Tagcash: Social Media, Payments and Loyalty Programs Combined into One Platform

by Fintech News Singapore February 14, 2016UK native entrepreneur is looking to provide a solution for micropayments in Southeast Asia, starting with the Philippines. With Tagcash Ltd. Inc., founder and president Mark Vernon is offering a platform and ecosystem that combines social media and payment functionalities.

“We started by creating a rewards business with the idea that merchants would offer incentives to share ads on Facebook and social media based on results,” Vernon told Fintechnews in an email communication.

“We started by creating a rewards business with the idea that merchants would offer incentives to share ads on Facebook and social media based on results,” Vernon told Fintechnews in an email communication.

“Small amounts of money would go into users wallets which would then be spent with other merchants etc. Traction was hard to achieve, so we took a couple of the best ideas around that could also work here in the Philippines: M-Pesa in Kenya and WeChat in China.”

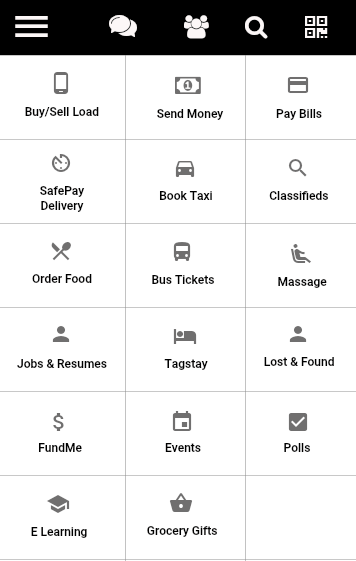

With Tagcash, Vernon said that he intends to create an ecosystem that would enable users to chat, post “moments,” but also spend and pay for products and services; and merchants to use mini apps within the system to promote and manage their business such as loyalty programs, sales and booking functionalities.

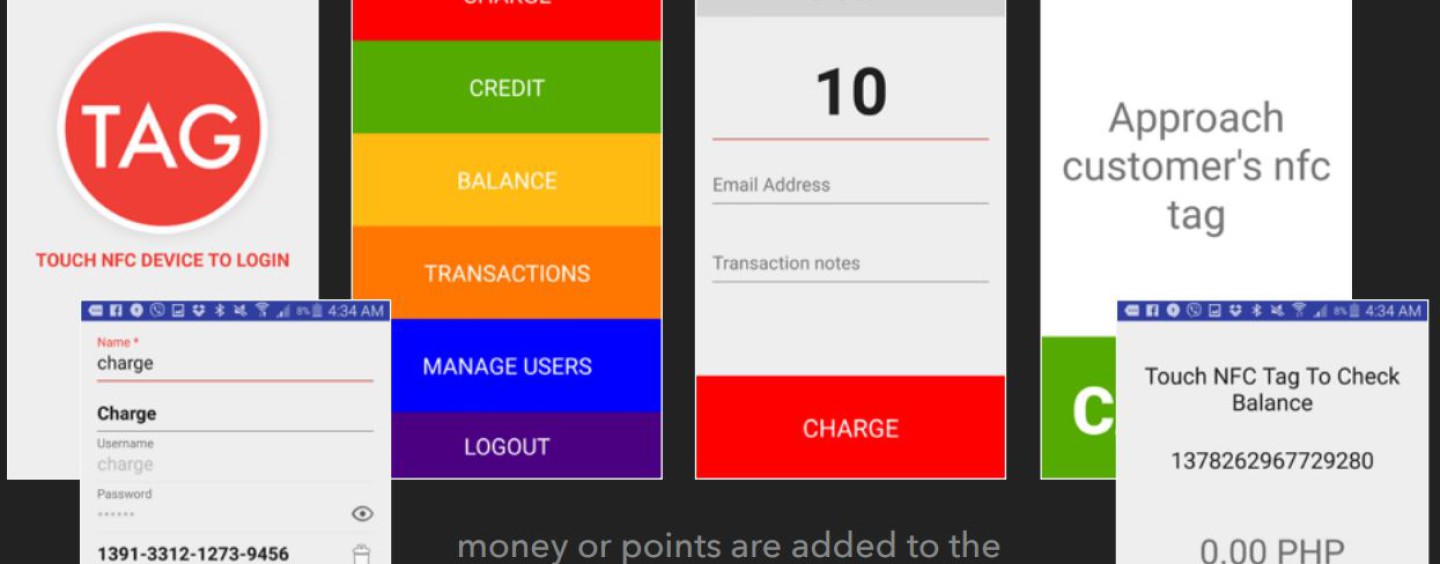

Tagcash: how it works

Tagcash is mainly a digital wallet which you can top up either at a local 7-Eleven convenience store in the Philippines, by bank transfers, via a local agent and by using bitcoins.

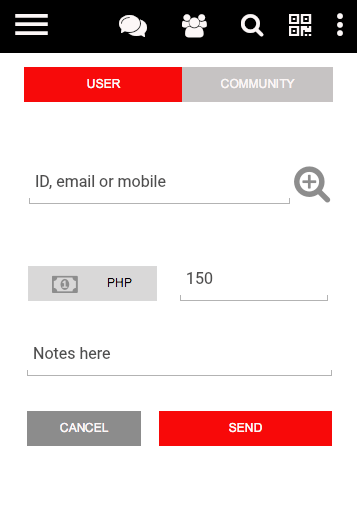

Transactions on Tagcash are made via SMS, web, mobile or API integrations, and are free of charge. Tagcash has also integrated Stripe and Paypal, allowing merchants to have payments sent directly to their accounts.

The collaboration with 7-Eleven, announced last month, allows users to deposit funds using a voucher code that can be created on Tagcash. Users redeem their digital code and have their digital wallet credited after bringing the relevant amount in cash to a local 7-Eleven store.

Tagcash users can also pay for products and services using mobile app or SMS, which will prove very useful to the one million Sari Sari convenience stores around the Philippines. They in turn can pay for goods and services using their mobile phone including the ability to resell airtime load to customers using their Tagcash balance.

Tagcash has teamed up with a number of service providers ranging from mobile phone credit, taxis, to hotels, providing these merchants with a more efficient and cheaper way to accept digital payments. The company’s latest partnership has been with Packing Delicious, a Filipino food delivery services based in Manila. Users on the other hand, have access to a large range of services they can pay for easily using their mobile phone.

In addition to the social payment platform, Tagcash has also created Tagcoin, an internally cryptocurrency that can be used by merchants for rewards and/or affiliate programs. Businesses can also choose to create their own loop currency for internal use, rewards and micropayments.

As of cashing out, bank transfer to an account is free for local merchants. For foreign companies using bitcoin, Tagcash charges a 3% fee. Users can transfer balances to cobranded Security Bank MasterCard ATM cards and transfer money to each other via the chat feature using simple commands or via SMS.

Tagcash: How it works? See here