Technology is taking over the financial markets, and some aspects of decision making are now handled by machines; for retail investors, as well as traders.

Machine learning and artificial intelligence technology have democratized retail investing and trading, forcing many brokers to slash fees in order to remain in business.

Internet penetration in Asia is growing fast & it is currently at 55%, and this means 55 in every 100 people have access to the internet.

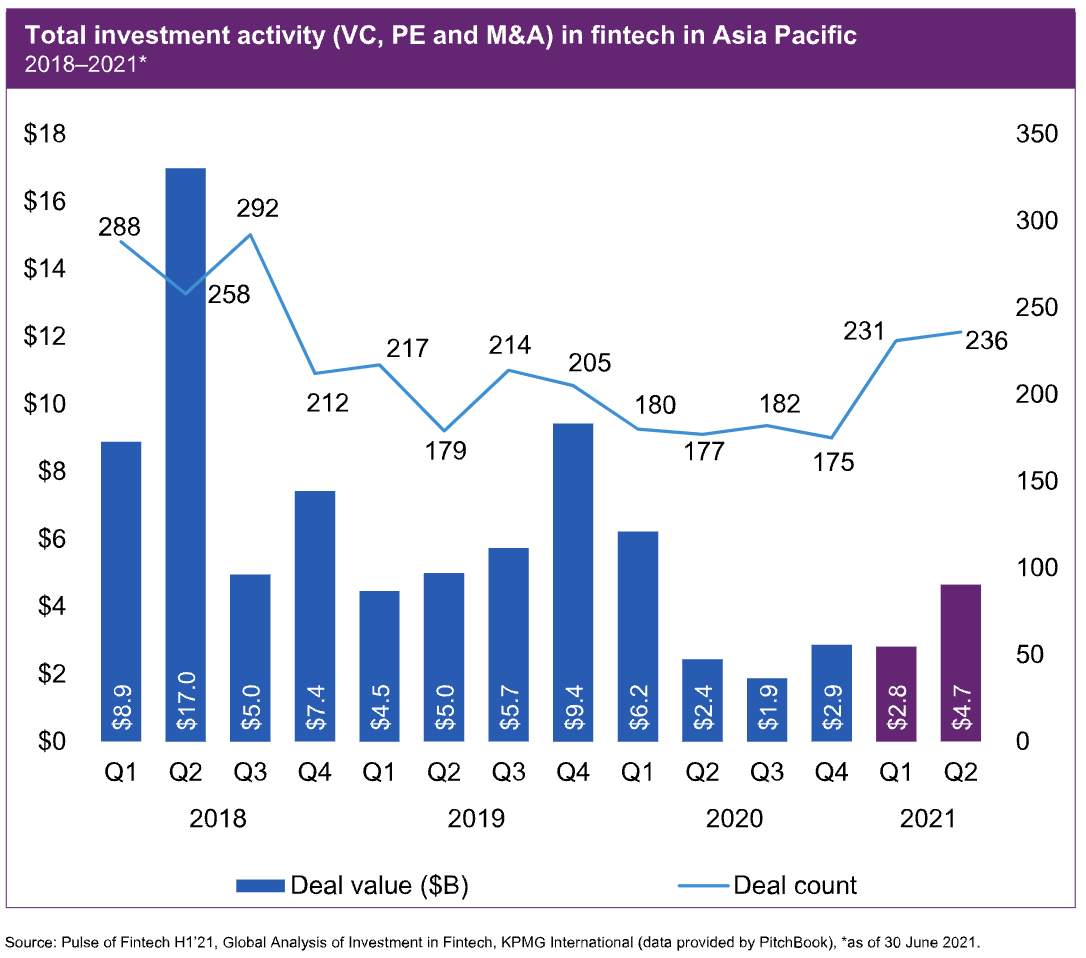

According to a KPMG report, the fintech investments across Asia Pacific was $7.5 Billion in H1 2021. Growing investment in Fintech would only increase the adoption of various financial services by users.

The effect of technology can be felt by everyone in the capital market- from the market regulator, down to the investors and traders. Let us discuss some of the positive effects.

Better regulation of Brokers

The local regulator’s duties are to license and regulate Stock brokers and forex brokers in Singapore.

With modern technology, regulators can carry out off-site regulation, using networks that connect them to the stock exchange and to the brokers. There is no longer a need for frequent physical visits to the brokerages, except where necessary.

Brokers can be held accountable, and cases of insider trading and conflict of interest can now be investigated, and sanctioned more efficiently.

The rise of online Retail brokers

Retail forex trading has been made possible by technology, as the forex market has no physical location, and everything is done online.

Old generation stockbrokers who previously had a monopoly over the market, have now been demystified and replaced by online stockbrokers. This has reduced the cost of buying and selling stock.

Thanks to technology, it is now possible to buy foreign stock such as Apple (AAPL), Microsoft (MSFT) etc. and be exposed to the “wealth of the world” from your smartphone, in Singapore.

Many new brokers of different types are now entering the SE Asian market.

According to a report by Forex Beginner Singapore, more CFD & forex brokers are now accepting clients from SE Asia, and are opening local offices in the region. But many of these brokers are not regulated & are risky for retail traders. There are 100+ brokers that are unregulated & still accept traders from SE Asian countries. While there are risks, but increase competition is good as this will lower the trading costs for Professional & retail traders.

Development of high-tech trading/Investing platforms

Trading and investing can now be done via desktop software, browser/web-based platforms and mobile Apps.

Technology has made development of popular trading platforms such as Metatrader 4 (MT4), Metatrader 5 (MT5), cTrader etc., possible. These apps run complex algorithms and make trading easy.

They also enable you trade and invest anywhere, and at any time. Without technology you would need to visit your broker’s office each time you want to buy stock.

Healthy Competition

Online brokers keep slashing fees, and some even offer zero commission services, all in a bid to win over new clients. Brokers keep improving on their trading Apps to out-do each other.

For example, Metaquotes Inc. had to upgrade their popular forex trading platform Metatrader 4 (MT4) to Metatrader 5 (MT5), so as to stay ahead of the competition.

Today, brokerages spend so much money in developing Demo trading simulation accounts, and still offer them for free to clients, just because they want to remain competitive.

Today, more people are getting into the brokerage business, and since trading Apps are expensive to develop, they use white labels.

A white label brokerage rents a trading platform technology, and renames it. They then integrate this rented trading platform into their website, for their clients to use. White label brokerages have been aided by technological advancement.

Ease of account opening and document upload

Opening an account with an online broker is now very easy. All you need to do, is upload the required documentation such as your National Registration Identity Card (NRIC), your signature specimen, etc., via the App portal, and verification is carried out by the broker.

After verification which takes about a day or two, your account will be up and running. This has replaced the old practice of paying physical visits to the broker’s office to fill out paperwork, which discouraged many Singaporeans. All this can now be done from the comfort of your home.

Deployment of Demo trading

With recent technological advancements, it is now possible to simulate a real trading experience, complete with virtual money. Retail Investors & traders now have the opportunity to practice and get familiar with the App software, before going live with your real money.

Demo accounts are invaluable because they let you test out different trading strategies without the fear of losing money.

Prior to now, you would have needed to take physical investing/trading lectures from a professional and pay for the classes.

Faster access to liquidity providers

In order to give you the best BID/ASK price, non-dealing forex brokers and stockbrokers are connected to various liquidity providers via Electronic Communication Networks (ECNs), and Straight through Processing (STP) networks.

These computerized networks enable your broker to compare BID/ASK prices from various liquidity providers in real-time, and arrive at the best BID/ASK price for you. This results in tighter spread and cost savings for you.

Connecting directly to the liquidity providers via ECN/STP networks, also makes for faster execution of orders. This is because there are no market makers in-between, who could want to aggregate several small orders into one big order, before executing.

Social Trading /Copy trading

Firstly, social trading is based on social media itself. It serves as a link between beginner and experienced traders. Traders come together on social media to exchange knowledge, communicate, offer help to each other and establish partnerships.

They create chat rooms where they engage each other, and share trading and investment ideas. Signal sellers also send trading signals to traders via electronic channels such as email, Whatsapp, Telegram, etc.

Social trading on paper can help beginners start trading while in training, get coached by more experienced professionals, and share ideas.

Secondly, Copy trading is built off social trading. When people partner on social media, they can copy the trades of other members of the community.

Automated risk management

Risk management tools such as stop-loss orders, can now be automated, thanks to technology. A stop price is set by you and once the price of the asset crosses that stop price, a market order is automatically triggered. This will help you save a lot of money, as your position is closed automatically once the market begins to move against you.

Tighter security

Your trading device can now be protected by passwords, and biometric authentication. Two factor authentication (2FA) has also been integrated into most trading and investing Apps. It requires two forms of identification which are something you know and something you have with you physically.

2FA could combine a password, and a verification number that will be sent to your mobile phone, and this makes hacking into your trading and investing App more difficult.

Technology has also made encryption possible so data sent from your phone to your broker can’t be stolen. Your broker is also able to store their data in data centers that are protected by complex firewalls, and sensitive data such as passwords can now be hashed and encrypted.

In December 2013, Google built their first urban multi-story data center in South-East Asia, on 2.45 hectares of land in Jurong West, Singapore.

The data center is meant to serve users across the Asia pacific region. A data center like this will grant Google users faster speeds while using any Google function. This will help in securing mobile devices since mobile device security for most phones is configured around Google.

Google’s Gmail also helps aid 2FA and none of this will be possible without technology.

Creating smarter Investors & Traders

With technology, you are better informed and can take decisions on your own. The market has been democratized and you now have more control.

As an investor, you now have access to the tools for carrying out fundamental analysis before buying a stock. Today, financial statements of a Company can be downloaded online, and this puts relevant information needed for investment and trading decision making, at your fingertips.

It is now easy to compare different brokers, and choose which is best for you. Today it is also easier to report a broker to the regulatory authorities through various electronic reporting channels, in the event of any infraction or fraudulent practice.

It has only just begun

New technologies are still being incubated and investing and trading is going to get more simplified in the future. Technology has also increased the rate of scams and hacking by cybercriminals and this is the risk you have to manage, and educate yourself about.

The combination of technology and human investment will only become more intertwined over time.

Also, it is really important to educate yourself about the risks involved with online investing, and have bulk of your portfolio in long-term investing.

Featured image credit: Unsplash