Posts From Company Announcement

BIS Innovation Hub Singapore Calls for Regtech Solutions for Regulatory and Supervisory Challenges

The Saudi G20 Presidency and the Bank for International Settlements (BIS) Innovation Hub today launched the G20 TechSprint Initiative to highlight the potential for new technologies to resolve regulatory compliance (RegTech) and supervision (SupTech) challenges. The BIS Innovation Hub, through its Singapore

Read MoreEx-Skype Co-Founder Bags Yet Another US$ 50 Million For His Lending Startup to Expand into Vietnam

Oriente, a lending startup headquarted in Hong Kong and operating in the Philippines (via Cashalo) and Indonesia (via Finmas), announced today that they have secured a fresh capital injection of approximately $50 million in its on-going Series B funding round. Dr.

Read MoreCOVID-19: UnionBank’s Platform Accelerates Online Donations for Philippine NGOs

Union Bank of the Philippines through its UShare platform, is enabling non-government organizations (NGOs) in the country digitize with some recording up to 30-fold increase in daily online donations after an Enhanced Community Quarantine was imposed on March 17. With

Read MoreBIS Appoints Innovation Hub Heads in Singapore and Switzerland

The Bank for International Settlements (BIS) today announced two key appointments to the BIS Innovation Hub, a new initiative designed to support central bank collaboration on new financial technology. Andrew McCormack, Chief Information Officer at Payments Canada, will head the BIS

Read MorePhilippine Fintech Festival to Showcase Philippines as Asia’s Next Fintech Hotbed

The Philippines is all set to cement its role as the next hotbed for fintech and tech innovation with all the necessary ingredients to tech up already present in the Southeast Asian country. A solid financial and business ecosystem with

Read MoreBruc Bond Announce Expansion into Asian Market with Singapore Opening

Bruc Bond, (formerly Moneta International), a specialist in business banking and international payments from Lithuania, has announced the opening of its Singapore office in the heart of the thriving financial district. Bruc Bond shared that it is working with a

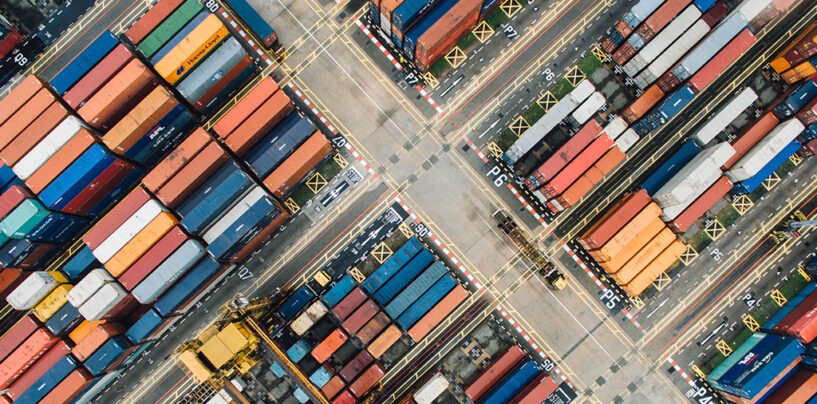

Read MoreStandard Chartered Invests Further in Blockchain Trade Finance Platform Contour

Standard Chartered announced Tuesday its investment into Contour (formerly known as Voltron), a blockchain-based open industry platform that will initially focus on digitally creating, exchanging, approving and issuing Letters of Credit (LCs), following the full commercialisation of its offering and

Read MorePand.ai Bags Pre-Series A Funding From Bangkok Bank’s Corporate VC Arm

Singapore-based AI start-up Pand.ai has secured an undisclosed amount in Pre-Series A funding from Bualuang Ventures, the corporate venture capital (CVC) arm of Bangkok Bank. This new funding round comes less than 3 months after the company announced its first

Read MoreLightnet Raises $31.2 Million in New “Series A” Financing from Prominent Investors

Lightnet, the Bangkok-based fintech company has received A round funding of US$31.2 million in fresh capital. With this round completed, Lightnet is Asia’s first blockchain company to receive financial backing from six large conglomerates, providing access to millions of Asian

Read More1st Online Property Loan Platform in Philippines Launched

A financially-backed property fintech firm on Wednesday launched the first-ever online mortgage broker platform in the Philippines that makes the property loan application process easier and more efficient. The platform, Nook, will enable Filipinos to conduct entire property search, do

Read More