Singapore Fintech Report 2023: Pioneering Digital Currencies and Cross-Border Linkages

by Fintech News Singapore December 4, 2023The Singapore Fintech Report 2023 examines a significant year for the space in Singapore. With one of the most advanced and innovative fintech ecosystems in the world, an enhanced focus on digital money and assets, increased adoption of new technologies, and a surge in real-time cross-border transactions were noticeable.

As the sector evolves, so does the necessity for updated regulations. The Singapore Fintech Report 2023 illustrates the scale in digital lending and payments in the country as sectors like AI and blockchain record impressive growth. Despite fintech funding overall being cut back, the Singapore Fintech Map 2023 shows that the ecosystem is healthy and growing rapidly, ensuring startups remain relevant and effective.

With consumer security and fraud still a paramount concern, regulatory modifications have been introduced to keep pace with technological advancement, securing transactions and preserving trust. The Singapore Fintech Report 2023 offers a succinct overview of these developments. Here are some of this year’s notable highlights in Singaporean fintech.

Singapore Fintech Report : Real-Time Cross-Border Payments

2023 marked the year Singapore, the financial and technological pacesetter in Southeast Asia, initiated real-time cross-border payment connections with its neighbours. As per the Monetary Authority of Singapore (MAS), they have established cross-border payment linkages with various partner jurisdictions, enhancing convenience for cross-border fund transfers and small-value payments.

Residents in Singapore and their partner countries can now transfer funds directly to each other’s bank accounts or e-wallets nearly instantaneously, using just a mobile number or QR code.

At the recently concluded Singapore Fintech Festival, MAS launched a cross-border QR code payment linkage between Malaysia and Singapore, enabling customers of participating financial institutions to conduct retail payments by scanning DuitNow QR and NETS QR codes.

Additionally, Singapore and Indonesia have commenced a cross-border QR code payment linkage, while users of Singapore’s PayNow and Malaysia’s DuitNow can now execute person-to-person funds transfers.

Earlier in 2023, a cross-border linkage between Singapore’s PayNow and India’s UPI was introduced, facilitating real-time fund transfers using scalable cloud-based infrastructure and incorporating a non-bank financial institution for the first time.

Furthermore, the Singapore Fintech Report 2023 highlighted how the city-state played a pivotal role in Project Nexus, developed by the Bank for International Settlements (BIS) Innovation Hub Singapore Centre, aiming to connect multiple domestic instant payment systems. The prototype linked the instant payment systems of the Eurosystem, Malaysia, and Singapore, enabling payments using only mobile numbers.

Indonesia, Malaysia, the Philippines, Singapore, and Thailand were joined by Vietnam in the Regional Payment Connectivity (RPC) initiative to expedite cross-border payments in the ASEAN region — with the aim of making them faster, more affordable, transparent, and inclusive.

Linking payment systems across member states is expected to boost trade and remittances, fostering financial inclusion and fortifying the ASEAN economy. There’s potential for the RPC to broaden its scope to neighbouring economies and countries beyond the region as well.

Singapore Fintech Report: Singapore’s Digital Currency Initiatives

Singapore, supported by its progressive financial authority, the Monetary Authority of Singapore (MAS), is exploring and implementing a number of projects revolving around digital money, as detailed in the Singapore Fintech Report 2023.

Together with the BIS and the central banks of France and Switzerland, Singapore has successfully concluded Project Mariana. This project examined the cross-border trading and settlement of wholesale central bank digital currencies (wCBDCs) between financial institutions, utilising new decentralised finance (DeFi) technology concepts on a public blockchain.

MAS and BIS are further collaborating with the Reserve Bank of Australia (RBA), the Bank of Korea (BOK), and Bank Negara Malaysia (BNM) on Project Mandala. This initiative investigates embedding policy and regulatory compliance for cross-border transactions into a unified protocol.

The proposed compliance-by-design framework could enable more efficient cross-border transfers of digital assets, including central bank digital currencies (CBDCs) and tokenised deposits. It may also become the foundational compliance layer for both legacy and emerging wholesale or retail payment systems.

The MAS has finalised its new stablecoin regulatory framework, incorporating public feedback. The regulator stated that the framework will apply to single-currency stablecoins (SCS) pegged to the Singapore Dollar or any G10 currency, issued in Singapore.

In addition, MAS has devised the Orchid Blueprint, building upon insights from the Project Orchid industry trials and identifying the infrastructural elements for the sound use of digital money in Singapore.

Under the Orchid Blueprint, four new trials will be conducted with industry participants to investigate relevant infrastructure components and commercial models. These trials will focus on testing bank-issued tokens for retail payments, trialling e-wallet interoperability, exploring supply chain financing, and examining payment controls for deposit token transfers among banks within a trusted ecosystem.

Singapore’s Approach to Financial Planning and Digital Innovation

Amidst considerable volatility in certain fintech sectors such as cryptocurrency and buy now, pay later (BNPL) entities, the Singapore Fintech Report 2023 found that Singapore is concentrating on improved financial planning for its citizens, utilising data for enhanced wealth and asset management.

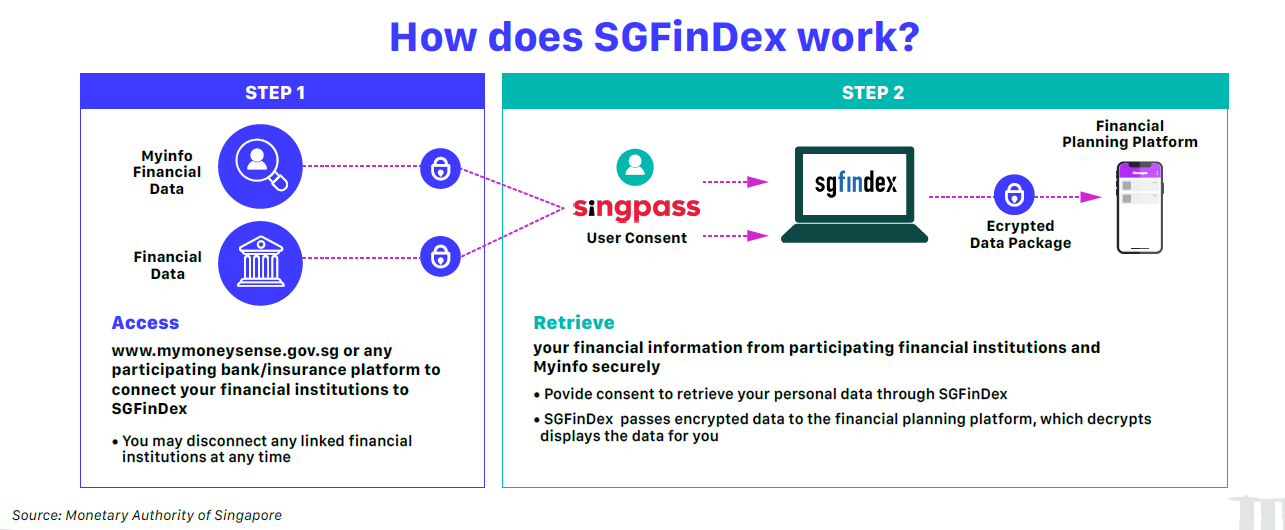

Developed by the MAS and the Smart Nation and Digital Government Group (SNDGG) with support from the Ministry of Manpower, the Singapore Financial Data Exchange (SGFinDEx) epitomises Singapore’s dedication to digital innovation and empowering consumers in finance.

SGFinDEx offers a streamlined, standardised approach, featuring a centralised gateway for data-sharing based on unified data and Application Programming Interface (API) standards. The core of this transformation is its capacity to offer increased financial transparency, enabling individuals to make informed decisions and strategically plan their financial futures.

Through SGFinDEx, consumers can access a variety of financial planning tools, providing customised insights and recommendations based on their financial data. SGFinDEx simplifies the process by offering a single access point to consolidate financial information, resulting in a more efficient user experience.

SGFinDEx is the world’s first public digital infrastructure enabling individuals to securely access their financial data held across government agencies, banks, insurers, and the central securities depository.

Singapore Fintech Map 2023

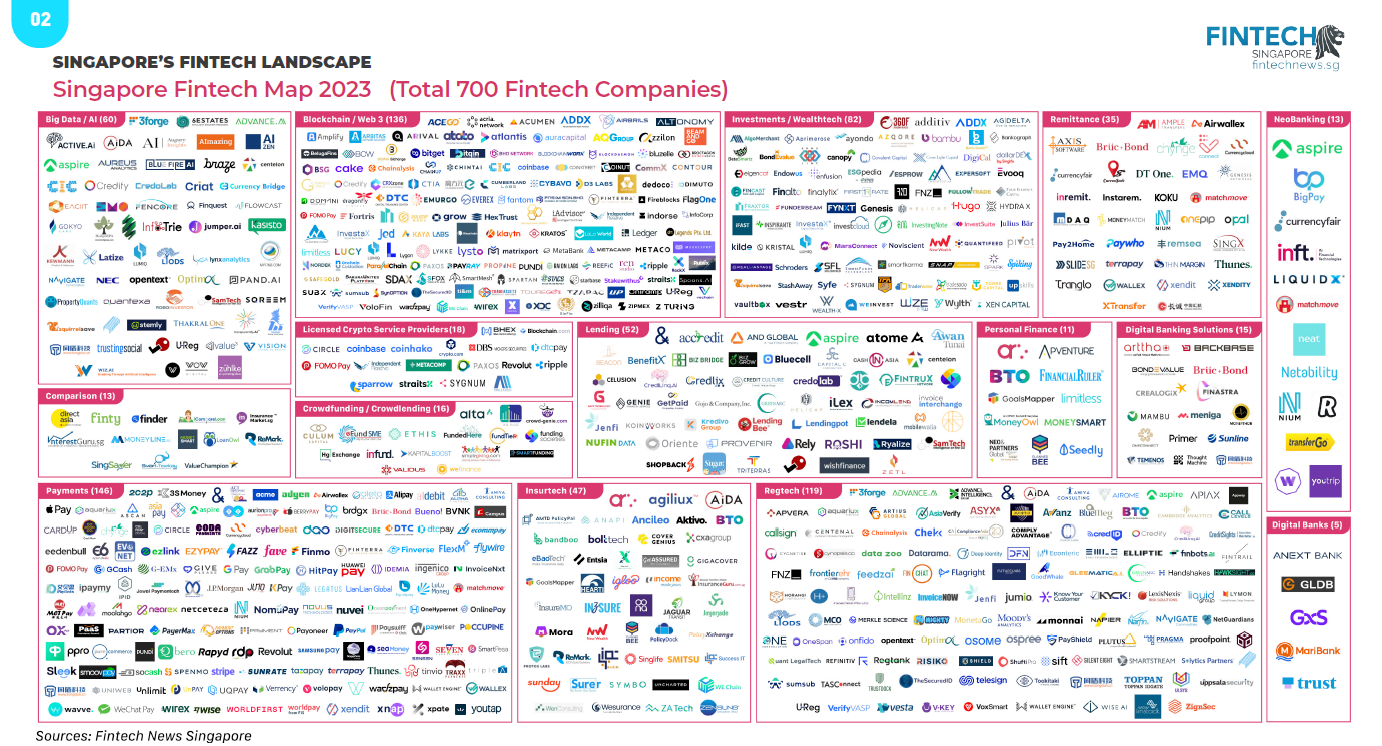

Despite economic setbacks and weaker VC/PE funding climate over the past year, the Fintech Map in the Singapore Fintech Report 2023 showcases another growth spurt in the local fintech landscape. At least 700 fintech companies of various segments were recorded, with the Payments space the biggest with 146 companies in the mix.

Regtech is now the third biggest category, with companies releasing their digital ID and Know-Your-Customer onboarding products in well-regulated Singapore. Surprisingly, while Singapore has been cracking down on illicit and volatile cryptocurrency firms, there has been healthy uptick in companies operating within the broader distributed ledger technology and Web3 markets.

Blockchain and Web3 is the second biggest category as of 2023, followed by Regtech and another growth sector, AI and Data companies. Not to be outdone, Wealthtech category has also expanded as both regulators and organisations seize upon the investment and financial planning opportunities in the city state.

You can download the Singapore Fintech Report and Map 2023 here:

| Download the full Singapore Fintech Report 2023 |