Cashless payments are booming in Vietnam, more than doubling in value over the first three quarters of 2018. In particular, transactions over mobile apps and digital wallets rose by an impressive 126% and 161%, respectively, according to Department of Payments at the State Bank of Vietnam.

“Mobile payment is becoming a new trend with the rise of technologies such as QR codes, contact and contactless payments, and the tokenization of card information,” Nghiem Thanh Son, deputy director of the department, said, quoted by VN Express.

The first months of 2018 saw the number of users and the value of transactions conducted through online and mobile channels, and e-wallets, skyrocket at many banks.

At Sacombank, the number of registrations for mobile banking reached 1.1 million accounts in October. At VietinBank, the country’s second largest lender by assets, 1.5 million people used mobile banking and engaged in transactions totaling VND64.35 trillion (US$2.76 billion) between January and June.

Besides banks, local startups too are tapping into the trend with key players now operating in the Vietnam mobile payment market including Mobivi, NganLuong, OnePay, Payoo, Momo, 123Pay, Moca, telco-run ViettelPay, VNG’s ZaloPay, and Ononpay. Overall, there are 27 licensed payment services and 20 of them operate e-wallets.

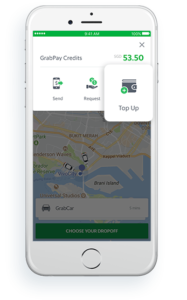

Grab expands mobile wallet business

GrabPay, via Grab.com

Singapore-based tech company Grab recently partnered with Vietnamese payment startup Moca to launch GrabPay by Moca, a mobile wallet integrated into Grab’s app in Vietnam, with which it aims to provide reliable and affordable financial services for the masses. Grab also acquired a stake in the startup.

The deal focuses on leveraging the strengths of both companies to push for mobile payments in Vietnam: Grab chose Moca for their local knowhow and access to licenses, while Moca’s mobile payment system will gain traction through its integration with Grab.

GrabPay is now setting its sights on Cambodia and Myanmar, according to Nikkei Asian Review, and signed a partnership with Philippine-based conglomerate SM Investments Corp (SM) to expand its mobile wallet to the Philippines. It also partnered with Thai lender Kasikornbank (KBank) to offer GrabPay and other financial services in Thailand by early next year. KBank has committed to invest US$50 million in Grab’s ongoing fundraising found.

An alliance with United Overseas Bank Limited (UOB) was announced last month to have the bank’s digital banking service integrated into its app.

Go-Jek launches in Hanoi

Go-Viet, via Go-Viet.vn

Grab’s Indonesian rival Go-Jek launched its ride-hailing services in Hanoi in September under the brand Go-Viet. Go-Jek announced in May a US$500 million international expansion strategy starting with four countries in Southeast Asia: Vietnam, Thailand, Singapore, and the Philippines.

App-based on-demand service Go-Viet is driven by a Vietnamese founding team with Go-Jek providing technology, expertise and investment. It currently offers two-wheel ride-hailing (Go-Bike) as well as courier services (Go-Send) but plans to introduce additional services such as Go-Car, a four-wheel ride service, Go-Food, for quick food delivery and Go-Pay, its e-money service.

Go-Viet grabbed a 35% share of the Vietnamese motorbike ride-hailing market in Ho Chi Minh City just six weeks after launching in the city in August 2018.

QR code payments gain traction

QR code payments are becoming increasingly popular in Vietnam and is now implemented at 18 banks, including state-owned banks such as BIDV, Vietcombank, VietinBank, and large joint stock banks such as VP Bank, Maritime Bank, SCB and SHB, with 8 million users.

The QR feature on apps allows users to scan QR codes with a smartphone camera to quickly transfer money, make payment for bills and shop.

VNPay-QR, via Vnpayment.vnpay.vn

Tran Tri Manh, CEO of payment services provider VNPAY, said that more than 20,000 merchants now accept payments with VNPAY-QR with the number of users increasing by 30% a month.

Products and services accepting payments through QR codes are becoming more diverse with large companies such as Vietnam Airlines, Vietjet Air and Jetstar all adopting the trend. Vietjet, which began accepting VNPAY-QR on October 3, saw more than 50,000 air ticket bookings being paid with QR Pay as of early November.

Digital wallet and online payment gateway NganLuong recently got into the QR code payments craze as well, launching QR code payments capabilities in September and announcing co-operation with 15 local banks. NganLuong has 1.3 million users who conducted a total of 15 million transactions for a total value of US$200 million.

Mobile payments to reach US$70,937 million by 2025

According to a report published earlier this week by Allied Market Research, the Vietnam mobile payment market is projected to reach at US$70,937 million by 2025, growing at a CAGR of 18.2% from 2018 to 2025. The market was valued at US$16,054 million in 2016.

The report notes changes in customer preference from cash to digital payments, surge in need for immediate transactions in Vietnam, increased penetration of internet and smartphones, and growth of the e-commerce industry as the major factors contributing to the growth of the market.

Featured image credit: Freepik