How are FinTech based enterprises bringing about a ‘Positive Disruption’ in Singapore?

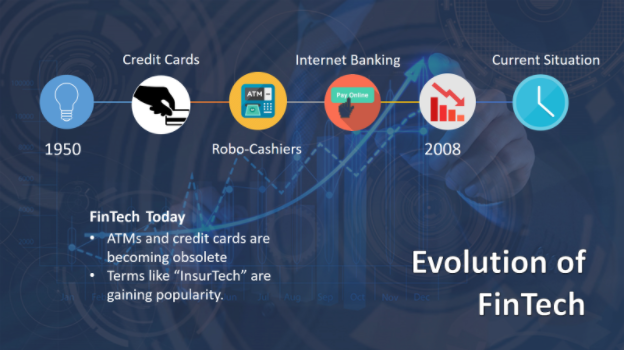

by Chi Le, Rashi Behani, Shashank Bakliwal, Shahana Doolull, Tanushree Kumar August 23, 2017FinTech, also known as Financial Technology, is a portmanteau of financial technology which englobes a better user interface for financial services and products. The concept of FinTech goes back to 1950 when conventional banking transactions were getting replaced by technological banking.

The industry has further evolved since then in the form of Credit Cards, Robo-Cashiers (ATMs) and E-Trade. It got hold of its significant meaning after the financial crash of 2008, when the policymakers were focusing on recovering from the economic loss whereas the customers extensively started using technology in their day-to-day life. This created a gap between the banks and the customers, which was filled in by the FinTech industry.

Singapore is Asia’s fastest growing FinTech hub. The growth in Singapore’s FinTech industry has been empowered by the country’s supportive government, business-friendly environment and access to expertise. Lattice 80, the world’s largest FinTech hub is based in Singapore and it provides a friendly environment for startups to collaborate, connect and co-create.

The MAS (Money Authority of Singapore) has set up a FinTech office to serve as a one-stop virtual entity for all FinTech related matters. Its objective is to provide training sessions and networking activities to facilitate consultations for startups and to experiment for FinTech solutions. Transaction value in the Singaporean FinTech market amounts to S$18838 million in 2017. This value is expected to see an annual growth of 19.9% in 2021, resulting in a total amount of S$38944 million. In the FinTech platform, the number of potential users in Singapore is expected to amount to 5.2 million by 2021 (Statista.com, 2017).

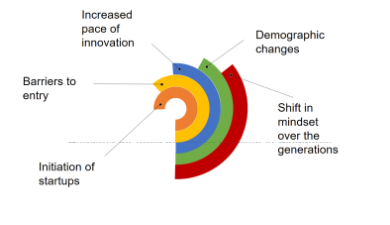

Reasons for rapid growth of FinTech in Singapore

Shift in mindset over the generations:

The current generation of investors want to be in control of their finances and wish to make their decisions independently. These decisions are generally based on automated advice (robo- and virtual advisors) whereas the older generations are more inclined towards human advisors. Furthermore, the BFSI market is now shifting from product centric to consumer centric. FinTech gives way to innovative solutions which allow catering for customers based on their personal preferences.

Demographics Changes:

Experienced financial advisors are retiring and leaving the industry faster than they can be replaced. Additionally a transfer of wealth from baby boomers to their heirs is upsetting many established advisor-client relationships, thus creating opportunities for new firms at that expense of incumbent firms. Furthermore, with the introduction and adoption of consumer-oriented technology, customers expect personalized and low cost insurance and wealth management services, provided on efficient and flexible platforms.

Increased pace of innovation:

Increased pace of innovation:

The increased pace of innovation has lead to the introduction of products like autonomous cars and usage- based models. Thus, creating a need for customers to adopt new insurance solutions. This need is creating new opportunities in the market to provide more tailored solutions and services for different segments.

Barriers to entry:

Over the years, the barriers to entry of financial services market has decreased marginally. For example, there is now easier access to open source frameworks and scaled cloud computing.

Initiation of Startups:

The biased advice by bankers and consultants and the support by MAS has encouraged the new generation to initiate new start-up ideas. When customers seek services, the banks tend to offer their standard service, irrespective of the relevance to the concerned customers. However, unbiased advisors (FinTech firms) know who you are and how much you are saving.

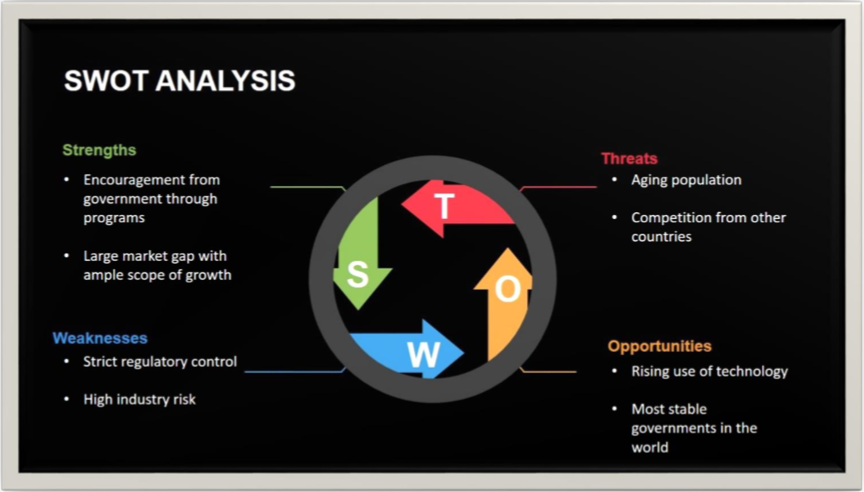

SWOT

To gain a greater understanding of Singapore’s FinTech industry, we culminated our internal analysis and external research of the topic in order to identify the strengths, weaknesses, opportunities and the threats that the industry is currently facing.

To gain a greater understanding of Singapore’s FinTech industry, we culminated our internal analysis and external research of the topic in order to identify the strengths, weaknesses, opportunities and the threats that the industry is currently facing.

Strength:

The industry’s strength lies in the encouragement that it receives from the government. The Money Authority of Singapore encourages the growth of firms in the FinTech industry through different programs. It has vowed to invest S$225 million in FinTech by the end of 2020. The FinTech industry has managed to generate a lot of buzz in the media because of its novelty. This enables firms to capitalize on this factor and market their products with comparative ease.

Weakness:

As FinTech firms are generally startups, they are unable to take advantage of the different economies of scale. Moreover, reasons like terrorism and money laundering have led the MAS to impose strict regulations on the data available. This restricts the players in the FinTech industry and poses as a weakness.

Opportunities:

One of the major demographic populations of Singapore, the students, are a driving force behind the increasing use of technology. In addition to this, Singapore has one of the most stable governments in the world which eliminates uncertainty. This encourages firms to invest in Singapore, creating a pool of opportunities for the industry.

Threats:

While Singapore is the largest FinTech market in Asia, countries like England have an upper edge which poses as a threat. Furthermore, doing business in Singapore is becoming expensive. Startups are struggling with the high costs of doing business.

Recommendations

In order to stimulate the growth of the FinTech industry in Singapore, we came up with several recommendations.

Customer Relationship Management:

All the companies under the financial services industry should work on making their Customer Relationship Management (CRM) system more user friendly by incorporating human touch. Companies must adopt strong customer-centric strategies in order to achieve customer confidence. This will happen when someone integrates decades of financial advisory experience into the system. A more detailed system will provide holistic advice to the customers, something that FinTech does not offer currently.

Collaborations:

The businesses in FinTech industry should look for partnerships. Drivers of the financial services, especially banks, should come up with collaboration schemes so as to ease banking transactions by eliminating geographical restrictions. An evolved business model with a fine balance between technology and human touch will tackle a majority of their current problems like inefficiency and impersonal financial services. Finally, we encourage firms to reassess their branding strategies and re- establish their place in the current market.

Competition:

Singapore lags behind developed countries like the United Kingdoms in terms of FinTech innovation. The FinTech accelerators in Singapore must take an initiative towards absorbing the Western ideas. The accelerators can then encourage different startups to collaborate and elaborate on the idea. This will make the nation up to date with the latest innovative ideas throughout the world.

Education:

FinTech is seen as the future of financial services. Hence, it is our recommendation to incorporate a module of FinTech at tertiary levels of education for students majoring in finance. This will lead to a larger talent pool for the FinTech industry in Singapore. FinTech must also be introduced as an industry of great potential in the secondary education curriculum so that students consider it as an option for higher education.

Preventive Measures:

When it comes to regulatory bodies, we believe that the FinTech sector should be given a breathing time away from protective policies. Regulators should stop over-protecting banks as their over- protection is bringing about inefficiency within the banking framework. The policies are acting more as shields against success rather than instability. A certain level of access to database must be given to the accelerators in order to prevent scams and frauds.

In conclusion, this research project can serve as a guide for all the stakeholders of the FinTech Industry in Singapore to help the nation transition smoothly into a vibrant FinTech hub.