With the global economy increasingly showing signs of weakness, more people are considering gold as a safe haven.

Thankfully, with platforms such as BullionVault and Bitgold now available, gold is no longer a reserve of the rich and literally anyone can invest in the commodity.

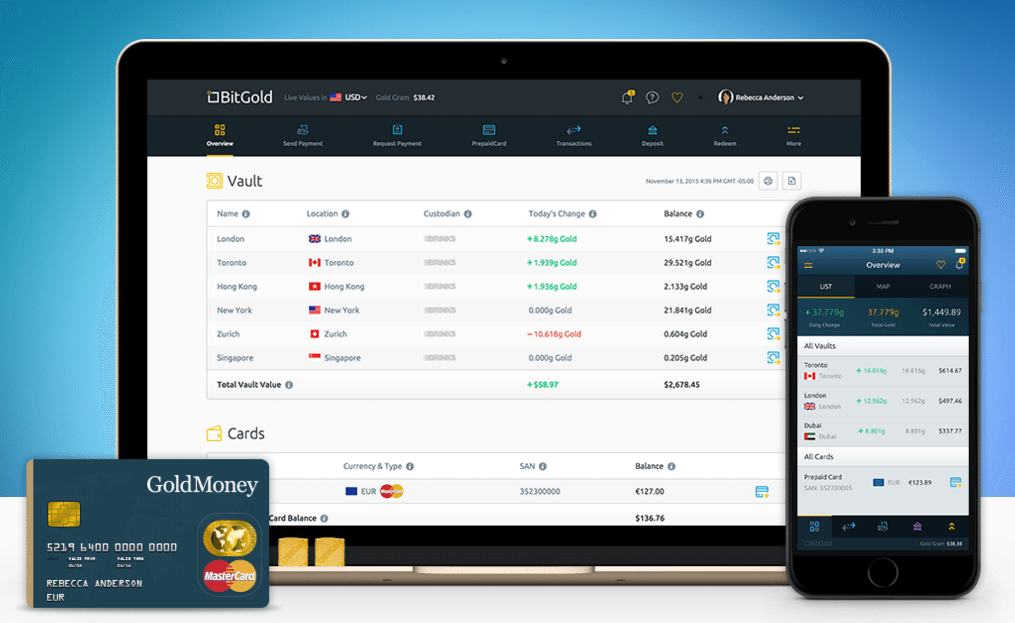

Founded in 2014, BitGold is a Canadian fintech company that aims to reintroduce the concept of commodity money. It provides users with a vault account to purchase and hold gold, the ability to make and receive instant gold payments, and a debit card for spending gold at traditional points of sale.

BitGold currently serves some 671,000 users from over 150 countries. As of January 2016, the company had processed a total of US$41.7 million worth of transactions, and reported a total of gold deposits worth US$25.3 million.

BitGold is a subsidiary of GoldMoney Inc. (TSX: XAU), a multinational holding company it had acquired in May 2015 for US$51.9 million. The acquisition led to the integration of over US$1.5 billion in assets and more than 135,000 user signups into the combined company.

The firm’s other subsidiary is a precious metal custodian and investment firm that allows customers to buy, sell or hold physical allocated metal stored in high-security vaults located in a number countries.

BitGold and GoldMoney Inc. are based in Toronto. BitGold’s European headquarter is located in Milan, Italy.

How it works

BitGold’s platform, which officially launched in May 2015, relies on a technology called Aurum – currently patent pending -, a ledger that collects and distributes real-time gold prices from bullion counterparties quoting bids and offers for the purchase or sale of physical gold bullion at each respective vaulting location where BitGold maintains a vault.

BitGold stores users’ gold in seven vaults around the world located in Zurich, Toronto, Singapore, New York, London, Hong Kong and Dubai.

BitGold allows users to send and receive gold as payment to and from any BitGold user or seller for free. Gold can be sent as payment to non-BitGold users with email or mobile phone.

Additionally, users can spend gold at outlets and online businesses, as well as withdrawal local currency anywhere MasterCard is accepted with the BitGold prepaid debit card. The first card is free and available in USD, GBP and EUR. It has no minimums and hidden fees, and BitGold charges a 1% of spot redemption fee.

Another feature that BitGold is offering is Automated Payments, which can be easily set up and tracked via the dashboard. Users can easily add and manage contacts.

Consumers can choose to add an Automatic Redemption Plan to protect themselves from gold price change. Once set up, gold payments are automatically redeemed to either your bank account or debit card in a selected currency.

All gold is fully redeemable as 1kg bullion bars or 10g gold cubes. Bullion bars and gold cubes can be redeemed on the BitGold platform, and you can request to have them sent to your home.

“What we are doing is introducing basically spendable gold,” Josh Crumb, co-founder and chief strategy officer at BitGold, explained in a video interview.

“There are still populations that fundamentally understand gold as a natural asset … as something permanent and [that] holds value, and something that they seek to protect their surplus and their efforts.”

You can open an account here.