India Bets on Digital Banking to Improve MSME Access to Finance

by Fintech News Singapore February 15, 2023India, a world leader in digital payments and fintech innovation, is entering the next phase of its digital finance transformation, now eyeing the prospects of digital banking to address the credit gap faced by micro, small and medium-sized enterprises (MSMEs).

The government is said to be readying a framework that would allow MSMEs to more easily and securely obtain digital credit, information technology minister Ashwini Vaishnaw said on February 09, 2023, quoted by the Financial Express.

“We are working on a Reserve Bank of India (RBI)-regulated framework so that digital credit also becomes secure and reliable like the country’s digital payment system,” Vaishnaw said, adding that even small businesses like street vendors would be able to access credit. “This year, we will be rolling out digital credit and the National Payments Corporation of India (NPCI) will take a big lead in that. Over a period of the next 10 to 12 months, a good construct of digital credit will be created.”

Government officials have previously hinted at new rules that would permit digital banks to provide business loans entirely digitally, noting that because these players had the capabilities to leverage cutting-edge technology and real-time data, they could introduce new credit products to the market, enhance customer experience and reach those that have so far been excluded from the formal banking system.

“Small ticket size of such loans, often between INR 100,000 (US$1,210) and INR 1,000,000 (US$12,100), naturally does not make best commercial sense for traditional banks due to cost-benefit concerns,” a person working for the Union government told the Hindustan Times in January, 2023. “Commercial banks consider it a compulsion rather than incentive. If India has to become a US$5 trillion economy, it can no longer ignore credit needs of MSMEs.”

Another official explained that digital banks work like traditional banks but without any brick and mortar branches. They take deposits and lend money in a regulated environment but don’t require any physical paperwork, using instead customers’ data to process loan applications and lend money.

“Allowing such banks may have some regulatory challenges, which must first be addressed by the RBI before licenses could be granted to both private and public sector entities,” an official working in an economic ministry said. “It is a work in progress.”

India is home to about 63.8 million MSMEs, which are responsible for over 111 million jobs and contributed to about 26% of the national gross domestic product (GDP) in 2020-2021. Yet, despite their critical role in the local economy, most still struggle to secure funding from commercial banks and are forced instead to rely on informal money markets and illegal lending apps.

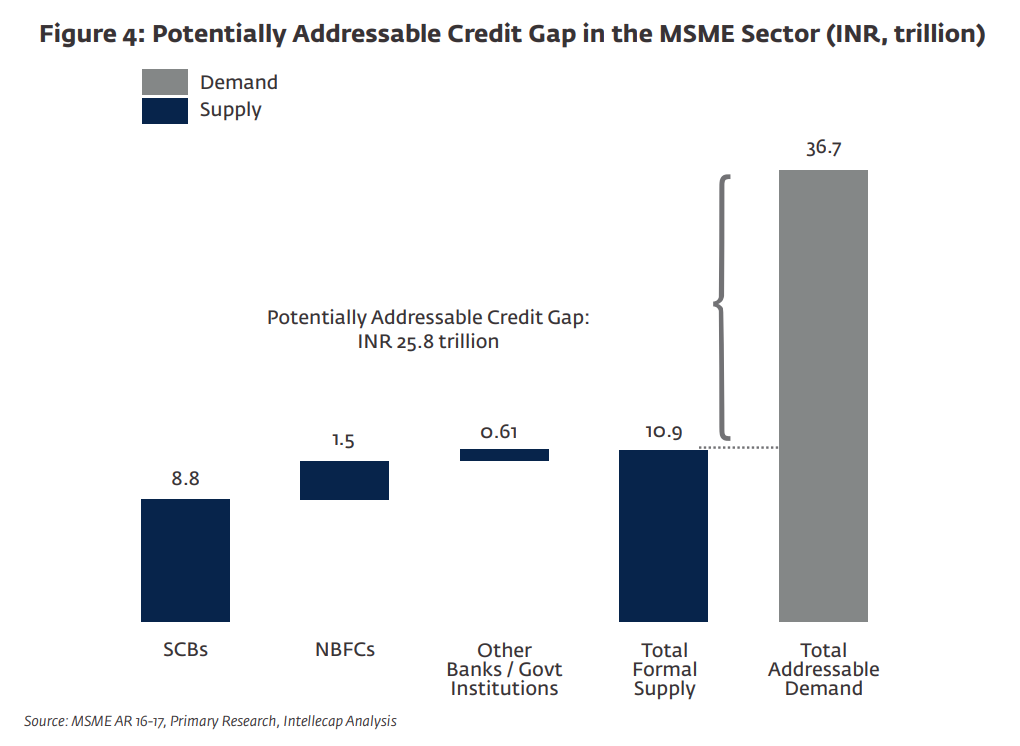

A 2018 report by the International Finance Corporation (IFC) and Intellecap pegged the credit gap at INR 25.8 trillion (US$397 billion).

Potentially Addressable Credit Gap in the MSME Sector (INR, trillion), Source: IFC/Intellecap Analysis, 2018

The next phase of India’s fintech revolution

India has one of the fastest-growing fintech industries in the world. According to the country’s Department for Promotion of Industry and Internal Trade (DPIIT), India is home to more than 2,000 fintech startups, among which more than a dozen of fintech unicorns, data from CB Insights show.

A critical enabler of this growth has been the India Stack, a digital infrastructure project introduced more than a decade ago. The India Stack aims to create a unified software platform for governments, businesses, startups and developers, and seeks to promote financial inclusion, improve the delivery of public services and benefits, and increase competition in the Indian financial sector.

Several APIs currently make up the India Stack, including the Unified Payment Interface (UPI), the national real-time payment system; the Aadhaar digital identification system; and eSign, an online electronic signature service.

Having prepared the bedrock of financial innovation, India must now look towards the next steps of its digital finance transformation journey and focus on enabling the entry of full-stack digital banks, government think-tank Niti Aayog said in 2022 report.

The report, titled Digital Banks: A Proposal for Licensing and Regulatory Regime for India, makes a case for a digital bank licensing regime and regulatory framework, stressing the potential of fully licensed and functional digital banks on financial inclusion and access to credit.

Lacking a formal regulatory framework for digital banking, India has instead witnessed the rise of so-called neo-banks over the past years, the report notes. These fintech startups are teamed up with banking incumbents to offer “over-the-top” services to the consumers, relying on the bank’s balance sheet to lend and issue deposit from.

Neobanks oftentimes specialize in either retail banking or SME banking. A consumer facing neobank would typically offer a digital checking account with an accompanying debit card, savings accounts, as well as personal financial management tools like spend analytics and budgeting. Some platforms also provide investment products, credit facilities and foreign exchange services. Popular neobanks serving Indian consumers include Niyo, which claims four million customers; Freo, which clocks 1.5 million customers; and Fi Money, a neobanking platform designed for working professionals that count one million customers.

SME-facing neobanks, meanwhile, would typically offer expense management products such as employee prepaid cards, payroll management, accounts receivables management, as well as business loans through banking partners. Popular neobanking platforms serving Indian MSMEs include RazorPayX, the business banking platform of paytech firm Razorpay; and Open, a neobanking platform for SMEs and startups which serves more than 2.3 million businesses.