MyCash Raises RM1.3 Million in 24 Hours via Equity Crowdfunding

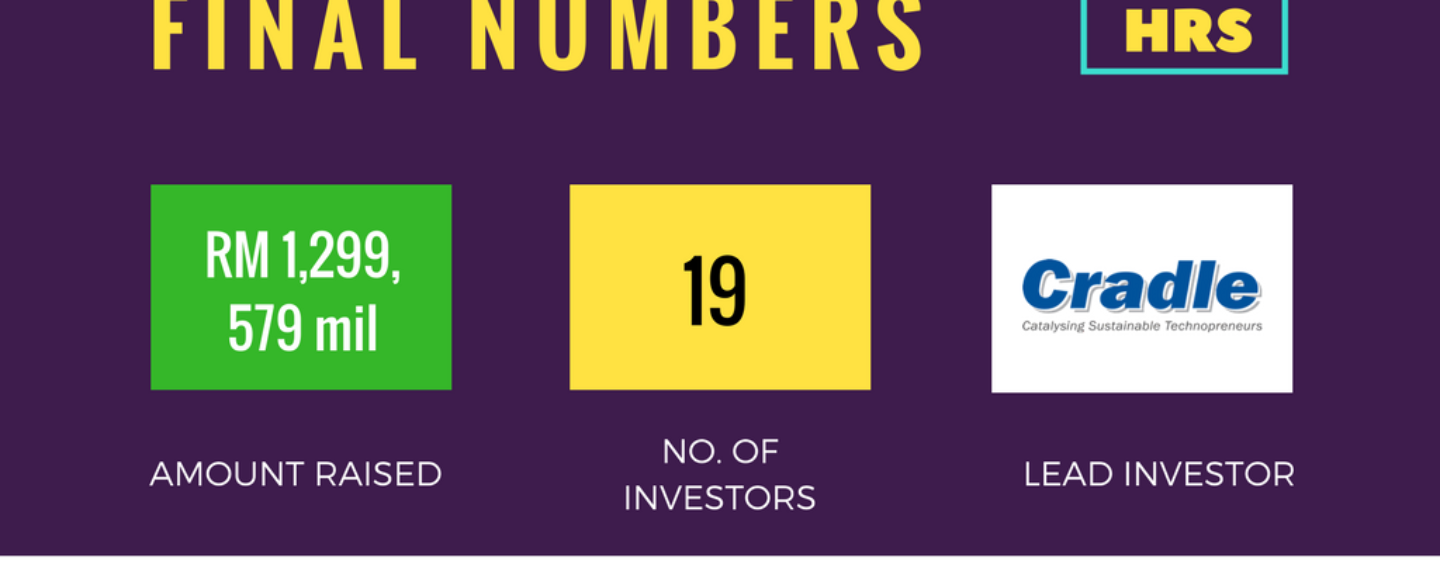

by Fintech News Singapore June 16, 2017MyCash Online, a fintech startup that is providing online services to the unbanked has raised RM1.3M (300k USD) in 24 hours in their equity crowdfunding campaign on pitchIN. Cradle Fund Sdn Bhd (Cradle) led the funding round through their co-investment exercise along with a Hong Kong based co-investor.

The MyCash Online equity crowdfunding (ECF) campaign went live on 1st June 2017 and was fully taken up in 24 hours. Cradle Fund and co-investor JC Management took up RM1.2M while other investors snapped up the remaining RM100K.

MyCash Online operates a platform that offers online purchasing services to foreign workers. Users can reload phone credit, pay bills, buy bus tickets, and more. MyCash Online is also seeking regulatory approval to build and operate innovative remittances and banking services for the same target market. The company hopes to become a ‘virtual bank for the unbanked’.

MyCash Online also made history by becoming the first fintech company to successfully raise funds through equity crowdfunding in Malaysia.

MyCash Online CEO Mehedi Hasan Sumon is grateful for the trust he has received from investors. “We are overwhelmed with the support we received. We would like to express our thanks to Cradle Fund and JC Management for participating as lead investors. Their investment is a validation of the potential of the market we are addressing. We will now be able to ramp up our services and do our part to bring our customers into the digital age through innovative services. We launched our business in April 2016. To date, we have served 65,000 unbanked customers and carried out more than 280,000 transactions worth RM4.3 Million.”

Juliana Jan, Cradle Chief Investment Officer said, “We see the potential in MyCash because it addresses customers that most people forget, the migrants. There are more than 3 million migrants in Malaysia and 90% of them do not have access to banks or financial institutions. With the growing digital services available online, we strongly believe that the e-marketplace that MyCash operates provides the infrastructure for these unbankable migrants. Their business model has been proven and this is evident with the traction of over 230,000 in just the first year.

MyCash has been in our radar for almost a year. The opportunity presents itself when pitchIN brought us this deal and we’re ecstatic that we could close the deal fast. And this is our first deal with pitchIN and we’re hoping that we can co invest again in the future.”

With this deal, pitchIN has cemented its position as the leading equity crowdfunding platform in Malaysia. Sam Shafie, the CEO of pitchIN said, “MyCash is yet another company curated by pitchIN that attracted strong interest from investors. pitchIN has consistently brought promising companies with validated business potential to investors. Over the past 12 months, 9 companies have successfully raised over RM6,000,000. We are seeing growing awareness from investors with each successful deal. Investors can look forward to yet more deals as pitchIN will be bringing plenty more deals this year.”

Read more about MyCash in our recent featuring here : http://fintechnews.sg/9554/malaysia/mycash-online-leveraging-fintech-mobile-drive-financial-inclusion/