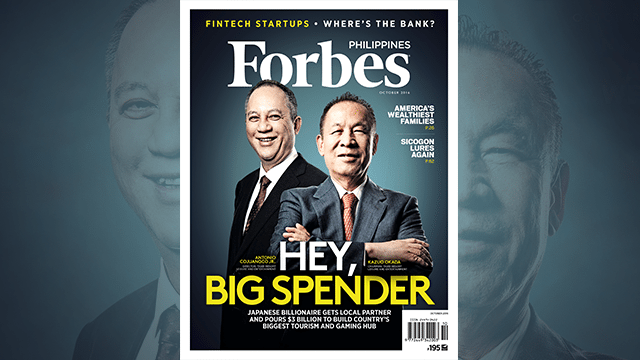

Forbes Philippines has published a list of the country’s leading fintech startups in the magazine’s October 2016 issue.

Photo from Forbes Philippines

The list includes 24 fintech startups in the country. The magazine also noted that the footprint of fintech startups is rapidly expanding in the last five years. These offer a variety of Internet-based financial services such as remittance, payments and lending. Five of the companies in the list were established just last year.

Apart from the list, the issue also published articles on 2 fintech startups in the Philippines: Coins.ph and PawnHero. Coins.ph, incorporated only in 2014, offers Bitcoin-related services such as payments and remittances. PawnHero is a digital pawnshop also established in 2014 with a reported gross revenue of P7.4 million.

24 Top Fintech Startups in the Philippines

MoneyMax.ph![]()

The independent financial comparison website helps users compare deals on car insurance, personal and housing loans, credit card products and broadband options all under a minute. The options presented are customized for each user, based on the details they provide the website.

Mynt

Mynt

The Globe Telecom-backed startup extends the mobile money service of GCash into online and mobile payments, remittance, loans and business solutions platforms. In August, the firm partnered with the Bureau of Internal Revenue to extend the agency’s tax payment services to mobile.

myRemitHub

myRemitHub

Also a comparison platform, myRemitHub was formulated for OFWs choosing remittance services. The site also helps them compare foreign exchange rates. According to Forbes Philippines, the startup is part of UP Enterprise Center for Technopreneurship, an incubator funded by the Department of Science and Technology.

PawnHero

PawnHero

Founded in 2014, PawnHero is the first digital pawnshop in Southeast Asia. Unlike its brick-and-mortar counterpart, the startup lets users pawn and sell items other than jewelry, like gadgets and mobile phones. Any user may simply take pictures of the item they want to pawn for the startup’s appraisal. After which, a courier service will pick-up the item from the user’s location for free. Payments will also be done through an online cash-card system by the company.

PayBilis

PayBilis

The startup allows users to pay for their bills through their mobile phones. The company has partnered with RCBC and Smart Communications Inc. since its inception in 2013.

Paylance

Paylance

The online platform allows users to pay and transfer money to the Philippines through Bitcoin for free. As of posting, one Bitcoin is equivalent to Php 29,025. The platform also allows users to shop in e-commerce site, PocketMarket.

PayMaya

PayMaya

One of the first and most aggressive fintech companies in the country, Paymaya provides users with a digital prepaid Visa card which can be used for both offline and online payments. It has also partnered with Beep as an added feature of its physical card. The company has earned Php 838.7 million, according to Forbes Philippines.

Paynamics

Paynamics

A digital financial solutions provider, Paynamics has a number of notable clients such as Kalibrr, Rappler and Zipmatch. It offers online billing services to online disbursement gateways.

PaySwitch

PaySwitch

Through its web platform, PaySwitch allow MSMEs to offer services such as electronic loading, remittances and bill payments. Using a point-of-sale system, customers may use over 500 products and services from 200 companies. The platform is mostly used by MSMEs such as internet cafes, pawnshops and drug stores in far flung areas.

Peppermint

Peppermint

Based in Australia, Peppermint offers its financial solution services to big companies such as Metrobank, UCPB and Unionbank. According to Forbes Philippines, its mobile banking service allows users to process payments through phones and transfer money from one account to another.

PesoPay

The online payment service provider has a wide-range of client portfolio, from television giant ABS-CBN to the biggest fast-food company in Asia, Jollibee. The company is one of the biggest earners on the list with Php 33.3 million worth of revenues in 2015.

Salarium

Salarium

The only Fintech company catering to the human resource market on the list, Salarium is a payroll service which processes various company functions, from timekeeping to salary disbursement. What sets it apart from most companies of its kind is the SAL Pay app, which allows employees to cash out their salaries in the bank or through cash-on-delivery.

Apptivate

Purchasing gift cards for online application stores like iTunes Store and Amazon Appstore usually requires credit cards. With Apptivate, users can buy credit through their prepaid or postpaid load instead. Aside from the two stores specializing on mobile apps and entertainment content, Apptivate also offers gift cards for gaming shops such as PlayStation Store, Xbox Store and Steam.

Ayannah

One of the first Fintech companies founded in the Philippines, Ayannah offers digital remittances, payments and business solutions through its own platforms: Sendah, Sendah Direct and Sendah Remit. The startup mainly caters to OFWs but aspires to grow its network in South Asia and Latin America. Founded in 2006, the company won the main award at the Rising Expo SEA 2015, Forbes Philippines noted.

BloomSolutions

This startup offers a more advanced technology for its digital remittances with blockchain, instant payments and messenger bots. The result is a faster and cheaper money transfer service (at least by four percent compared to those done in banks). The service is in partnership with 25 banks in the Philippines, including BDO, Metrobank and Bank of the Philippine Islands.

![]() Coins.ph

Coins.ph

The two-year-old startup offers remittances, fund transfers, bill payments and shopping through the digital currency of Bitcoin. With 17,000 locations nationwide, Coins.ph hopes to reach the underserved markets in far-flung areas with a digital wallet and financial service. In his interview with Forbes Philippines, Coins.ph co-founder Ron Hose said that compared to most remittance centers that charge 7.5 percent of the money sent per transaction, the startup only charges an average of one to three percent.

Cropital

Cropital

The crowdfunding platform allows users to invest for as low as Php 5000 to a farmer’s land, earning a share from profits raised by the goods it will produce. Its chief operating officer, Rachel de Villa, was one of the notable personalities named at this year’s Forbes Asia 30 Under 30 list.

Dragonpay

Dragonpay

One of the biggest earners on the list, Dragonpay raked in Php 35.7 million worth of revenues in 2015 for its online payment system. Through its service, customers may have online transactions even without credit cards, and instead pay with their respective online bank accounts. Merchants will then be notified once transaction is complete. Some of its clients include Cebu Pacific Air and AirAsia.

Emulating the concept of crowdfunding, GiftLauncher allows anyone to pool funds to purchase a gift for an individual. Gift registry for weddings is also allowed, with a personalized website for the couple in tow.

iPay88

iPay88

Founded in Malaysia, iPay88 started servicing the local market in 2012 with its payment gateway. Some of its merchants include SM Tickets, Globe Telecom and KFC.

![]() IT.Corea

IT.Corea

This Korean IT company specializes in three key fintech services: remittances, payment gateway systems and online consumer payments. Coreon Card allows users to pay for bills and remit cash, Coren Pay is used for online shopping while Coreon Wallet serves as a digital credit card.

Lenddo

Lenddo

The startup can gauge an individual’s creditworthiness through his or her social media accounts such as Facebook, Twitter or LinkedIn, veering away from what most traditional financial institutions demand from consumers. The company aims to aid the rising middle class in emerging markets, including those in the Philippines.

LoanSolutions

LoanSolutions

The startup plays as a matchmaker between loan seekers and financial institutions in its digital platform. LoanSolutions offers four key products: personal, OFW, car and business loans which users may apply for in three minutes, given that they provide all details needed.

Satoshi Citadel Industries

Satoshi Citadel Industries

The startup focuses on providing and growing the Bitcoin ecosystem in the Philippines, Forbes Philippines noted. To further its cause, it launched Boom Cash late last year which allows users to transfer digital money even without internet connection through SMS.

Fintech News also made “The Philippine Fintech Startup Report and Landscape”, you can find more information here.

Featured Image: From Pixabay