Mesitis, a Singaporean fintech startup that provides asset management and investment platforms, has raised US$3 million (S$4.05 million) in a Series A funding round to accelerate its global expansion to overseas markets, including Hong Kong, Zurich, Dubai and London.

According to founder Tanmai Sharma:

“The investment came entirely from individuals; the bulk from experienced startup investors including corporate CEOs and entrepreneurs who actually are Canopy customers, and the balance from employees. I consider this as a great vote of confidence in us.”

Founded in 2013 by Tanmai Sharma, a veteran banker, Mesitis is a wealth management fintech startup that provides private investors with two platforms: Canopy, an account aggregation and reporting platform for individuals and their wealth managers; and Uptick, a low-cost asset management and investment platform for Accredited Investors.

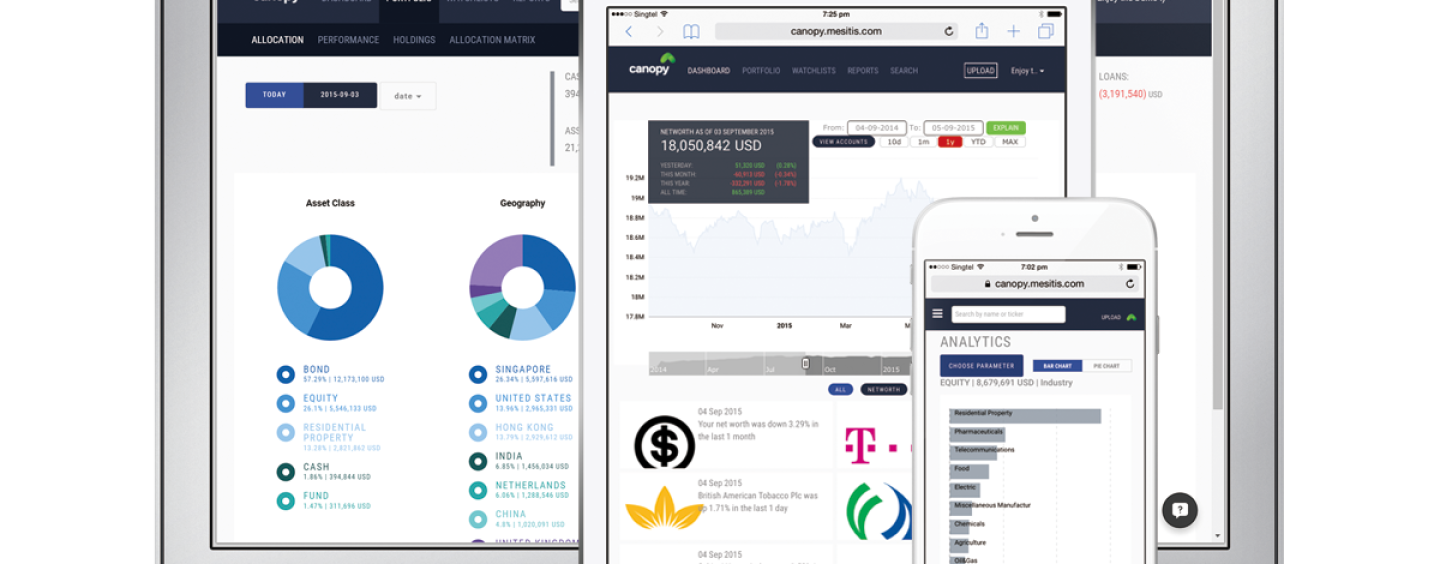

Launched in March, Canopy aims to help wealthy people consolidate financial data across multiple banks and financial institutions and help them visualizing better their investments portfolio.

Launched in March, Canopy aims to help wealthy people consolidate financial data across multiple banks and financial institutions and help them visualizing better their investments portfolio.

“There is a strong need from high-net-worth individuals and their wealth manager for account aggregation; the ability to see an accurate picture of one’s whole wealth across asset classes, currencies and most importantly, across banks,” Sharma said.

He continued:

“This became a mission for Mesitis: to make aggregated account reporting available to all individual investors – fast, accurately and at a low cost.”

According to Sharma, wealthy people typically have between three and 10 financial accounts with different institutions. However, these people naturally seek to aggregate all their accounts in order to have one consolidated report. A single report makes it much easier to analyze one’s financial performances.

Canopy’s platform seeks to provide just that and respond to the lack of affordable and efficient tools on the market.

The platform automatically extracts data from any account statements in PDF, CSV or other digital format, and processes the data into a comprehensive report.

The company charges Canopy’s users US$299 per month for any number of statements to be aggregated. The first two months are free.

Uptick on the other hand, is an asset management and investment platform dedicated to Accredited Investors. Individuals with the equivalent of at least S$300,000 (US$213,000) of annual income or S$2 million (US$1.4) of net personal assets, qualify for the service, as well as financial advisors and startup fund managers.

Uptick on the other hand, is an asset management and investment platform dedicated to Accredited Investors. Individuals with the equivalent of at least S$300,000 (US$213,000) of annual income or S$2 million (US$1.4) of net personal assets, qualify for the service, as well as financial advisors and startup fund managers.

Mesitis claims it is now handling over $1 billion USD in assets under reporting and has been quick in acquiring new customers.

Since 2013, Sharma has pumped S$1 million (US$710,000) as seed funding into his startup. Now with the freshly raised US$3 million Series A funding, the company wants to reach promising markets such as Dubai, London, Zurich and Hong Kong.

Along with helping the company extend its global footprint, the funding will also help Mesitis make additional hiring in the coming months, the company said.

In an email Sharma added:

There are millions of users of account aggregation software in the US (where bank data-feeds are quite easy to get) … So now that we have figured out how to calculate the entire data feed from a PDF statement, it is not surprising to see the traction we are getting in this part of the world where data feeds are quite rare