Life.SREDA, a fintech-focused venture capital fund headquartered in Singapore, has released its annual fintech research report detailing the major fintech trends for 2016.

‘Money of the Future,’ co-authored by Life.SREDA, business school INSEAD, and consultancy firm Deloitte, examines the 15 main fintech trends to expect in 2016.

‘Money of the Future,’ co-authored by Life.SREDA, business school INSEAD, and consultancy firm Deloitte, examines the 15 main fintech trends to expect in 2016.

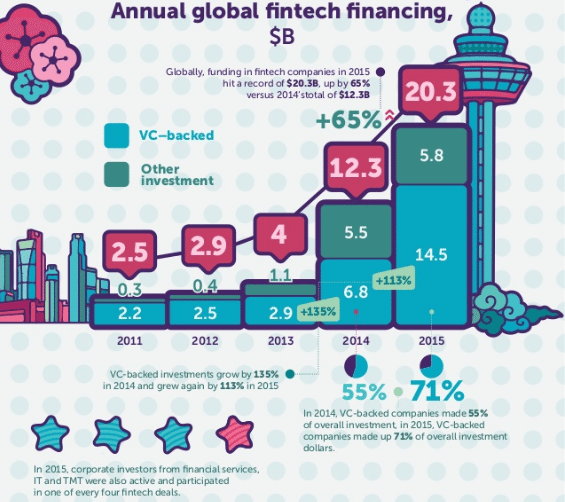

There are more than 5,000 fintech startups in the world, and fintech is undoubtedly hot topic with over US$20 billion being invested globally in the sector in 2015.

“The bigger effect from the fintech revolution will be to force flabby incumbents to cut costs and improve the quality of their service,” argues Serguei Netessine, professor of Global Technology and Innovation at INSEAD. “That will change finance as profoundly as any regulator has.”

While 2015 was likely the best year for venture investment in US fintech, 2016 will be “a pivotal year for the future of fintech,” which will determine longer-term valuations of global fintech ventures; ventures that are creating new solutions that might forever change the financial services industry.

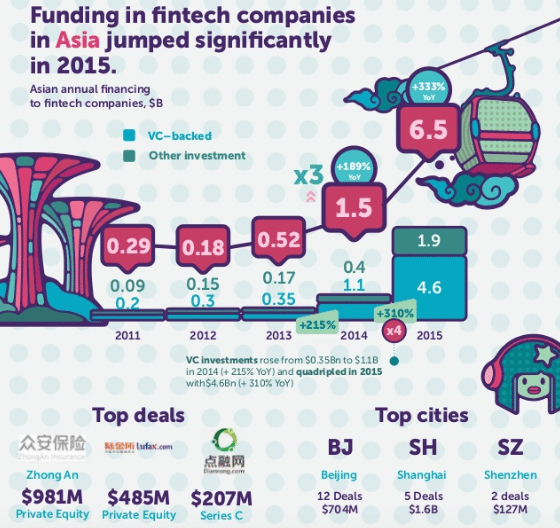

Most particularly, funding in Asia increased by over 300% in 2015, reaching an all-time record of US$6.5 billion. China is leading the way in fintech, with the three largest deals being closed by Chinese fintech ventures.

According to Mohit Mehrotra, executive director of Consulting at Deloitte Southeast Asia, “over medium term in certain markets (smart cities), fintech will morph into a broader technology play enabled through the Internet of Things, allowing for the cities of tomorrow to perform more efficiently and for people to make better use of their civil services.”

This statement echoes Singapore’s bold ambition of becoming the world’s first smart nation and a “smart financial center” where the pervasive use of technology is expected to improve the lives of citizens.

15 Key Fintech Trends in 2016

Fintech is a hotspot

By the end of 2015, there were 46 fintech unicorns. All together, they totaled a capitalization of US$98.1 billion. The report suggests that there are 36 more unicorns to come.

M&A rather than IPO

Giants that have accumulated a large amount of cash such as Apple, Google and Facebook, should acquire most of the “new stars.” Following the trend, the fintech sector has seen the largest deals in merger and acquisitions: PayPal and Xoow, Alibaba and Paytm, BBVA and Simple, Samsung and LoopPay, and so on.

Asia: the rising star

While fintech initially started in the US and Europe, Asia is catching up and the true potential of the region has become evident.

Governmental support in Singapore, Hong Kong and Seoul have contributed to the fintech boom across the continent.

Mobile point of sale (mPOS)

“mPOS-acquiring is turning into customer attraction channel, while the integrated POS management and customer relations systems are becoming the core business,” the report says.

In Asia, there are two main drivers of mPOS development: rising number of bank cards and the boom of e-commerce.

Online-acquiring

Online-acquiring is following the growth of e-commerce and is growing rapidly in Asia where e-commerce is booming, especially among small merchants.

Crowdinvesting and crowdfunding

“We have only hit the top of the iceberg with crowdfunding,” according to Vladislav Solodkiy, managing partner of Life.SREDA VC. “The beauty of the crowdfunding model is just how simple and adaptable it is.”

Blockchain technology

While it is impossible to predict how blockchain and the hype surrounding the tech will evolve in the future, the potential of the blockchain lies in task like remittances and currency conversion, cloud bank processing, and insurance.

“What blockchain needs is a Netflix or [Amazon Web Services] type of company,” Solodkiy said. “It needs to be able to disrupt traditional financial services in a big way and bring more democratized services to a larger audience.”

Online lending

For users of online lending platforms, notably those from developing countries or underbanked populations, online lending combined with online credit scoring is a valuable avenue to access the funds they need to build their businesses, take care of their families or provide for their communities.

Big data and online scoring

The growth of online lending services, lower barriers to entry and the proliferation of cheap data, have created a demand for online scoring. These scoring methods takes into account unconventional data notably from social networks, smartphone manufacturers and mobile operators to provide lenders with online-loans.

Social payments

While many social networks and messaging apps have begun integrating fintech solutions into their platforms, the journey to a global fintech-powered messaging service is still many years away.

Fintech for insurance firms

Insurance firms have begun researching and collaborating with existing player in fintech. These firms will now have to understand how to integrate current services in their core business.

Fintech for SMEs

Many fintech startups are now actively integrating technologies and products for merchants, such as alternative capital sources, mobile banking technologies, tablet-based cash registers and POS management systems.

Bank-as-a-service

In the US, Bancorp provides middle-ware platform (licenses, processing, integration) for a fast and cheap launch of startups. In some countries, it is practically impossible to obtain banking licenses for new market players.

Offline-to-online and the Internet of Things

Offline-to-online, which combines with experience of online purchases with online technologies, is being investigated by the like of Tesla, Burberry and Line.

Chinese Internet giant Alibaba, among others, have already announced it will actively develop the trend which is expected to have great potential in improving the quality of customer service.

The key role of consulting firms

Consulting firms are sensitizing their clients to fintech. They are conducting internal fintech research and organizing conferences to bring knowledge and techniques of the fintech world to legacy companies.

Consulting firms are not only helping startups connect with potential clients and/or partners, they are also discovering new business and monetization models, enabling their clients from the banking, insurance and telecommunications industries, to gain access to innovation through a familiar channel.

Read Life.SREDA’s ‘Money of the Future 2015/16’ report: http://www.slideshare.net/vsolodkiy/money-of-the-future-20152016-60208464

Featured image: Analytics and big data concept, by a-image, via Shutterstock.