Myanmar Fintech Sector On Route To Growth: Fintech Startup Report and Map

by Fintech News Singapore June 22, 2018While the Myanmar financial system remains largely dominated by banks, the non-bank and fintech sector is on route to growth and will likely be playing a key role in the country’s modernization push.

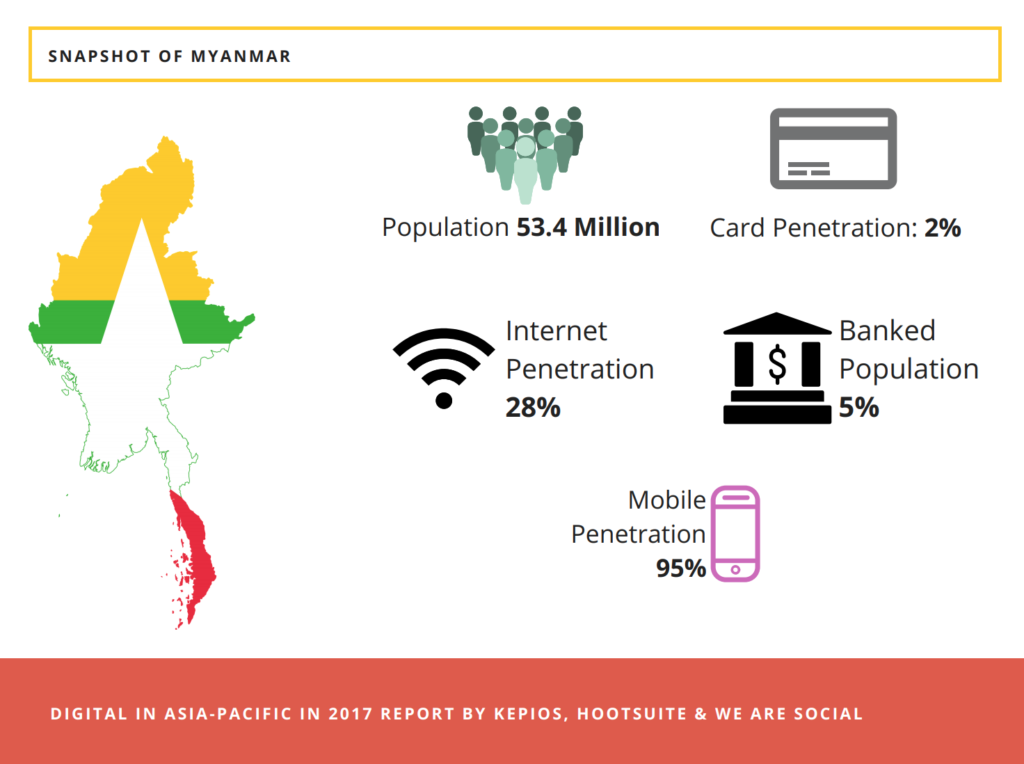

Currently, only 5% of the Myanmar population has a formal bank account and 2% has bank card, but Myanmar’s 95% mobile penetration makes it fertile ground for the mobile revolution. The arrival of mobile financial services and fintechs in the past years has opened up new opportunities in the Southeast Asian market.

Companies such as Wave Money are making it easy for local users to send and receive money using just their mobile phones. A joint venture between Norwegian telecoms operator Telenor and Myanmar’s Yoma Bank, Wave Money was the first non-bank organization to provide mobile financial services in the country, according to a report by Asia Money. The company received its license from the government in 2016.

Since its inception, Wave Money has grown tremendously, reaching 1.3 million customers in February 2018. Its mobile agent network has expanded too with now over 20,000 agents across almost 300 towns.

Sean Turnell, an economic consultant and digital adviser to State Councilor Aung San Suu Kyi, expects Wave Money to become “a huge and long-term financial player.”

“People trust them. And their alliance with Telenor adds to their credibility, because people trust that brand more than they trust any local bank,” Turnell said.

But as Wave Money’s mobile payments business thrives, the company’s next step is to get into the insurance business with a vision of bringing insurance products to the largely underserved market.

“We plan to work with Yoma Bank as a full financial partner, offering insurance and micro-insurance, and providing loans to individuals and small businesses,” said Brad Jones, CEO of Wave Money.

Fintech in Myanmar

Compared to its Southeast Asian neighbors, Myanmar has a relatively small fintech industry with just a little over a dozen fintech ventures. In comparison, Singapore boasts over 200 fintech companies, and Malaysia nearly 100.

(Please note in case we missed a Fintech Startup let us know by email or comment here!)

Unsurprisingly, fintech ventures in Myanmar almost exclusively focus on digital payments or mobile payments.

Alongside Wave Money, several other non-bank ventures in Myanmar are providing mobile payments services.

M-Pitesan, a joint venture between Myanmar lender CB Bank and Ooredoo, a telecoms operator based in Qatar, is one of them. M-Pitesan provides a platform that aims to make it easy for users to transfer and receive money, buy airtime and make payments using their mobile phone instantly, anywhere and anytime.

OK Dollar, a unit of local firm Internet Wallet, is another mobile payments provider. OK Dollar allows users to buy airtime, movie tickets, share bills, rent with friends, buy flowers, order pizza, shop online, and more.

Other noteworthy fintech startups in Myanmar include TrueMoney, a company originally from Thailand, which launched operations in Myanmar in October 2016. TrueMoney focuses on cross-border payments and remittance services.

Myanmar mobile payments firm MyPay made headlines in 2017 when it acquired Singapore’s Fastacash, a social and mobile payment platform.

Other resources you might be interested in

Curious about other Asian Fintech Startup Maps and Report? Here’s a handy guide looking at the fintech startup maps in Asia by country.

and the fintech startups report in Asia by country.