Myanmar is an untapped and growing market that has surprisingly quick uptake of mobile phones which opened the door for mobile payment. We explain how Myanmar’s mobile payment system works from behind the scenes and for the ordinary citizen. There are 4 major players in the market now but Leo Tech is putting up a stiff challenge with an open ecosystem.

Opening Doors

Myanmar is one of the last major untapped market in the world when it opened up in November 2010 when it transit from a military to civilian government. Its population of 60 million had seen drastic improvement in their lives and one of the shining areas would be in the mobile communications industry. Before Myanmar opened up in 2009, 1 SIM card would cost $2,000. Only the wealthy and politically connected could afford the spotty coverage.

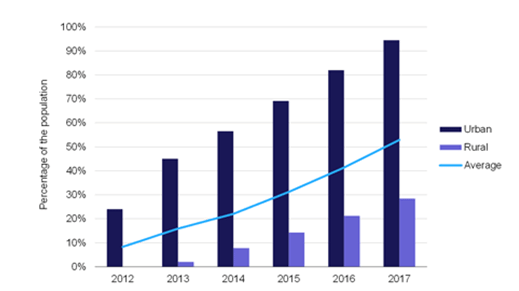

As Myanmar introduced new telco players into the market, prices dropped to $250 in 2013 to just $1.50 in 2014. This made it affordable to the masses (who earned $200 per year on average) and opened up explosive growth in mobile penetration.

Source: : GlobalTelecomBusiness

The chart above is a survey done by professional mobile research firm Analysys Mason in 2013. They had expected that 50% of Myanmar population would have mobile phones by 2017. However Myanmar exceeded expectations by reaching that point in June 2015 according to its Ministry of Communication and Information Technology.

Behind The Scenes

This opened the door to rapid and exciting growth in Myanmar for mobile payment. Mobile payment means a lot to a country where only 5% of the population had access to the banking system as of 2014. Contrast it with the 50% of people who has mobile phones, there is explosive growth in mobile payment.

As infrastructure is still being developed in Myanmar, mobile payment operators would have to collaborate with other institutions. One of the major mobile banking firms that facilitated this mobile cash phenomenon is Myanmar Mobile Money (MMM). MMM is a firm under the military run Myanmar Economic Corporation (MEC) which works closely with its MEC affiliated bank Innwa Bank.

The typical mobile payment client would choose to deposit their mobile account through an authorized agent (described below) which would then deposit it into their mobile payment company’s account in the mobile banking firm. This money is then held in trust in mobile banking firm’s bank under the rules set by the Central Bank of Myanmar.

For example, an EasyPay agent will deposit her cash daily at the nearest Innwa Bank branch for an EasyPay account in MMM which is held in trust by Innwa Bank. In other words, the typical Myanmar citizen have to go through at least 4 layers of agents behind the scene to use mobile money. The fees that they pay in percentage terms are high especially for small deposit amounts but this is the only effective manner which the poor can obtain mobile payment services.

Grocery Shops – The De-facto Bank Branches In Myanmar

In an advanced economy like Singapore, the first point where money can enter your mobile wallet like Dash or DBS Paylah! would be through your bank account. However this is not scalable in Myanmar where only 5% of the population have bank accounts. Instead they have to deposit or withdraw their money through authorized agents with their identity card without the need for registration.

Source: WaveMoney

These agents include the thousands of SIM card point of sales and small businesses like grocery store merchants that are scattered around the country. In other words, they are at the place where the ordinary people shop and buy their phone in the first place. These businesses have the network that Myanmar banks are unable to reach profitably for the masses.

Source: WaveMoney

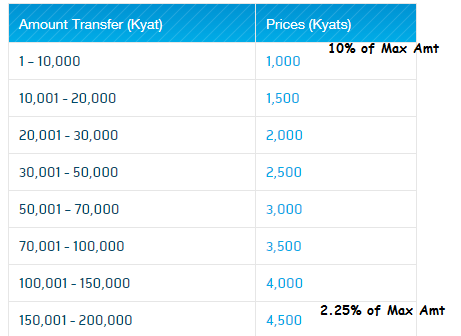

These agents are aggregators who then bring the money to the respective bank branches for settlement into the mobile payment bank account. They earn their fees from the depositors themselves which starts from 1000 to 4500 Myanmar Kyats (MMK) (SGD$1.09 to $4.95) per transaction. These agents effect the payment through their phone and their clients will receive SMS notification as a form of e-receipt.

4 Major Players

For the typical mass Myanmar public, these SIM card shops are the de-facto bank branches where they can choose to deposit their hard earned cash into one of these major mobile payment players in Myanmar:

Mobile payment is used for the following functions in Myanmar:

- Payment for electricity and internet bills

- Mobile airtime top-ups

- Money transfer

- Business to Business payment

- Microfinance payment collection

- Cash in cash out services

We have described the cash in and cash out services above which helps improve the safety (less cash on hand means smaller target for criminals) and the efficiency of the nation. Gone are the days where ordinary people have to queue up at banks all day to make payment for their electricity bills.

80% of phones in Myanmar are

Singapore Entry

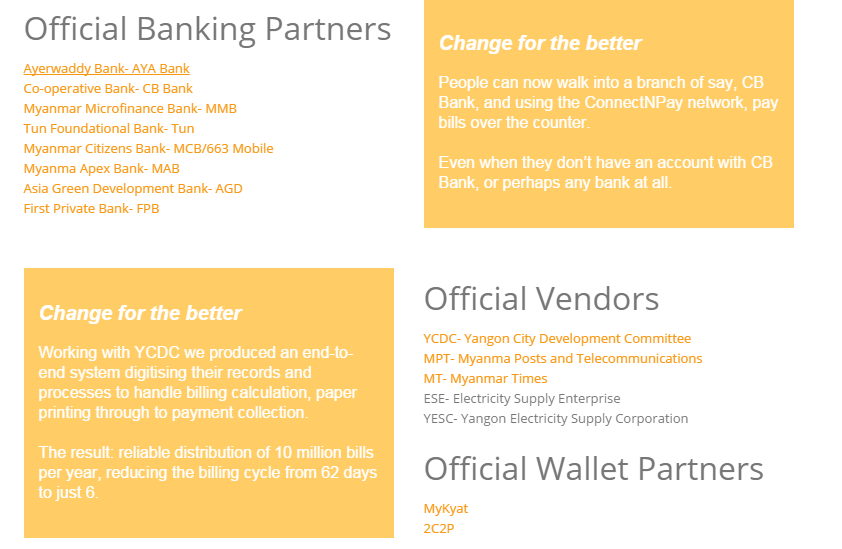

Singapore based Leo Tech is also looking to challenge the 4 incumbents in the market. Leo Tech started a Fintech subsidiary called ConnectNPay in 2014 just to tap this market.

MCC Group is Myanmar’s oldest IT company, in Myanmar since 1986 and they provided the connections and expertise needed for Leo Tech to penetrate the Mynamar market. ConnectNPay’s first product, MyWallet Plus was launched with great fanfare in February 2014.

Source: Leo Tech

It would appear that Leo Tech had considerable commercial success with MyWallet Plus. Following on from that project, Leo Tech has added other partners to the ConnectNPay network. The Yangon City Development Council has engaged them to handle the billing for business and residential tenants.

This Fintech goes beyond

Source: Leo Tech

Leo Tech is trying to create a financial ecosystem with ConnectNPay and has pulled in a long and growing list of banks, vendors and partners – providing payment wallets, billing systems and secure APIs. They are following the footsteps of Google’s Android open source system with their no exclusive policy. As this ecosystem grows, there may come a day where companies can get their business loans approved within the same day from the ConnectNPay platform. And as a neutral, open platform, ConnectNPay could even end up connecting the other four networks mentioned in this article.

Conclusion

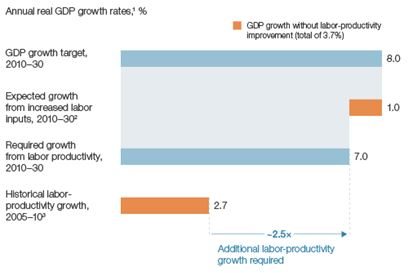

According to management consultant McKinsey, Myanmar has the potential to grow by 8% until 2030 if it were to improve its productivity and shift from agriculture to manufacturing. This is a strong performance in an environment where even China grew by 6.9% in 2015. Mobile payment would be a great asset as it is a strong driver of productivity for Myanmar.

This means that the mobile payment market has vast potential as its people gets wealthier as they get used to the mobile payment banking model. The only question is whether telcos like MPT, Ooredoo and Telenor can expand coverage fast enough to meet growing consumer demand.