How SGFinDex Drives Digital Transformation in Singapore’s Financial Sector

by Rebecca Oi May 18, 2023In a progressively digital world, the essence of open banking has found its way to the heart of Singapore’s financial ecosystem with the introduction of the Singapore Financial Data Exchange (SGFinDEx).

This innovative data-sharing platform serves as a transformative tool, enabling consumers to have a comprehensive, consolidated view of their financial portfolio across different platforms.

This approach not only empowers consumers with a deeper understanding of their financial health, but also heralds a new era of digital transformation in the financial services sector.

By enabling data-driven solutions, it caters to a broad spectrum of consumer needs and preferences, paving the way for a more personalized and efficient financial management landscape.

The power of SGFinDEx: Efficiency, Security, Convenience, Empowerment

Developed by the Monetary Authority of Singapore (MAS) and the Smart Nation and Digital Government Group (SNDGG), with support from the Ministry of Manpower (MOM), SGFinDEx exemplifies Singapore’s commitment to digital innovation and empowering consumers in the financial sector.

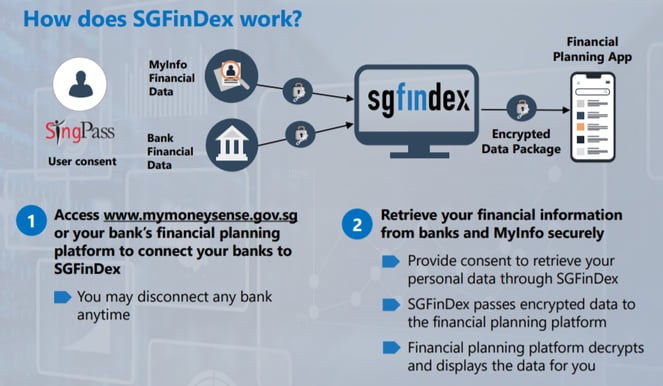

SGFinDEx represents an efficient, standardized solution, utilizing a centralized gateway for data sharing based on common data and Application Programming Interface (API) standards.

One of its key advantages is the secure infrastructure it operates on, utilizing Singpass, Singapore’s national digital identity, authentication, and a robust consent framework.

By harnessing Singpass, SGFinDEx delivers a seamless, reliable, and user-friendly platform for individuals to manage their financial affairs.

The core of this transformation lies in its ability to provide heightened financial transparency, enabling individuals to make informed choices and strategically plan for their financial future.

Through SGFinDEx, consumers can access various financial planning tools, offering bespoke insights and recommendations based on their financial data.

This, in turn, fosters digital transformation and innovation in the financial services sector, enabling data-driven solutions that cater to a broad spectrum of consumer preferences and needs.

The platform allows customers to securely share their banking data with third-party entities, including other banks or financial planning apps, effectively consolidating their financial information across different platforms.

To ensure data privacy, the transmitted data is encrypted, and only authorized financial planning apps can decrypt it. SGFinDEx itself does not store any personal financial data, assuring users of its commitment to safeguarding their privacy.

At the heart of SGFinDEx is convenience. Gone are the days of juggling multiple platforms and logging in and out of various accounts.

SGFinDEx simplifies the process by providing a single access point to consolidate financial information, resulting in a streamlined and efficient user experience.

Challenges and opportunities with SGFinDEx

Despite its immense potential, SGFinDEx faces several challenges that must be addressed to reach its full potential.

These include raising awareness about its benefits, educating consumers about data privacy and security, and encouraging sharing of financial data with authorized financial planning apps.

It also requires collaboration and coordination among multiple stakeholders, including government agencies, financial institutions, and fintech firms, to align with common goals, standards, and governance.

Yet, these challenges also present opportunities. By providing fintech firms access to rich and comprehensive financial data, SGFinDEx can help them develop personalized products and services for consumers. It also paves the way for collaboration on innovative solutions and enhances consumer choice and convenience through its connectivity with various financial planning apps.

SGFinDEx and fintech: A symbiotic relationship

SGFinDEx not only empowers consumers but also creates opportunities for fintech firms to thrive. With access to a vast pool of financial data, these firms can develop highly personalized, relevant, value-added products and services.

This, in turn, paves the way for collaboration between fintech firms, financial institutions, and government agencies, ultimately fostering innovation and offering consumers an expanded range of choices.

A prime example of SGFinDEx in action can be seen through the integration of various financial planning apps.

Prominent apps such as DBS NAV Planner and OCBC Your Financial OneView have harnessed the power of SGFinDEx to provide users with comprehensive financial overviews and actionable insights.

Additionally, popular personal finance apps like Planner Bee and Seedly have also joined the SGFinDEx ecosystem, offering users a holistic view of their financial status and providing valuable resources for effective financial planning.

Through SGFinDEx, these apps are crucial in empowering users to take charge of their financial well-being.

By consolidating data from multiple sources, individuals can understand their financial landscape holistically, allowing for informed decision-making and more effective financial planning.

Furthermore, these financial planning apps leverage the power of SGFinDEx to go beyond basic financial tracking.

They provide users with actionable insights and recommendations tailored to their financial situations. Whether it’s budgeting, retirement planning, or investment strategies, these apps offer personalized guidance based on the comprehensive financial data available through SGFinDEx.

How Singapore compares to its neighbours?

Like Singapore’s SGFinDEx, both Hong Kong and Malaysia have embraced open banking initiatives, each adopting unique strategies and stages of implementation.

In Singapore and Malaysia, a voluntary model for banks has been employed, fostering a competitive and innovative banking sector in both countries.

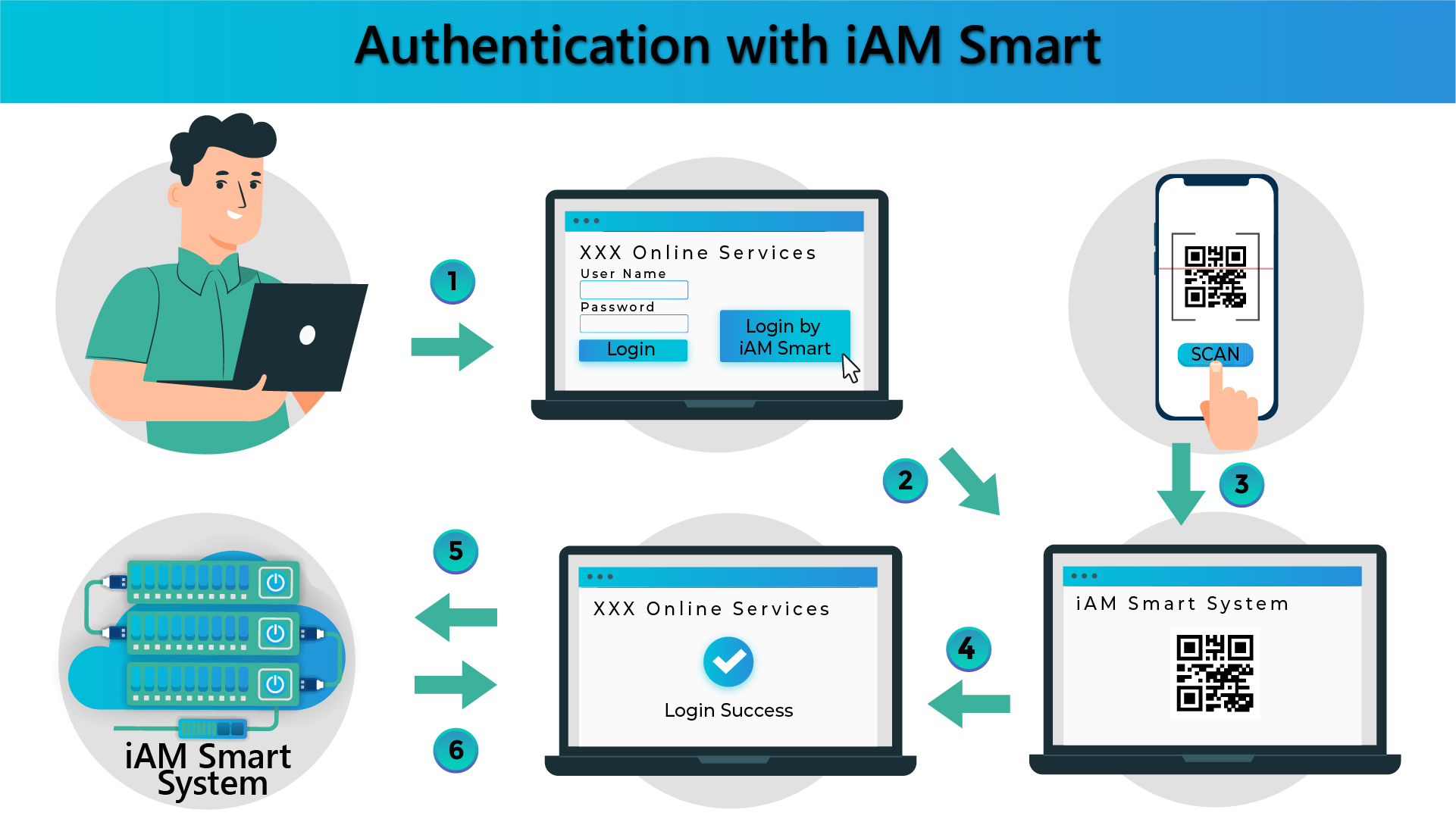

Hong Kong’s open banking system, regulated by the Hong Kong Monetary Authority (HKMA), operates via a phased approach. It relies on the iAM Smart digital identity system for secure authentication and data protection, similar to Singpass in Singapore.

However, unlike Singapore’s market-led approach with government support, Hong Kong’s system is more regulatory-driven. The HKMA has issued a four-phased progressive implementation approach for the Open API Framework with non-mandatory deadlines to encourage banks’ adoption of open APIs.

In contrast, Malaysia’s open banking landscape is in its nascent stage and more market-driven, akin to Singapore’s strategy. Malaysia’s initiatives focus primarily on open data APIs, granting access to non-sensitive information.

However, the absence of a clear regulatory framework poses challenges. Efforts are underway to establish a framework, potentially enabling a more comprehensive range of financial services, paralleling Singapore’s SGFinDEx.

The road ahead for SGFinDEx

In essence, SGFinDEx is an example of how Singapore is leading the way in leveraging open banking to empower consumers.

Its secure, efficient, standardized system provides a model from which other countries can learn. As consumer awareness grows and more services integrate with it, SGFinDEx is poised to revolutionize the financial sector in Singapore and potentially worldwide.

By fostering innovation and collaboration among stakeholders and by offering solutions that cater to diverse consumer needs, SGFinDEx exemplifies the transformative power of open banking.

It is a testament to Singapore’s commitment to harnessing technology to improve the lives of its citizens and the efficiency of its financial sector.