Archive

Philippines’ Digital-Only Bank Tonik Raises $21M Series A Led by Sequoia India and Point72

Tonik Financial Pte Ltd (“tonik”) announced today that it closed a $21M round of Series A equity funding. The round was led by blue-chip VC investors Sequoia India and Point72 Ventures, with a significant participation from previous VC investors Insignia

Read MoreB2B Forex Tech Provider Koku Targets Southeast’s Non-Bank Financial Institutions

COVID-19 continues to spread around the planet with now more than 7.3 million reported cases, including over 416,000 deaths, according to the latest data from the Johns Hopkins University. In Southeast Asia, Singapore has one of the highest infection tallies,

Read MoreGBCI Ventures Pours US$11 Million into Its Own Fintech Startup

GBCI Ventures announced an US$11 Million investment into Fincy a fintech startup led by Douglas Gan, Vannesa Koh and Lim Ming Wang who are all from GBCI Ventures. In a media statement, they shared that Fincy is the venture capital

Read MoreMatchmove and KPMG Partner With Construction Firm to Facilitate E-Remittance for Migrant Workers

MatchMove, a fintech offering a ‘Banking-as-a-Service’ platform and KPMG, today announced their partnership with the Expand Group, a leading homegrown building construction group with integrated civil engineering and construction support service capabilities, to facilitate Employer Assisted contactless e-remittance for foreign

Read MoreRapyd Research Identifies Rising Digital Payments Winners Across Asia Pacific

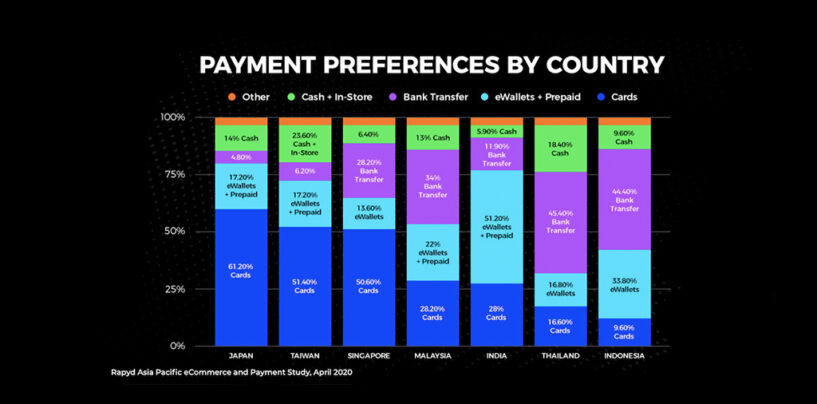

Rapyd, a global Fintech as a Service company, has released its 2020 Asia Pacific eCommerce and Payment Study. The study analysed the financial habits, payment methods, considerations, and preferences of consumers in seven Asia Pacific countries, uncovering how consumer buying

Read MoreNTUC Income Launches Snack, a Bite-Size “Stackable” Insurance Product

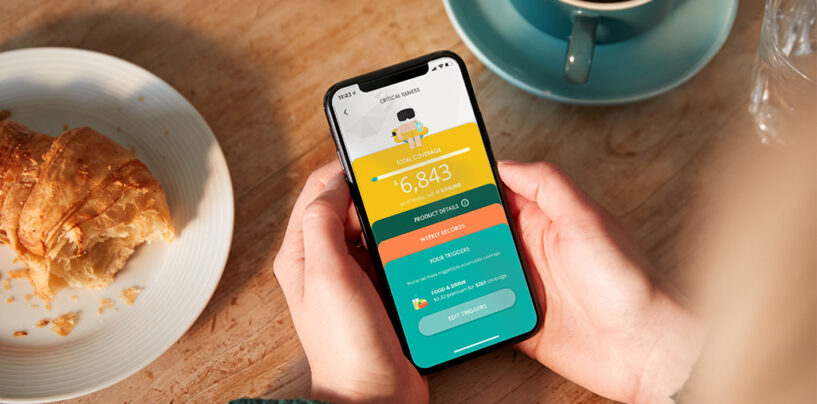

NTUC Income (Income) launched SNACK, which they described as an “innovative, industry-first insurance proposition that revolutionises the way consumers engage with, purchase and obtain insurance protection in Singapore.” Typically, an insured is required to pay insurance premiums at a fixed

Read MoreBASIS ID Disrupts the KYC & AML Data Management

KYC (Know Your Customer) is an integral part of fighting Money Laundering and Terrorist Financing. It has become one of the necessities for every organization in the financial sector. Managing your customers’ KYC data can be very frustrating, however, there’s

Read MoreOCBC’s Virtual Wealth Advisory Service Sees 45% in Sales During Circuit Breaker

On 18 April 2020, with the Circuit Breaker period still in effect, OCBC Bank took the highly-regulated wealth advisory process – a complex face-to-face process involving over 50 pages of documents and a comprehensive Financial Needs Analysis (FNA) – online.

Read MoreHow Singapore is Helping its Fintech Stay Afloat During the COVID-19 Crisis

In Southeast Asia, Singapore has been leading the way when it comes to fintech innovation. As of late 2019, the city state was home to more than 600 fintech firms, which had attracted over half of total funding for the

Read MoreTransferWise Reaches £2 Billion Milestone in Their Multi Currency Account

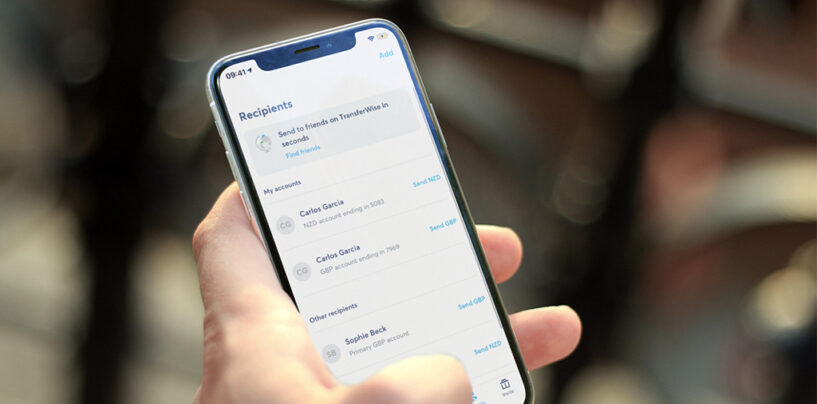

TransferWise, announced today that its customers are currently holding £2 billion in deposits in the multi-currency accounts. TransferWise’s account has seen rapid adoption year-on-year by millions of expats, travellers, freelancers and businesses across the world looking for a cheaper, faster,

Read More