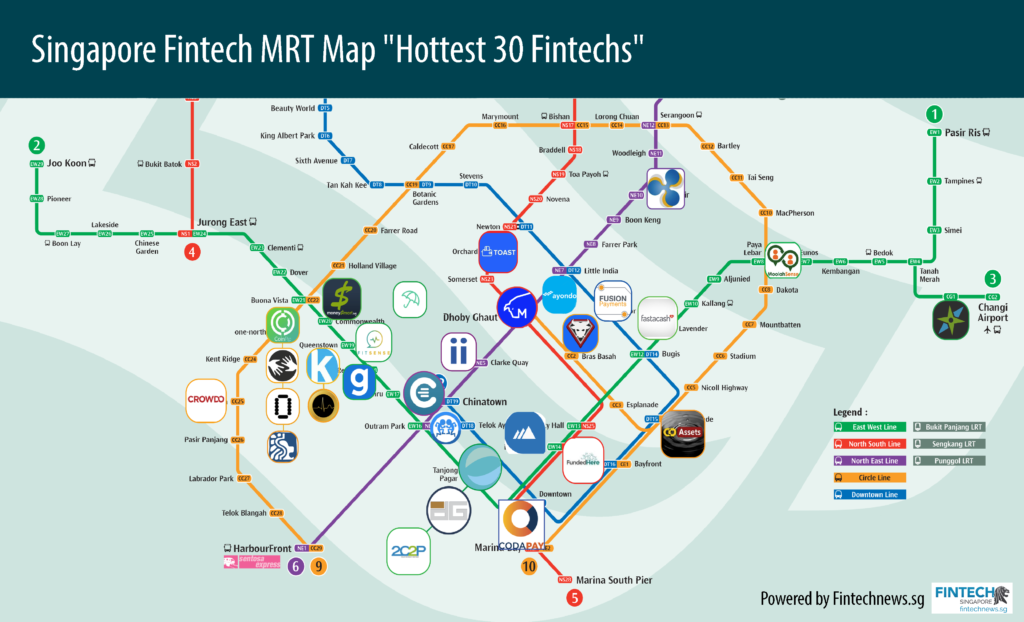

TOP 30 FINTECH STARTUPS IN SINGAPORE

Editors Note: An updated list for 2019 now available

As a part of drawing the FinTech scene in ASEAN, especially Singapore, Fintechnews collects, tracks and analyzes hundreds of FinTech Startups, established over the last two decades. Today, the FinTech industry experiences the huge changes. So many few startups are slowly knocked out of the game while more and more players have been joining.

After all deep learning into the startups’ performance, we filter and pack the FinTech starts in this Top 30 FinTech Startups Singapore List for 2016.

Stay tuned the 2019 list will follow soon.

Top FinTech Startups in Money Transfer

Top FinTech Startups in Money Transfer

CoinPip is a Singapore-based payments company that leverages Bitcoin to make it easier and faster to pay remote workers. Payments are sent directly into the recipient’s bank account so they don’t have to actually touch Bitcoin.

Total Equity Funding: $100k in 1 Round from 1 Investor

Most Recent Funding: $100k Seed on November, 2014

fastacash™ provides a global social payments platform which allows users to transfer value (money, airtime, other tokens of value, etc.) along with digital content (photos, videos, audio, messages, etc.) through social networks and messaging platforms. The company has developed a patent pending link generation technology that enables the value transfer with a secure link.

Total Equity Funding: $23.5M in 4 Rounds from 7 Investors

Most Recent Funding: $15M Series B on July 14, 2015

TOAST is a Peer 2 Peer money transfer application that allows Filipinos in Singapore, Hong Kong to remit money back home directly from a smartphone without the need to utilize existing banking infrastructure or queue up at a Money Transfer Shop. They make themselves unique in terms of the most efficient price offerings.

Total Equity Funding: $865.93k in 2 Rounds from 4 Investors

Most Recent Funding: $850k Seed on October 9, 2015

Top FinTech Startups in Lending

Kyepot brings social financial service to the digital age. People with bank accounts find it difficult to save and people without bank accounts incredibly harder. Financial exclusion limits access to good product for saving and borrowings. They offer tools for people to save in trusted communities. The borrowing is at a reduced cost of capital so a win win for everyone.

Total Equity Funding: $215.93k in 3 Rounds from 2 Investors

Most Recent Funding: $175k Seed on February 28, 2016

MoolahSense, Singapore’s first crowd-financing platform, cultivates entrepreneurship by empowering businesses and investors with a trusted and vibrant Crowd-lending platform. They aim to connect established businesses seeking loans for capital expansion, equipment purchases or other needs to the broad investor community.

Total Equity Funding: Undisclosed Amount in 1 Round from 2 Investors

Most Recent Funding: Seed on March 19, 2015 / Undisclosed Amount

Top FinTech Startups in Online Wealth Management

InvoiceInterchange is a P2P invoice trading marketplace that allows businesses to auction their outstanding invoices, otherwise tied up for 90 to 120 days, to investors for immediate cash. Unlike traditional lenders, they’re a flexible pay-as-you-go service, there are no restrictive security arrangements, no hidden fees or minimum charges, and business owners are given complete control.

Founded by a group of veterans from the FX and Securities Industries with experience averaging 15 years amongst the key members, M-DAQ is a game-changing platform that prices and trades exchange-traded products in a multitude of choice currencies by blending ‘executable’ FX rates into equities and futures products. M-DAQ enables Securities Exchanges to go multi-currency without significant changes to systems and back-end processes, with low start-up and running costs. All investors now, regardless of profile or trade size, can benefit from a multi-bank FX wholesale price in their overseas investment. It is a Game Changer that aims to create a World without Currency Borders®.

Total Equity Funding: $11.7M in 1 Round from 2 Investors

Most Recent Funding: $11.7M Series B on October 21, 2013

Mesitis empowers individual investors and their advisors with account aggregation and visualization across asset classes and banks. They run 3 different business lines, all of which are chosen because of large revenue potential with almost no direct competition; including: Canopy – Data Visualization, Canopy – APIs from PDF statements, Mesitis Securities – Discount Broker to the High Networth

Total Equity Funding: $6.13M in 3 Rounds from 1 Investor

Most Recent Funding: $2.35M Venture on May 16, 2016

Top FinTech Startups in Blockchain/Crypto-Currency

The gold standard in peer-to-peer digital assets. Purchase gold on ethereum with bitcoins, dogecoins, litecoins, and ether.

Digix is an asset-tokenisation platform built on Ethereum. They leverage the blockchain’s immutability, transparency and auditability by applying it to precious physical assets.

Digix has created a range of technologies including The Proof of Asset Protocol (POA), Digix Gold Tokens (DGX), a gold-backed token for Ethereum, and DGD – Digix DAO Tokens.

Open Trade Docs reduces errors, bottlenecks and fraud risks in trade finance by creating digital, non-repudiable, original documents, and complementing paper originals with unique digital copies. Both digital-paper and paper-digital pairs have full lifecycle and audit trail. By using private blockchains, participants remain in control of all data and access rights instead of relying on a third party. Auditable OTDocs uses blockchain technology to ensure that once written, data can not be amended, even by system administrators.

Otonomos is engineering the world’s first blockchain-chartered company, in which users hold their shares in the same way as owning bitcoins in a digital wallet. It is a Singapore Private Limited company, registered as a Filing Agent under the Accounting and Corporate Regulatory Authority Act with Professional Number: PB15000304

Total Equity Funding: $165.93k in 3 Rounds from 5 Investors

Most Recent Funding: Seed on May 18, 2016 / Undisclosed Amount

Ripple Gateway Pte Ltd was founded by 4 entrepreneurs with a common passion; the math based currency movement. The company creats a global real-time payment system by providing enterprise-grade solutions to banks and financial institutions.

Top FinTech Startups in Crowdfunding/Investment

Crowdonomic’s mission is to empower entrepreneurs in Asia. For entrepreneurs, they offer a crowd funding platform to raise funds, gain visibility, and build traction, allowing global supporters to access innovative new goods and services and to tap into Asia’s growth story.

FundedHere was founded in Singapore in 2015; it is the first Singapore home-grown crowdfunding platform that offers equity crowdfunding and lending-based crowdfunding. Equity crowdfunding is a financing mechanism through which investors are investing into the start-ups in exchange of equity holdings. Such share holdings will entitle them to future capital gains as well as dividends declared by the start-ups. Lending-based crowdfunding is where investors lend money to a company and receive the company’s legally-binding commitment to repay the loan at pre-determined time intervals and interest rate. The primary objective of FundedHere is connecting investors to startups in Asia, getting good entrepreneurial ideas funded and offering attractive returns for investors.

Total Equity Funding: $1.29M in 1 Round from 7 Investors

Most Recent Funding: $1.29M Seed on April 11, 2016

Top FinTech Startups in Personal Finance Management/Comparision

The MoneySmart, founded by the entrepreneur Vinod Nair, specializes in the management tool of personal finances. They provide simplified financial advice to customers, limiting the confusing jargon and helping them decide which financial service is suitable for them. The startup allows users to ask for advice, compare prices and features for products like loans, insurance, and credit cards, and apply for them through the site.

Total Equity Funding: $2M in 1 Round from 4 Investors

Most Recent Funding: $2M Series A on October 6, 2015

Moneythor enables financial institutions to deliver improved functionality and experience to their customers across their digital channels.

It provides a white-labelled solution to help financial institutions deliver contextual recommendations & insights to their customers within their existing online & mobile banking applications.

TradeHero

Founded in 2012 by app developer MyHero, TradeHero’s mission is to provide a platform for traders to monetize their investment expertise, by democratizing trading in a social and gamified mobile app. TradeHero is a free stock market simulation app, which draws real-world data from stock exchanges to create an un-rivalled global social investment network. Users can compete with friends from their social networks, or on the global leaderboards with users from across the world. The app brings novice and knowledgeable traders together, allowing novice traders to subscribe for stock tips via push notifications, and top traders to earn subscription fees from followers.

Total Equity Funding: $10.46M in 2 Rounds from 4 Investors

Most Recent Funding: $10M Series A on September 26, 2013

Shereit

A Social Trading Network changes the way people invest in stocks. It allows them to interact, through live trades or messages with other traders around the world in a real-time and transparent way. It is a social network designed and built specifically for stock trading.

Investing has always been social. For hundreds of years investors have always gotten their trading advice from Friends and Family, people they trust. Investors have always researched what the Best Performers are doing, people they look up to. Some non-professional investors even follow their friends’ strategies and while others go one step further and even copy the trades. Social Trading has always been with us and ShereIt uses the concept to make share trading easy for everyone.

ShereIt is a white-label social trading network for stock brokerage firms. The platform offers:

• Traders, inspiration to share trades and ideas globally with other traders, along with integrated trade copy and analytics tools to catapult trading returns.

• Brokerage firms, increased deal flow, accelerated conversion ratios and better customer insights.

Total Equity Funding: $15.81k in 1 Round from 2 Investors

Most Recent Funding: $15.81k Seed on March 14, 2015

WeInvest is the first digital personal-finance assistant for Affluent Investors in Asia. Singaporean startup WeInvest provides individual investors with tools to discover and manage their investments. The platform curates investment opportunities across real estate, mutual funds and deposits, provides search and compare tools, and presents investment data in an easy-to-understand format.

Top FinTech Startups in Data Management

Call Levels is a simple, independent and reliable tool to track users’ financial assets. The automatic notification feature frees users from the time-consuming market analysis tasks.

Total Equity Funding: $500k in 2 Rounds from 6 Investors

Most Recent Funding: Seed on January 10, 2016 / Undisclosed Amount

Smartkarma is an independent financial research platform that is radically changing the way market participants create, distribute and consume investment insights. As a trusted and unbiased information source, they provide differentiated research and transparency into the Asian markets that global institutional investors need to confidently drive their investment strategies. They combine intelligence from the world’s premier analysts, academics, data scientists and industry experts in one collaborative marketplace to help investors improve efficiencies, enhance returns, and optimize their research spend while accessing the widest range of global analysis of the Asian markets available.

Total Equity Funding: $4.7M in 2 Rounds from 3 Investors

Most Recent Funding: $4.7M Venture on June 1, 2016

Top FinTech Startups in InsurTech

The most effective, convenient, and reliable way to save on any insurance premium.

Fitsense is a data analytics platform working with insurance companies to reduce insurance premiums for anyone with a smartphone or wearable.

Fitsense is developing a data analytics platform to help health & life insurance companies personalize insurance

by using wearable data.

Total Equity Funding: $16.29k in 1 Round from 2 Investors

Most Recent Funding: $16.29k Seed on December 8, 2015

The PolicyPal provides a simple digital overview of buying and managing insurance for everyone. The platform will allow users to manage their policies in one place and understand where they have duplicate or missing coverage. It will also let them find the policies that are the most suitable for their needs

Total Equity Funding: $18.42k in 1 Round from 2 Investors

Most Recent Funding: $18.42k Seed on April 18, 2016

Top FinTech Startups in Payment

2C2P (Cash and Card Payment Processor) is a leading Southeast Asian comprehensive payment services provider, transforming millions of everyday payments across Asia. The company offers a number of services tailored for the needs of ecommerce and mcommerce merchants, banks and financial institutions of any size.

Total Equity Funding: $10M in 3 Rounds from 3 Investors

Most Recent Funding: $7M Series C on April 27, 2015

Codapay is an alternative payment gateway in Southeast Asia. Codapay enable merchants to accept payments in Indonesia, Malaysia, Philippines, Thailand, and Singapore using payment channels that every consumer can use, even if they don’t have a credit or debit card: direct carrier billing, bank transfers, cash payments at convenience stores, and physical vouchers. By making a single technical connection and commercial agreement with Coda, our merchants (companies like Baidu, Gumi, and Garena) significantly increase their revenues in the rapidly growing markets that we serve. Similarly, by appointing Coda as a merchant aggregator, our payment channel providers (companies like SingTel, Indosat, and Maxis) generate significant net-new transaction volume.

Total Equity Funding: $3.2M in 4 Rounds from 7 Investors

Most Recent Funding: $2.3M Series A on December 2, 2013

Fusion Payments Singapore Pte. Ltd.

Fusion Payments (Formerly InterAcct Solutions) provides a range of ubiquitous handset recharge, mobile banking and security solutions with partner mobile network operators and banks in the Asian region.

Whilst starting out life in 2001 as a dedicated USSD solutions provider, the portfolio has expanded to include all standard bearers. The mPayment and mRecharge hub / switch now provides, in addition to USSD, an open secure RESTful API for WEB, WAP and rich/native clients. This allows customers to safely expose their core transactional (bank, credit card or wallet) and recharge systems.

GoSwiff is a leading provider of mobile payment platforms and marketing solutions. They offer an integrated mobile commerce platform for online, mobile and in-store payment acceptance systems – and are helping to meet the growing demand for digital payments in both emerging and developed markets.

Incorporated in 2010, GoSwiff is headquartered in Singapore and currently has a presence in 25 countries around the world.

Kashmi is a brand new mobile payments application that allows young people to exchange money with their friends in a simple and fun way, for free. Sending money is as easy as sending a text by phone. Pay on-the-go, share experiences and remind friends about dues.

Total Equity Funding: $555.87k in 3 Rounds from 6 Investors

Most Recent Funding: $509.97k Seed on August 1, 2015

MatchMove Pay is Singapore’s fastest growing finance technology company, providing innovative enterprise solutions to help businesses increase revenue, user engagement and loyalty through the strategic use of our customizable cloud-based PCI-DSS compliant platforms.

Source: Crunchbase and the companies’ sites.