Traditional wealth management was popular for many decades. Given the large volume of managed funds and inclination of affluent clients to adopt conservative strategies, this investment approach was very successful.

It was tough to imagine that anything could disrupt this traditional market that was based on personal relationships between the client and the advisor. How could it be different? Wealthy people historically required a different approach for managing their finances. It included all aspects of their financial life. However, changes in the financial markets and a shift in the preferences of the wealthy forced the wealth management industry to search for new unconventional approaches to satisfy these new demands.

New solutions are needed

Recent trends in big data and artificial intelligence didn’t escape the attention of the financial industry. These changes first became widespread within the trading industry. Algo-trading utilized advancements in information technology to develop automatic software that can be used for performing trading of futures and commodities. At the same time ,more traditional wealth management stayed with time-tested strategies, which relied on human expertise. However, rapid market changes forced it to search for effective new solutions.

Interdependence plays a crucial role in the global economy. While complex relations between companies throughout the world led to advancements in the global economy, it also presented a new layer of complexity for investments. In order to have an effective investment strategy under these conditions, it is important to take into account vast amounts of data. While it is possible to rely on the professional acumen of a wealth manager, it is not possible to make this approach sustainable. Digitisation of wealth management can be a viable solution. By combining human expertise with sophisticated algorithms, it is possible to navigate in a complex and constantly changing investment environment.

Another sign of the need for new digital solutions in wealth management, is the rise of a new generation of wealthy millennials, who don’t adopt the old paradigm of traditional wealth management. They expect fast feedback, remote access and prefer to control their assets using a smartphone, instead of face to face interaction in an office.

In order to attract this group, companies must revise their wealth management approach. By introducing new solutions backed by information technology, they can appeal to a younger audience. It was also found that the majority of affluent millennials are not wealthy enough to use classic private banking and wealth management services. At the same time, new investment products, such as robo-advisors, lower entry barriers for affluent investors.

Robo-advisors – a promising solution for wealth management

Robo-advisors were developed in response to new demands in the wealth management market. The robo-advisor clearly explains its purpose – it is a computer program that utilizes complex algorithms to provide advice on investment strategies based on the client’s preferences regarding risk and their investment goals. Robo-advisors offer advantages in areas where computers traditionally outperformed humans. They can perform quick calculations and manage large amounts of data.

Recent developments in artificial intelligence and neural networks, which were implemented in a Bambu product, has allowed the development of a robo-advisor that can identify hidden insights in large amounts of financial data and formulate an optimal investment strategy.

Sophisticated advising algorithms, especially those based on neural networks, require large amounts of relevant data to produce quality investment recommendations. That is why Bambu gets data from trusted providers, like DriveWealth and Thomson Reuters. An additional benefit of automation is lower costs of service, which offers access to wealth management services for a wider range of prospective investors. Banks or wealth managers can use Bambu’s cost-effective platform to attract more clients, who were not previously able to afford the cost of traditional wealth management services.

Robo-advisor cares about investor goals

One of the advantages of traditional investment advisory services is the ability to develop a relationship between the client and their advisor. It is important to establish trust and truly understand the client’s needs. However, success in establishing this relationship depends on the qualities of the individual. It is not always possible to find a manager who matches the client’s personality.

If trustworthy relationships are not fully established between the client and their wealth manager, it is hard to achieve the best performance. This is because clear communication and understanding the client’s needs are essential for successful wealth management. A robo-advisor can utilize automation to provide trustworthy investment advice for any investor, thereby skipping the relationship building stage.

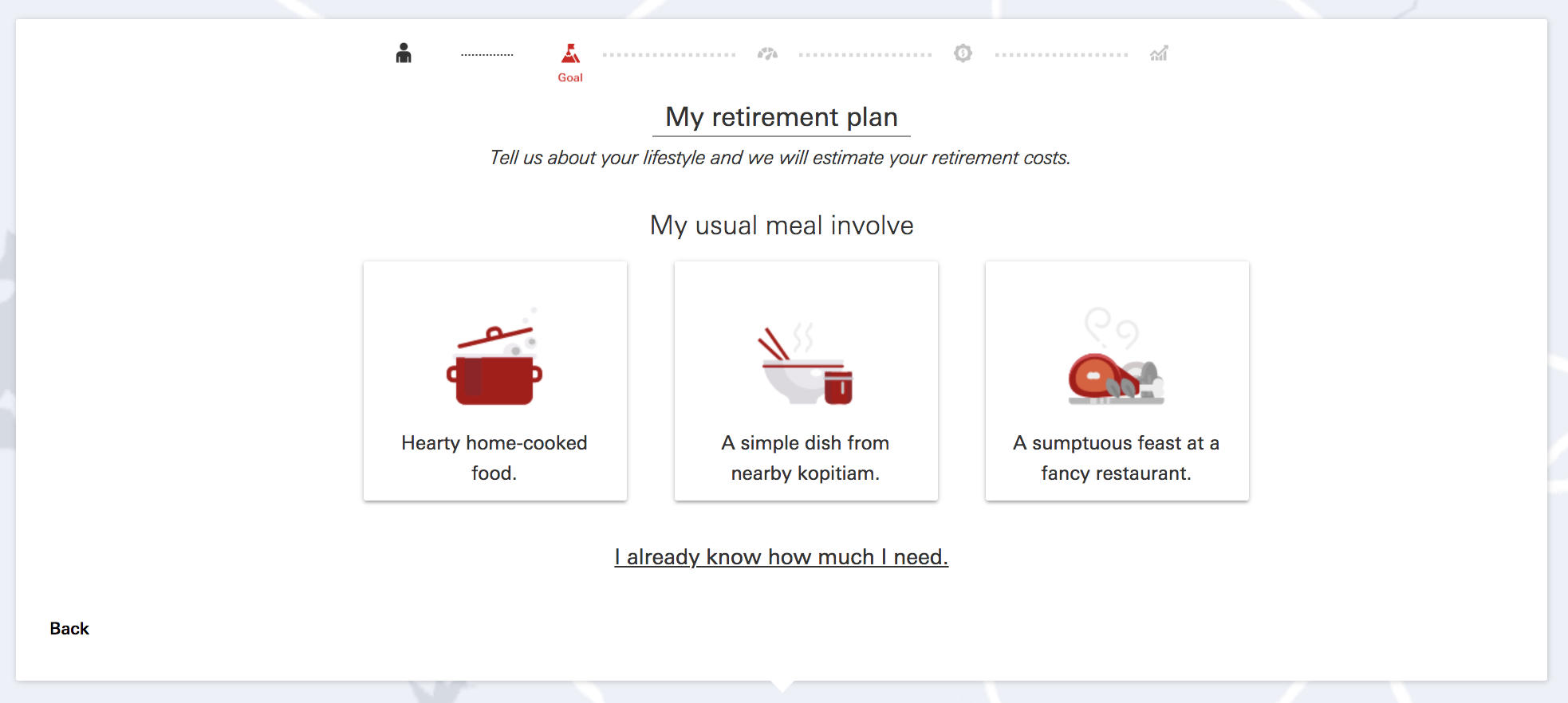

At the same time, it is not possible to build an effective investment strategy without taking into consideration personal goals and priorities. For this purpose, Bambu developed a questionnaire that each client answers before starting to work with the robo-advisor.

This questionnaire resembles a conversation between a wealth manager and the client. However, with the Bambu robo-advisor, this dialog is conducted online. There is no need to book an appointment with a manager. The questionnaire can be completed using a laptop from any location in the world.

Can robo-advisors replace financial advisor?

Analysis performed by Accenture demonstrates that even millennials need human investment advice. For someone who prefers personal contact, a combination of robo-advisors and a financial advisor may be the best option, since it combines the power of artificial intelligence and human interaction.

A professional advisor can leverage the robo-advisor for finding hidden market insights, by combining their years of experience and financial intuition with the big data and algorithms of a robo-advisor. Understanding the context of a situation is still a human responsibility. Therefore, it is unlikely that robo-advisors will completely replace humans. A robo-advisor can complement a financial advisor’s skills in areas where humans traditionally underperformed, which involves the analysis of large amounts of data and performing quick calculations. Robo-advisors also require new skills from financial specialists, which may lead to the appearance of new jobs.

Next step: Building something bigger than a robo-advisor

The majority of successful startups are not just products. They are platforms that allow the development of customized solutions beyond their infrastructure. iTunes became a platform for musicians and Ethereum turned into a platform for blockchain applications. In this way, Bambu established access to its own API (application programming interface).

This makes its functionality open for software developers, which allows new solutions to be built above the Bambu robo-advising platform. The API serves the role of a gateway that provides access for third-parties to utilize the power of the Bambu robo-advising solution. For example, a client may have their own data about assets which he is interested in. These data can be supplied to Bambu through its API. It can then be used to develop a holistic investment strategy.

Conclusions

The success of a robo-advisor depends on the combination of two factors – an intelligent algorithm and the quality of the data. The Bambu solution ensures that both of the necessary components are presented: algorithms based on cutting-edge developments in artificial intelligence and data provided by trusted partners.

The final step is to effectively use the Robo-advisor by solving a need for each particular investor. By introducing goal-based investing, Bambu brings the key element of traditional wealth management into the Robo-advising industry. It ties the personal life goals of an individual to his investment strategy.

This is a guest post from Dmitry Khramtsov from Bambu

Featured image credit: Unsplash