Archive

Grab-Singtel to Hire 200 Roles by 2021 to Build Its Digital Bank

Fresh off securing their full digital banking license in Singapore, the Grab-Singtel constortium announced that they have appointed Charles Wong as the CEO and they will be looking to set up a dedicated team and fill around 200 roles by

Read MoreThe Ultimate Guide to Singapore Fintech Festival 2020

Singapore Fintech Festival (SFF) is outdoing itself this year and going global with a week-long event that will provide both a digital and physical experience. With COVID-19 still spreading, SFF 2020 is going digital this year, providing participants with the

Read MoreGrab, SEA and Ant Among Those Who Secured Singapore’s Digital Banking License

The Monetary Authority of Singapore (MAS) announced four successful digital bank applicants. The full digital bank license was awarded to the Grab-Singtel consortium and SEA Group best known for its brands; Shopee and Garena. Meanwhile the digital wholesale bank license

Read MoreShinhan Bank Vietnam Taps Finastra to Bolster Its Trading and Risk Platforms

Finastra, a financial services software and cloud solutions provider, announced that Shinhan Bank Vietnam has chosen to integrate its trading and risk platforms with the former’s Fusion Kondor and Fusion Risk solutions. The flexibility and efficiency offered by these solutions

Read MoreUOB Co-Develops AI-Powered AML Solution With Tookitaki

UOB has co-developed an artificial intelligence (AI) powered anti-money laundering (AML) solution with Singaporean regtech company Tookitaki after more than two years of rigorous validation and evaluation. The solution is said to be highly accurate in identifying suspicious transactions and

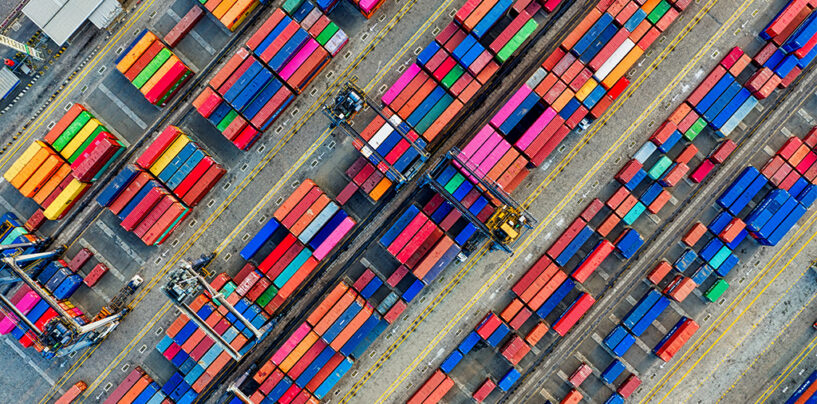

Read MoreMeet the Fintech Startups from Asia Thrusting Trade Finance into The Future

Small and medium-sized enterprises (SMEs), especially those in developing countries, have historically struggled to gaint access to trade finance, which, over time, has led to a global gap that the Asian Development Bank (ABD) estimated at US$1.5 trillion in 2018.

Read MoreSnackUp Partnership with Visa Allows You To Build Insurance Coverage as You Spend

NTUC Income (Income) and Visa launched SNACKUP, which allows consumers to build insurance coverage when they spend with their Visa cards, contributed entirely by merchant and participating brands. SNACKUP is an expansion of SNACK, a lifestyle-based micro-policy insurance model that

Read MoreSwiss Incubator F10 Partners PwC Singapore for Fintech Accreditation Programme

F10, a Swiss-based startup incubator and accelerator, announced that fintech startups joining its programme will be the first cohort to be evaluated through PwC Singapore’s accreditation program. The accreditation programme aims to boost industry-wide fintech adoption. The startups will be vetted

Read MoreA Secure Contactless Customer Experience on Mobile in This New Normal

COVID-19 has altered customer behaviour, and banks will have to enhance their business models to accommodate what’s new and next. Since the pandemic is still very much part of our lives, banks will be confronted by increased customer expectations and

Read MoreCardUp’s New Solution Enables Businesses to Use Credit Cards for Overseas B2B Payments

CardUp, a digital credit card enablement platform, has launched a new solution that enables businesses to instantly access credit on international payments at competitive rates. While the global remittance market is dominated by bank to bank transfers, CardUp enables these

Read More