Blockchain Technology Set To Transform Commercial Real Estate With Wide-Ranging Applications

by Company Announcement March 15, 2018Colliers International, a global real estate service launched a new research report assessing the impacts of blockchain technology in the context of commercial real estate (CRE) in Asia.

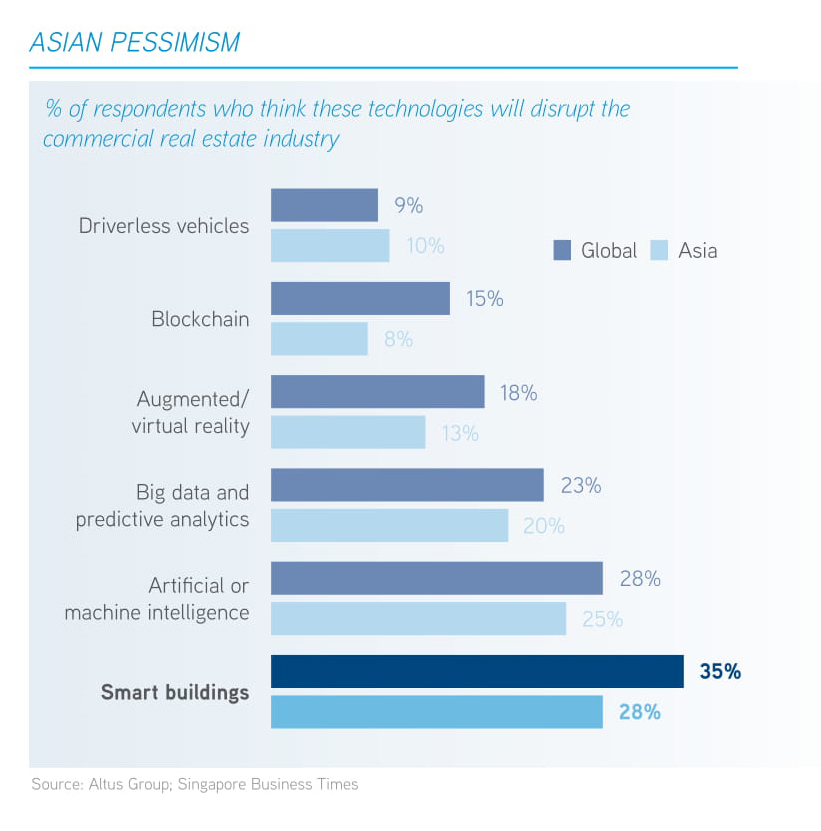

Blockchain has become part of the basic vocabulary of many industries over the past decade. The authentication and security possibilities opened by blockchain are of particular relevance for the property sector, and across Asia examples of the technology being applied in the field are already emerging.

Sam Harvey-Jones

Mr. Sam Harvey-Jones, Managing Director of Occupier Services Asia at Colliers International, commented:

“Real estate is ripe for blockchain-based disruption due to the complexity of the typical transaction. Moving land registries, for example, onto blockchain promises to create tamper-proof records, enhancing the clarity and security of property ownership.”

Meeting the Need for Speed

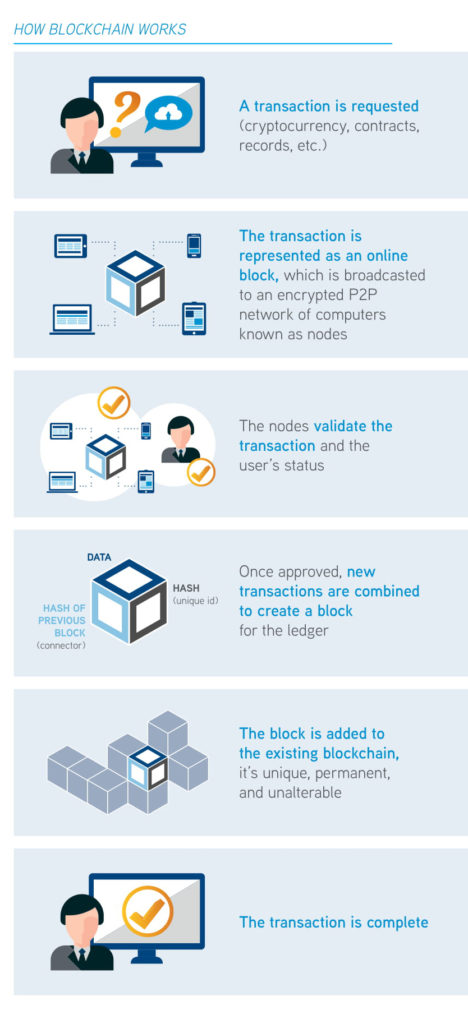

The list of parties involved in many real estate deals extends well beyond owner and occupier (or buyer), to brokers, banks, law firms, governments (via stamp duties or land registries) and utility operators. Blockchain could provide a secure platform for all parties to verify each other’s identities — as well as the history of and data on the real estate asset being acquired or leased.

Michael Bowens

Mr. Michael Bowens, Executive Director, Regional Tenant Representation Asia at Colliers International, explained:

“Blockchain could be used to build ‘smart’ contracts in which terms and related transactions are automatically, and near-instantly, recorded and immutable.”

Enhancing Transparency

Blockchain could also play a role in boosting the security and transparency of real estate markets — particularly those where data quality or availability is at times lacking, as is the case throughout much of emerging Asia.

Mr. Bowens added:

“One of the applications generating the most excitement is in land registries, which in their current form are often out of date, incomplete and/or prone to manipulation. Moving land registries onto the blockchain promises to create automatically updated, tamper-proof records, ultimately enhancing the clarity and security of land and property ownership.”

Driving Decentralisation

Beyond its direct technological applications, blockchain may have wider impacts on how CRE assets are traded and managed, and the broader structure of property markets in the region.

In combination with the spread of artificial intelligence and other technological trends, we also expect that blockchain will lead to lower staff requirements in back and middle offices and reductions in office sizes (or at least greater efficiency in office use). Blockchain should thus help accelerate a decentralisation process in the financial sector in particular, and to increase demand for flexible workspace.

Andrew Haskins

Mr. Andrew Haskins, Asia Head of Research at Colliers International, commented:

“A definitive industry shift towards smaller, remotely connected or flexibly deployed teams could encourage migration to non-CBD locations and the adoption of flexible workspace models, with clear consequences for markets where financial firms have a heavy presence.”

Practicalities & Challenges

- Regulation will inevitably lag the technology’s adoption, potentially leaving real estate applications in a grey area or thwarted, if, for example, registries or digital identities are not able to garner official recognition.

- Standardisation: Developing shared standards will be a particular challenge in Asia given the region’s diversity of assets, markets and regulatory regimes.

- Vested interests: Blockchain-based solutions could simplify, eliminate or replace some of the roles or tasks currently performed by agencies or legal professionals, such as title searches or the registration of transactions, which may discourage adoption in some segments of the market.

- Infrastructure limitations: Blockchain solutions may not interface easily with legacy systems, as a result many end-users will need to invest substantial time and funds to support a transition.

Featured image via Colliers International Blockchain report