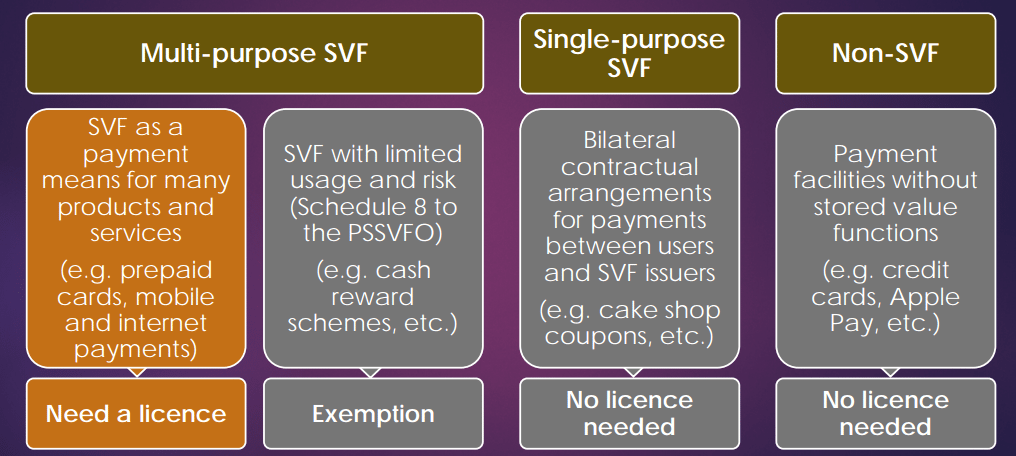

Hong Kong had granted Stored Value Facilities (SVF) Licenses to the first 5 batch of digital payment payment providers last month according to Startup Beat. This is in response to Payment Systems and Stored Value Facilities Ordinance which came into effect on 13 November 2015.

Source: Hong Kong Monetary Authority

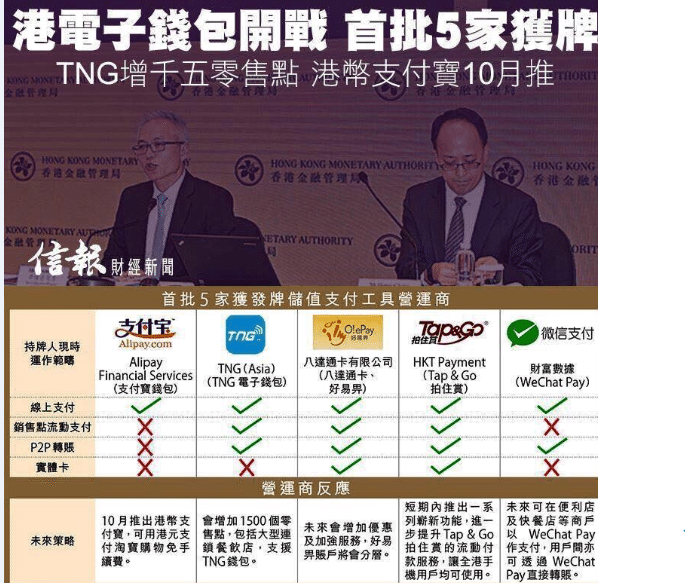

They are Alibaba’s AliPay, Tencent’s WeChat Pay, Octopus’ O! ePay, Hong Kong Telecom’s Tap & Go and TNG‘s TNG Wallet. In addition to these 5 players, Hong Kong might approve more licenses in November.

The Mainland China Precedent

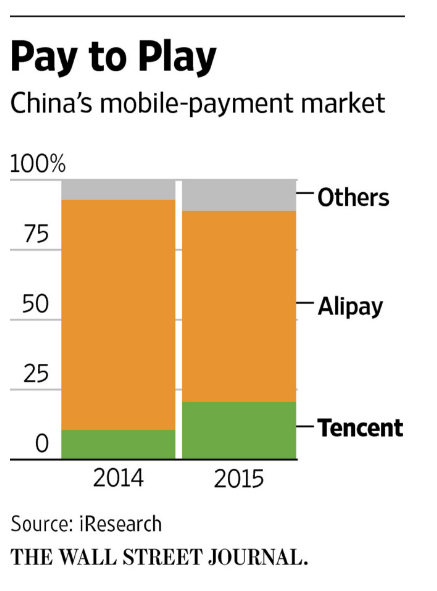

In other words, after China opened the gates to mobile payment, Hong Kong is following its footstep. Even though there are a multitude of mobile players in China, there are only 2 players that matter to the average consumers.

Source: Wall Street Journal

In the fiercely competitive mainland China market, Tencent gave generous incentives to its WeChat Pay users to lure them over from the dominant AliPay to such as extent that it is not profitable.

The Players

Most people would be familiar with Alibaba and Tencent so we don’t have to introduce them in detail. While AliPay and WeChat Pay are the main digital payment players in Mainland China due to their parent’s dominance in e-Commerce and mobile messaging, the Hong Kong market leader would actually be TNG.

TNG is the number 1 e-Wallet in Hong Kong with 370,000 registered users and it gained its prominence with its payment tie-up with taxi apps and the new age cultural practice of giving electronic red packets. They were conceptualized and produced from 2009 to 2012 and launched specifically for digital payments in 2013.

Hong Kong Telecom (HKT) is the largest telecommunication service provider in Hong Kong which includes mobile services. HKT wants to leverage on its large subscriber base to capture a significant slice of the mobile payment market. HKT is the subsidiary of PCCW chaired by Richard Li who is the son of influential local tycoon Li Ka Shing.

Octopus started its existence in 1997 to allow electronic payment services for Hong Kong’s 5 major transport operators. As it is widely used by Hong Kongers, its brand recognition is low. Both HKT and Octopus are widely linked with the Hong Kong identity and they serve common everyday purposes which give them an advantage.

The Battle For Advantage

Given that the digital payment space in Hong Kong is only going to get more competitive, these players have made their own strategies to be the dominant force.

Source: Startup Beat

Only HKT and Octopus offers all 4 features of online payment, digital wallet for store payment, peer to peer bank transfer and physical card with stored valued. So while both have native advantage, Alipay upped the ante by playing on its e-Commerce strength.

It allows its TaoBao e-Commerce users to top up the value of their AliPay account through local Hong Kong banks without having to pay fees of between 1.5% to 3% next month. In addition, their HKD can be converted directly into Chinese Yuan (CNY).

For TNG, they are going 1,500 Hong Kong businesses (including large restaurant chains) to accept their TNG Wallet payment gateway and lure them with better services. Their strategy is to widen the public conscious of their digital payment options. Tencent is surprising quiet in this front. Perhaps, we will see their response in time.

Conclusion

This is only the beginning for the mobile payment space in Hong Kong which started as a means to buy cheaper goods online. It has since spread from its online presence to offline presence in physical store payment. There are still some limits such as HK$3000 limit in 2 days for transfer into their account.

The SVF license shows that Hong Kong is willing to embrace these new payment methods and it signals more competition from other players in November. When that happens, the existing players would have to pull more rabbits out of their hats to retain their customers.

Featured image: Pixabay