2020 Fintech Vietnam Report and Startup Map: Fintech Startups Tripled since 2017

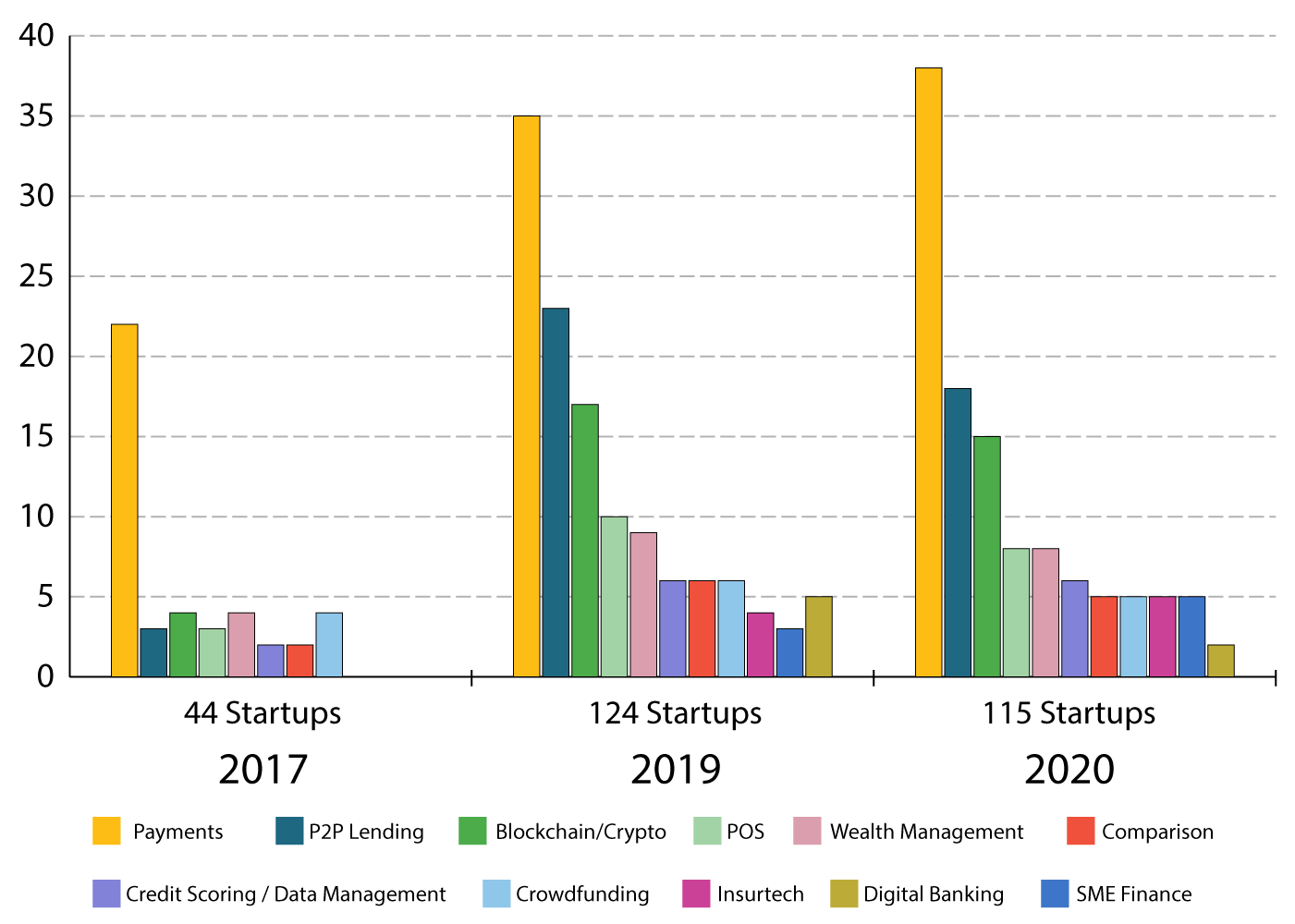

by Fintech News Vietnam November 24, 2020Vietnam’s fintech startup landscape more than tripled in size between 2017 and 2020, growing from 44 startups in 2017 to now 118 startups, according to a new report produced by Fintech News Singapore.

The Vietnam Fintech Report 2020 delves into the state of the domestic fintech landscape, shares key industry trends, and looks at the local fintech startups ecosystem.

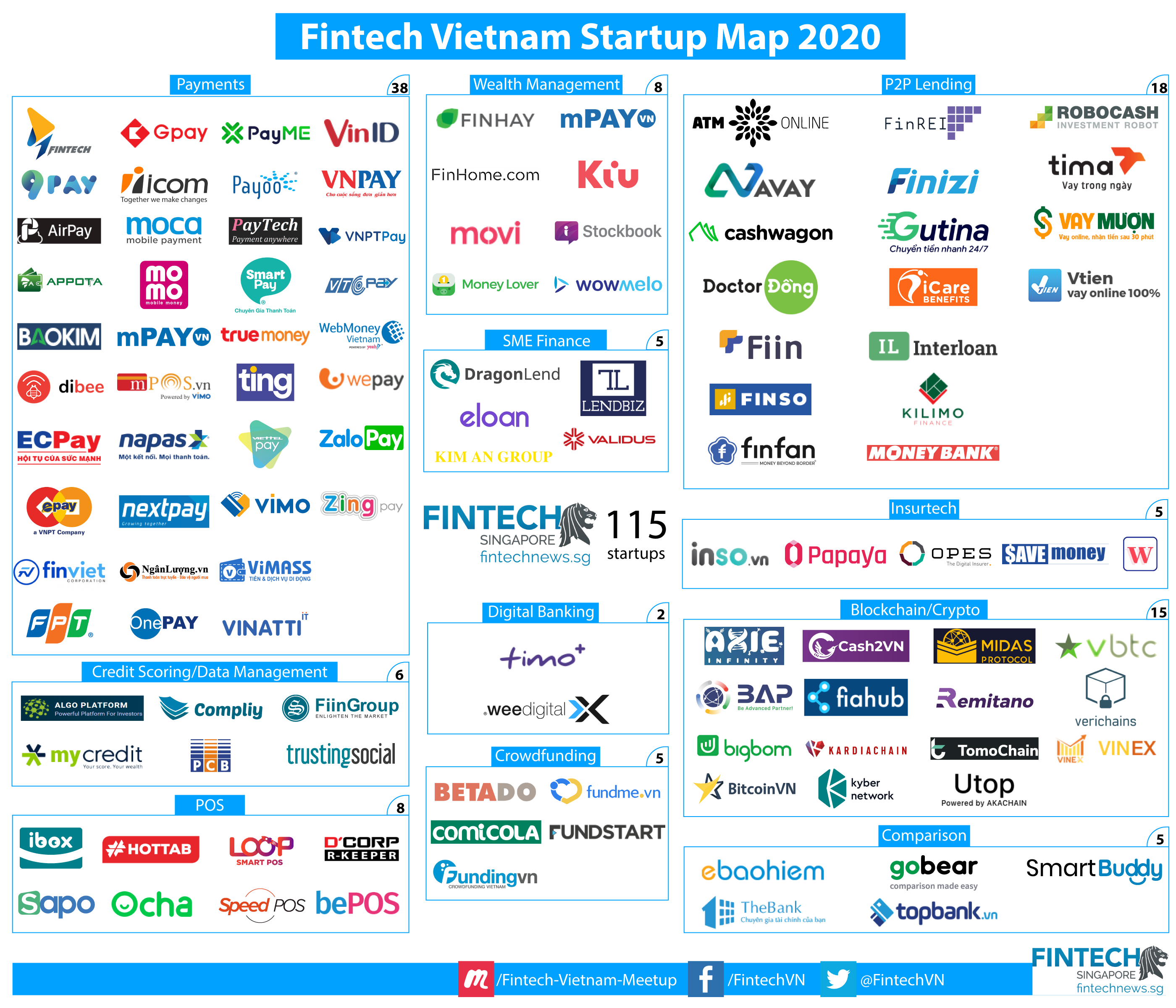

Vietnam’s fintech startups

According to the report, the number of fintech startups in Vietnam grew more than 179% between 2017 and 2020. Payment remains the biggest segment, representing 31% of all fintech startups.

As of October 2020, Vietnam was home to 39 licensed non-bank payment services providers, with the five biggest e-wallets being MoMo, Payoo, Moca, ZaloPay and ViettelPay.

Statistics from the State of Bank of Vietnam (SBV) revealed that as of 2019, there were 4.2 million e-wallet users out of the country’s population of 100 million people, implying that despite a rather crowded and highly competitive local payment sector, there are still plenty of growth opportunities.

While Vietnam’s payment startups continue to grow and attract investors’ interest, the strongest growth was actually recorded in peer-to-peer (P2P) lending and the crypto/blockchain space. These two segments saw the number of startups rise from less than 5 in 2017 to more than 15 startups in 2020.

Download Full Report here

The past three years also saw the emergence of insurtech, digital banking and small and medium-sized enterprises (SMEs) financing, three segments that were non-existent in 2017.

Despite notable traction and strides, Vietnam’s fintech sector remains nascent when compared to neighboring Singapore for example, and segments including data/credit/scoring management, and crowdfunding are still unrepresented.

Vietnam’s fintech scene throughout the years, Vietnam Fintech Report 2020

Key trends

The Vietnamese fintech sector is largely comprised of players operating under a business-to-consumer model, making the underdeveloped business-to-business (B2B) market poised for growth.

At the same time, Vietnamese banks are accelerating their digital transformation, with a growing number of them adopting a partnership approach to enable rapid innovation. This provides B2B startups with plenty opportunities to support incumbents in their digital efforts.

The report notes the collaboration between Vietnam International Bank (VIB) and Weezi Digital in 2017 to launch a mobile payment app, the partnership between VietinBank and Opportunity Network in 2018 to offer the bank’s clients access to a digital business matchmaking platform, and the partnership between VPBank and ride-hailing startup Be Group announced last year to develop a digital financial services offering called beFinancial.

The report also mentions ride-hailing giants’ expanding foothold in financial services with players like Grab, Be Group and Fastgo all providing e-wallet services. Most recently, Indonesian startup GoJek announced a significant push into Vietnam’s financial sector, acquiring local payment startup WePay to secure an e-wallet license.

In the fintech sector, these so-called “super apps” are rapidly gaining ground, leveraging their advanced tech platforms and expertise to deliver cheap and convenient digital financial services to the masses.

More developments are expected in the near future on the back of favorable regulations. These include the forthcoming fintech regulatory sandbox as well as a legal framework for digital assets and cryptocurrencies.