Regulatory Technology (RegTech) solutions can help investment firms to meet suitability requirements. Swiss RegTech start-up Riskifier provides in addition to the investor risk profile behavioural and social insights through a user centric experience to empower better investment decisions.

Investor protection in the focus

Across the globe investor protection frameworks have been further strengthened or are in the process of. A key element of investor protection is the collection of data about clients and the subsequent assessment that an investment product is suitable.

Demand for customer centricity as a challenge for compliance driven processes

While regulated entities must adhere to these regulatory requirements customers are demanding short and hassle-free processes to consume requested banking products and services. FinTech’s and Challenger Banks are providing their services with a strong focus on user-experience whereas traditional financial service provider are more risk averse and have built their processes along regulatory requirements.

These established players have a disadvantage in targeting specific customer segments such das digital natives and tend to offer standardised products offerings while younger generation may have different expectations and needs. Complex legacy systems and processes further increase the costs for additional documentation requirements such as updating of risk profiles.

Current suitability assessments may be ineffective

Outcome of studies in behavioural finance have shown that some of the current suitability assessments may be ineffective if client’s behavioural biases (e.g. mental accounting or loss aversion) are not taken into accounts.

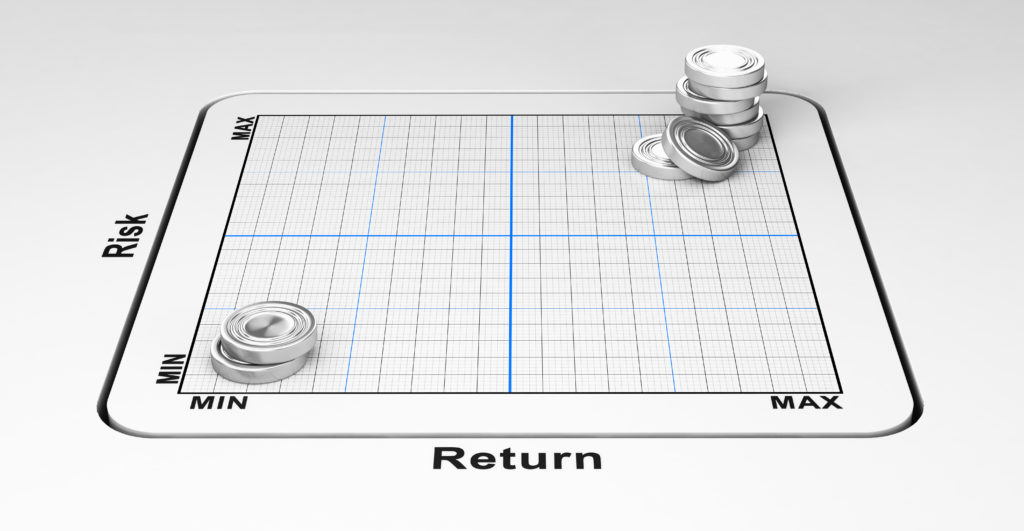

Behavioural finance theories focus on the specific risk perception of an individual investor (taking into account both individual psychological characteristic and the emotional sphere) while classical finance theory considers risk as an objective measure (ESMA, Consultation Paper, certain aspects of the MiFID II suitability requirements, 2017).

Using technology for fostering customer relationships

An ideal investor risk profiling process should therefore deliver a bias-free risk assessment through an effortless user experience while collecting all required information in a short time frame. This can be achieved by introducing gamified elements for the data collection and applying questions which are addressing latest results in behavioural finance research.

Sourcing of social media data upon user consent can shorten the data collection process and can deliver additional insights about user’s likes and preferences to find the best investment products not only in line with the risk profile. Built-in consistency checks enhance the quality of the data and prevent manual adjustments in a later stage while an automated update process of the profiling saves time and money.

Test the Riskifier Solution and meet the Co-Founders

Recognized as one of the world’s most innovative RegTech companies, Swiss based start-up Riskifier has created a prototype of a new suitability assessments using a user centric chatbot experience.

Riskifier is combining social media, behavioural finance and artificial intelligence to create personalised investor profiles with social and behavioural insights which empowers investors as well as financial advisor to make better investment decisions.

Meet the Co-Founders of Riskifier (Gino Wirthensohn and Jelena Jakovleva) during the Singapore FinTech Festival at the booth of F10 Incubator & Accelerator and see how investor risk profiling can be turned into a user engaging experience providing more insights for better investment decisions.