Accenture Releases New Paper on Fintech, the Challenges and Opportunities & Opens Fintech Innovation Lab in Asia-Pacific

by Fintech News Singapore April 24, 2016Banks should not consider fintech startups as competitors but rather enablers. Those that can assess, adapt and adopt new technologies most quickly will be best positioned to achieve their desired position in the new industry structure, according to consultancy firm Accenture.

“Successful banks will rapidly make clear strategic decisions on the business model and use this vision to rally their talent around a more compelling journey, rather than the cost cutting downward spiral in which many players are now falling,” the company claims in a new report.

“Successful banks will rapidly make clear strategic decisions on the business model and use this vision to rally their talent around a more compelling journey, rather than the cost cutting downward spiral in which many players are now falling,” the company claims in a new report.

Entitled ‘Fintech and the evolving landscape: landing points for the industry,’ the study analyzes the latest global fintech trends and discusses the challenges and opportunities that fintech companies can pose for banks.

The fintech landscape

In 2015, global fintech investment increased by 75% to reach US$22.3 billion. According to Accenture, the industry is showing signs of a new level of maturity with a continued increase in larger deal sizes and some regions cooling-off.

Asia-Pacific is now the second biggest region for fintech investment after North America, outpacing Europe. In APAC, fintech investment more than quadrupled in 2015 to US$4.3 billion with China leading the trend.

“The drive for fintech innovation is spreading well beyond traditional tech hubs,” Richard Lumb, Accenture’s group chief executive for Financial Services, said.

“New frontiers like robotics, blockchain and the Internet of Things are bound less by geography than by the industry’s ability to adopt and scale clever ideas that improve service and efficiencies. The so-called ‘Fourth Industrial Revolution’ is a global phenomenon that brings new innovation and digital companies that compete and collaborate with traditional financial services. Bank customers stand to gain from this.”

And we are OPEN for applications! Apply now to THE #fintech #accelerator in #APAC at https://t.co/glVG5mUmdF ! pic.twitter.com/KMaHHZkpal

— FinTechLabAPAC (@FinTechLabAPAC) 17. April 2016

Collaboration versus Competition

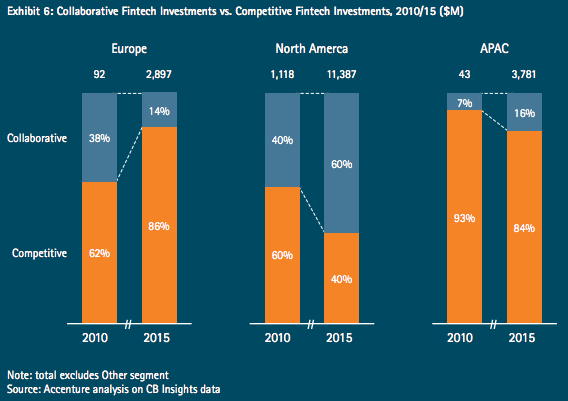

Accenture draws a distinction between “disruptors” and collaborative fintech ventures. Collaborative fintech ventures, those primarily targeting financial institutions as customers, are gaining ground over disruptive players.

“The proportion of competitive fintech ventures in Europe and Asia is much higher than in North America, which largely reflects the earlier stages of maturity of fintech markets, particularly outside of London,” Julian Skan, a managing director in Accenture’s Financial Services group who oversees the FinTech Innovation Lab London, said.

“London’s welcoming regulatory environment has made a preferred market for competitive fintech ventures to test their propositions. Banks too stand to benefit from this, as it drives momentum to re-imagine their own capabilities.”

Moreover, the report suggests that tech giants, most particularly Google, Apple, Facebook, Amazon and Alibaba (GAFAA), have started offering financial services and are progressively redefining the landscape.

“As banks face increased pressure to reduce costs and drive stickier, more profitable relationships with their customers, larger technology and platform players may offer a more attractive set of rails on which to deliver services to customers,” the report reads.

GAFAA is “resetting the benchmark for customer experience.” Because they’ve recognized the value of financial data, these tech giants are increasingly offering banking-style services to customers.

Accenture advises banks and financial institutions to start learning from and collaborating with GAFAA.

“Banks must learn lessons from GAFAA about how to reach, interact with and delight their customers. By forming partnerships with these firms, they can access their deep pools of customer data and drive future products and services.”

The report echoes a previous study released by Accenture warning banks and traditional financial services players on the growing competition from the likes Google, Facebook, and Amazon.

These players have access to a huge amount of data that are leveraging to provide personalized, targeted financial services, and are ultimately serving clients better.

An industry that Google has started to tap into is insurance. In 2012, the tech giant launched an online insurance comparison site in the UK. Google Compare is a comparison-shopping site that lets users compare rates from different insurance providers. The firm’s insurance partners include Mercury Insurance and MetLife, as well as local providers.

Read the full ‘Fintech and the evolving landscape: landing points for the industry’ report: http://www.fintechinnovationlablondon.co.uk/fintech-evolving-landscape.aspx