Singapore and India’s Real-Time Payments Linkage Goes Live

by Fintech News Singapore February 21, 2023The real-time payments linkage between Singapore’s PayNow and India’s Unified Payments Interface (UPI) has officially gone live today.

This will enable customers of participating financial institutions in Singapore and India to send and receive funds between bank accounts or e-wallets across the two countries in real-time.

They can do this using just the mobile phone number, UPI identity, or Virtual Payment Address (VPA).

The Singapore participants are DBS and Liquid Group. Meanwhile, India participants are Axis Bank, DBS India, ICICI Bank, Indian Bank, Indian Overseas Bank and State Bank of India.

Liquid Group is the first non-bank financial institution to participate in Singapore’s cross-border real-time payment system linkage via its LiquidPay e-wallet.

The service will be made available to Singapore customers of DBS Bank and Liquid Group under a phased approach. These institutions will progressively increase the number of eligible user groups and transaction limits from today till end of March this year.

Indian customers of 4 banks – ICICI Bank, Indian Bank, Indian Overseas Bank and State Bank of India – will be able to receive funds through the service from the onset. The scope will be gradually expanded to include more financial institutions.

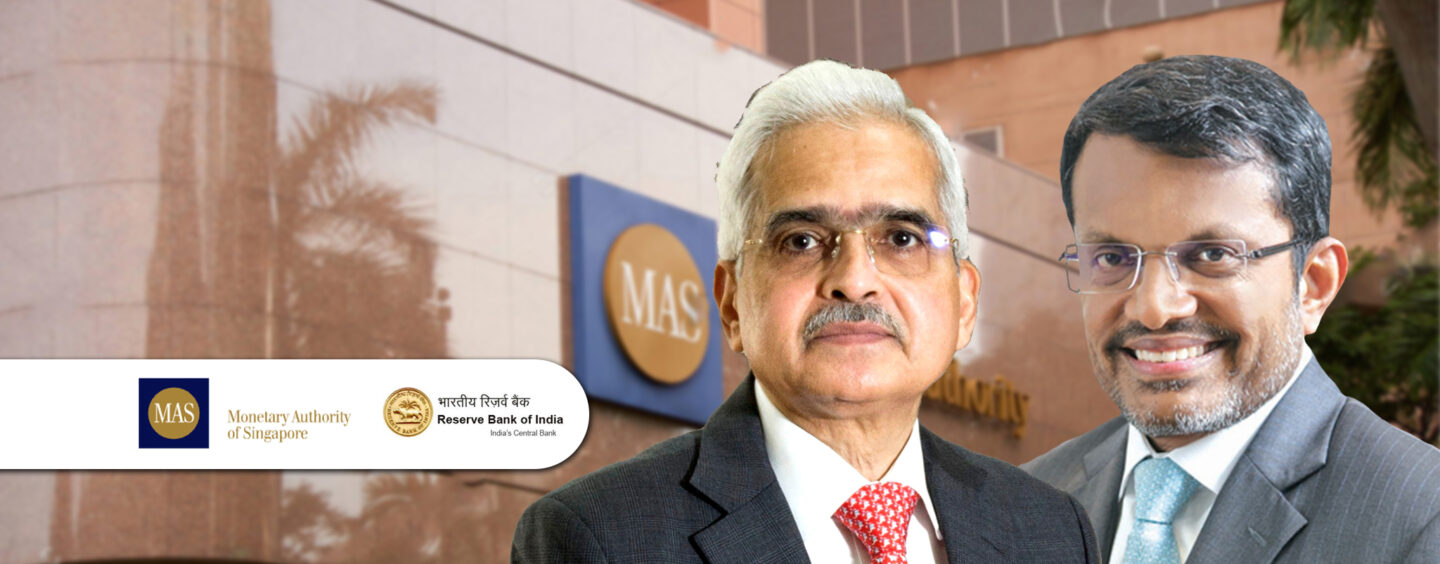

The PayNow-UPI linkage is the result of extensive collaboration between the Monetary Authority of Singapore (MAS), Reserve Bank of India (RBI), both countries’ payment system operators, payment scheme owners, and participating banks and non-bank financial institutions.

Singapore had previously linked its PayNow system with Thailand’s PromptPay, touting it as the first of its kind globally.

The island state has similar plans in motion to set up payment linkages with Indonesia, the Philippines and Malaysia.