Prudential Boosts Singapore Insurtech Scene With PRU Fintegrate Partnership

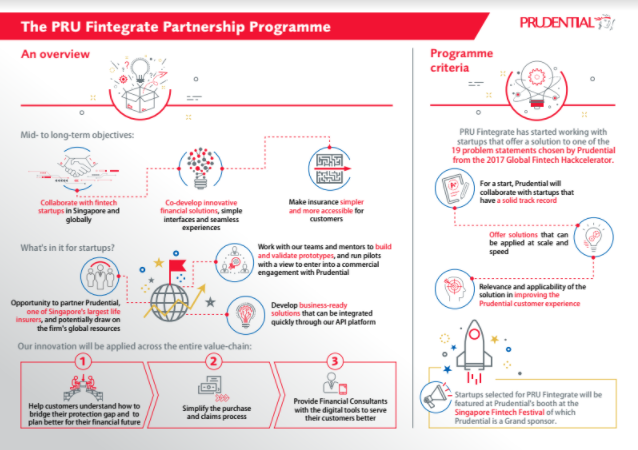

by Company Announcement October 19, 2017Prudential Singapore (Prudential) today announced the launch of the PRU Fintegrate Partnership (PRU Fintegrate) which seeks to collaborate with fintech startups in Singapore and globally, and to co-develop digital solutions for customers.

This is the first programme of its kind by Prudential globally, and marks a milestone in its continued effort to foster greater innovation in the industry.

PRU Fintegrate focuses on building innovative financial solutions, simple interfaces and seamless experiences for customers. These enhancements will be applied across the entire value-chain – from helping customers understand how to bridge their protection gap and to plan better for their financial future, to simplifying their insurance purchase and claims process, as well as providing Prudential’s Financial Consultants with digital tools to serve their customers better.

PRU Fintegrate is a rapid deployment programme offering startups the unique opportunity to build and to validate prototypes at scale and at speed. This will enable faster development of solutions to enrich the customer experience. The programme also provides a clear end-goal as selected startups may enter into a commercial engagement with Prudential, one of Singapore’s largest life insurers, as well as potentially draw on the firm’s global resources.

PRU Fintegrate is open to fintech startups from around the world which share Prudential’s commitment to making insurance simpler and more accessible to customers. The programme has started by working with startups which offer a solution to one of the 19 insurance-related problem statements selected by Prudential from Singapore’s 2017 Global Fintech Hackcelerator. The statements cover areas such as customer engagement, financial inclusion, Regtech and other financial categories.

Selected startups will be able to integrate their solutions into the business through the insurer’s Application Programming Interface (API) platform. Prudential’s business mentors and digital specialists will provide guidance to ensure that the solutions are commercially viable.

Mr. Nic Nicandrou, Chief Executive of Prudential Corporation Asia (PCA), said,

Nic Nicandrou

“Digital innovation is a key component in our overall strategy for the region as we recognise the fast-changing needs and preferences of our customers, including the technology-savvy millennial generation which is expected to represent 60 percent of the global population by 2020. We are committed to investing not only in enhancing our internal capabilities but also in seeking collaboration opportunities with entrepreneurial startups to create value for our customers.”

“Singapore is an important innovation test-bed for the Prudential Group and best-in-class solutions developed here could be deployed across the region. With its highly-skilled workforce, strong digital infrastructure and vibrant start-up scene, Singapore provides a fertile environment for our digital innovation programmes such as PRU Fintegrate to flourish and to help transform the insurance industry,”

he added.

Prudential investing to meet the changing preferences of customers

PRU Fintegrate is a key pillar of Prudential’s digital roadmap to deliver better customer experiences, engage new customer segments and enhance efficiency.

To support this goal, Mr. Wilf Blackburn, Chief Executive Officer of Prudential Singapore, said the company has been strengthening its digital architecture and developing the skill set of its people, as it continues to deepen its focus on customers.

Wilf Blackburn

“Our customers are leading digital lives where they work, shop and transact online with ease. To connect with them more meaningfully, we are building new digital capabilities which will provide a seamless and convenient experience for them at all our touch-points. We are also harnessing technology to understand their needs more deeply and to support the further development of value-added, quality financial solutions,”said

said Mr. Blackburn.

For instance, the company engages with nearly 8,000 customers and its Financial Consultants on its PRU For You online community platform and collects their feedback in real-time to gain a deeper appreciation of their preferences. Feedback from this channel was instrumental in the company’s decision to move into a claims-based pricing model for its private hospitalisation plan early in the year.

Another area of focus is ensuring that the firm’s large, mobile workforce can work more efficiently while on the move. Financial Consultants are equipped with digital tools such as the askPRU chatbot which can instantly retrieve information specific to a customer’s life insurance plans.

“Innovation is an area in which we are committed to investing over the long term. In addition to enhancing the customer experience and increasing brand loyalty, it translates into significant efficiencies for our business,”

said Mr. Blackburn.

The PRU Fintegrate Partnership criteria

For a start, Prudential will collaborate with startups that have a solid track record and offer solutions that can be applied at scale and at speed. Other selection criteria include the applicability of their solutions to provide better customer experiences, as well as viable customer use cases.

Startups selected for PRU Fintegrate will be featured at Prudential’s booth at the Singapore Fintech Festival of which Prudential is a Grand Sponsor.