Experian Says 25% Of Consumers Were Victims of Online Fraud in Asia Pacific

by Fintech News Singapore June 21, 2022Consumer financial data service provider Experian found that a quarter of consumers across Asia Pacific (APAC) have been victims of online fraud, but across all markets surveyed in the region, many remain unconcerned about fraud and identity theft amidst today’s growing fraud risk due to digitisation.

In the six APAC markets surveyed – Australia, China, India, Indonesia, Malaysia, and Singapore – in Experian’s Global Identity & Fraud Report, consumers in China and India appeared to be especially vulnerable, with 29% of consumers in each market having been the victim of online fraud.

This is slightly higher than global figures, where nearly 1 in 4 (23%) consumers have also experienced similar incidents.

There are varying levels of concern by consumers who were surveyed in the APAC markets.

While 45% of Indian consumers are very concerned about fraud and identity theft, only 9% of Chinese consumers feel the same way.

Meanwhile, 26% of Singaporean consumers are very concerned about fraud incidents.

The report also found there is a significant impact on both monetary and reputational damage for fraud victims – 5% of APAC consumers shared that at least one of the fraud incidents they encountered has resulted in substantial monetary or reputational damage.

Meanwhile, 8% of respondents’ friends and family also suffered substantial monetary losses due to fraud incidents.

Consumers are most vulnerable to fraud on social media sites and apps

The report found that consumers are most vulnerable to fraud on social media sites and apps, with consumers surveyed in APAC experiencing the most fraud incidents across these platforms.

This is exceptionally high in Indonesia, where more than half (51%) have experienced fraud incidents on social media sites.

Consumers rely on businesses to keep them protected – but whose responsibility is it?

Four in five APAC consumers (80%) expect businesses to take the necessary steps to protect them online, reflecting global trends where nearly three-quarters of consumers expect businesses to do so.

While consumers are starting to view online security as a legitimate trade-off for businesses collecting their personal data, they expect businesses to protect them from online threats that are too complex for consumers to handle.

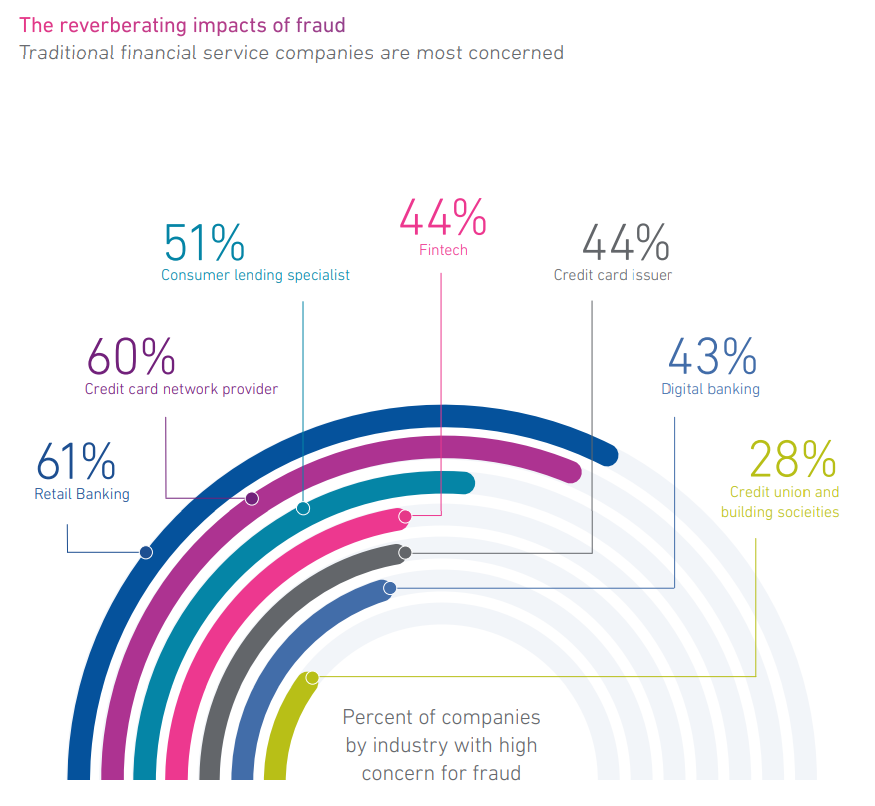

Businesses globally are acknowledging the growing risk of fraud – with nearly half of all business respondents reporting that fraud was a high concern, and more than half of survey respondents from retail banking, credit card networks and consumer lending specialists categorising their fraud concerns as high.

While businesses are taking action to protect against fraud, there remains a gap between consumer expectations and the digital experience businesses can offer.

Only 26% of Singaporean consumers who were interviewed feel that businesses have met their expectations when it comes to a digital experience, and 59% still do not feel secure when transacting with a business online.

Growing consumer ease and trust in advanced forms of digital recognition

A seamless digital experience continues to be a priority for APAC consumers, who trust businesses more if they can recognise them on a repeated basis without additional layers of verification.

In fact, 94% of Malaysian consumers surveyed – the highest in APAC – are extremely to somewhat trusting of businesses that can provide a seamless customer journey by recognising their online identity repeatedly.

The report also showed an increased dependency on advanced technology such as artificial intelligence (AI) – two thirds (67%) of APAC consumers have interacted with AI powered chatbots or virtual assistants in the past six months.

Overall, APAC consumers are becoming more comfortable with businesses leveraging AI – with 64% of India respondents – the highest in APAC – much more and somewhat likely to trust AI more than humans.

Luciano Scalise

“Maintaining a safe and secure online experience is a shared responsibility between consumers and businesses. Consumers need to be aware of the risks they face online and practise good cyber hygiene.

Meanwhile, businesses can leverage orchestration solutions to connect recognition, fraud prevention and their customer experience, and take advantage of a single platform to bring all their tools and data sources together,”

said Luciano Scalise, Decision Analytics Managing Director EMEA & APAC, Experian.

In the 2022 Global Identity and Fraud Report, Experian surveyed 1,849 business respondents and 6,062 consumers from 20 countries, including Australia, Brazil, China, Chile, Colombia, Denmark, Germany, India, Indonesia, Ireland, Italy, Malaysia, The Netherlands, Norway, Peru, Singapore, South Africa, Spain, UK, and US. There were also interviews with consumers from Brazil, Germany, the UK, and US.