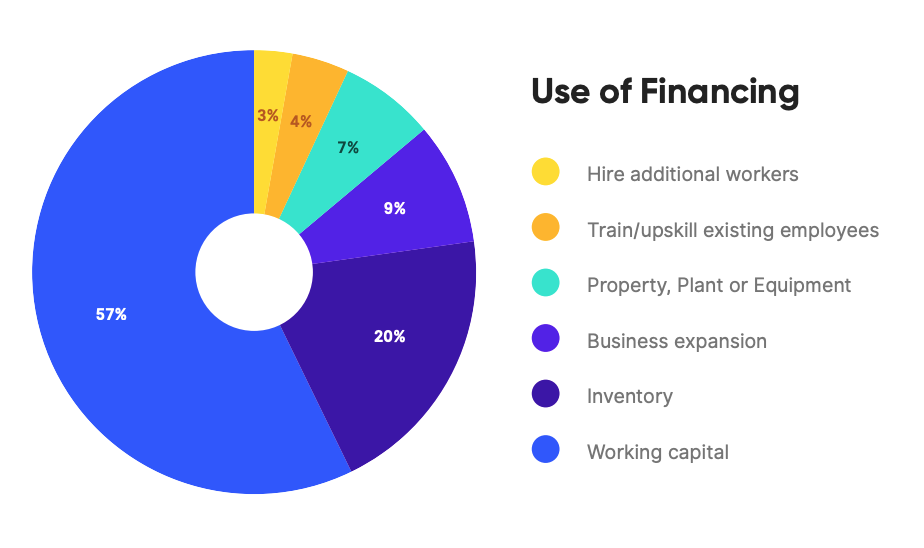

Out of the 400+ MSMEs polled, 57% said they used a portion of their loan proceeds for working capital, 20% used the capital for inventory, and 9% used it for business expansion. Overall, a staggering 72% said financing from Funding Societies has helped them boost their revenue.

How Funding Societies loan proceeds are used by MSMEs, Source: The Economic Impact of Funding Societies to MSMEs in Southeast Asia

MSMEs face numerous obstacles in borrowing funds from traditional lenders because they are small, less diversified, and have weaker financial structures and limited transaction history.

Against this backdrop, fintech startups have emerged in Southeast Asia to help bring the funding gap.

Using technologies including artificial intelligence (AI) and machine learning (ML), these companies are able to enhance various aspect of the MSME financing process by, for example, providing valuation tools and underwriting services. They are also able to make better use of alternative sources of data and technology to supplement traditional credit information, allowing them to adapt to the unique challenges and needs of MSMEs.

Funding Societies, which started in 2015, has financed over US$1.8 billion through more than 4.8 million loans to nearly 100,000 MSMEs in Southeast Asia. The company estimates that the MSMEs it has backed have added US$3.6 billion to gross domestic product (GDP), and created more than 346,000 new jobs over 2018 and 2019 alone.

Headquartered in Singapore, Funding Societies is the largest SME digital financing platform in Southeast Asia. It provides business financing to SMEs that’s funded by individual and institutional investors.

This year, it expanded into its fourth market, launching in Thailand in February, and started venturing in green financing. Funding Societies’ Green Microloans offers eligible MSMEs a 40% discount on interest.

These companies must satisfy one of the three green criteria: belonging to an industry that promotes environmental and climate solutions, embarking on a project that has clear tangible outcome for the environment and climate, or working towards or already holding an industry recognized green certification.

Funding Societies is currently looking to raise US$120 million in institutional debt to address the financing needs of Southeast Asia’s MSMEs.