Over the last decade, the quantity of money laundered has been steadily increasing. According to The United Nations Office on Drugs and Crime, it is estimated that approximately USD $1.6 trillion or 2.7 percent of global GDP was laundered in 2009.

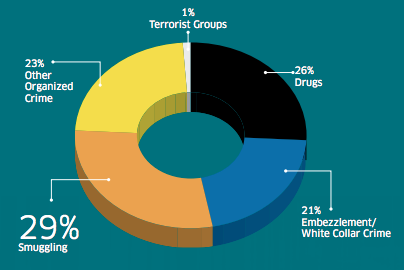

Even worse, less than 1 percent of this global illicit financial flow is ever seized and frozen, meaning that the criminals are winning. This is of serious concern to regulators and financial investigators as the proceeds of money laundering fuels serious transnational crime, as research by Celent shows below:

MONEY LAUNDERING BY ACTIVITY

Effective anti-money laundering (AML) regulations and processes are essential to countering such criminal activity. Yet due to tighter anti-money laundering regulations in the US and Europe, money laundering activity is moving into the Asia Pacific as a way to avoid detection. This puts pressure on regional financial investigation units, financial institutions and associated stakeholders to improve their AML practices.

Whilst efforts in the region are being made, many countries in Asia presently have lax AML practices, thereby allowing money launderers to exploit these weak links. This makes it particularly timely to examine several of Asia’s biggest money laundering incidents, the types of perpetrators committing these crimes and the techniques by which these activities are being countered.

Politically Exposed Persons (PEPs)

This category is of particular interest to financial investigators because of the risk, temptation and opportunity for these people to engage in money laundering. Yet despite their prominent positions in society, they are not immune from prosecution, as the following cases will demonstrate:

Perpetrator: Ex-President Chen Shui-bian

Perpetrator: Ex-President Chen Shui-bian

Country: Taiwan

Chen Shui-bian served as President of Taiwan from 2000 to 2008. Despite allegations of corruption during his two terms, Presidential immunity prevented prosecutors charging Chen whilst he was in office. However once he stepped down in May 2008, legal proceedings against him soon began.

In his defence, Chen stated that,

“Money is dry, and cannot be laundered. The money is clean, it is not dirty, and does not need laundering.”

Chen received a life sentence in September 2009 after being found guilty on charges of money laundering, bribery and embezzlement of government funds totalling NT$490m, (USD $15m). His wife, Wu Shu-chen, already jailed for perjury in the case, was also sentenced to life for corruption.

Speaking of the sentencing, court spokesman Huang Chun-ming described Chen’s corruption as having done, “grave damage to the country”.

Chen argued that both the charges and trial were politically motivated, leading him to appeal against the verdict. This resulted in one of the lesser corruption charges, that he had embezzled USD $330,000 of diplomatic funds, being overturned on the basis of insufficient evidence. Whilst Chen’s sentence has since been reduced to 19 years in prison, both Chen and Wu remain in prison today.

Perpetrator: Ex-President Ferdinand Marcos

Perpetrator: Ex-President Ferdinand Marcos

Country: Philippines

Ferdinand Marcos ruled the Philippines for 21 years, during which time he amassed an enormous wealth from the developing country. After being ousted from power by a revolution 1986, investigators estimated his family’s wealth at approximately USD $10bn.

In response to the strong suspicions of corruption, the next administration established the Presidential Commission on Good Government to track down and recover the Marcos family’s ill-gotten public funds.

However, the Marcos family had channelled their fortune into various offshore bank accounts, foundations and valuable assets making them difficult to find. To date, only approximately USD $4 billion has been accounted for.

The largest recovery by the Presidential Commission on Good Government so far has been the discovery of what has been called the Coco Levy Fund scam. It was found that government money meant for the development of the coconut industry, was instead used for personal profit including a majority stake in the San Miguel Corporation, amongst other investments.

In October 2012 the Presidential Commission on Good Government recovered this money and returned PhP56.5 billion (USD $1.2bn) to National Treasury, pledging to use the money for its original purpose.

In another notable case, the Philippine Supreme Court ruled that USD $356m from the Marcos family fortune, deposited in secret Swiss accounts was to be forfeited, after declaring the funds to be “ill-gotten.”

After Marcos died in exile in 1989 at age 72, the remaining Marcos family were granted amnesty by the ruling President, Corazon Aquino. The family has since re-established its political dynasty but the search for the former dictator’s fortune continues.

Perpetrator: Ex-President Suharto

Country: Indonesia

President Suharto ruled Indonesia for 31 years, between 1967 – 1998, and in that time amassed an estimated personal wealth of between USD $15 – $35bn. The immense scale of his alleged corruption led Transparency International to rank him number 1 in their league table ranking the most corrupt individuals of all-time.

Suharto stepped down as President on May 21 1998, amidst growing civil unrest, political discord and accusations of corruption. Only once out of power did legal action begin against him; legal action that was however impeded by the former leader’s fading health.

To the frustration of his opponents, the apparent reluctance of the judiciary to prosecute Suharto left him free of the prosecution to the very end. In 2008, a civil court judge acquitted Suharto of corruption charges but ordered his charitable foundation, Supersemar, to pay USD $110m.

Whilst it was found that money had been diverted from a scholarship fund for underprivileged children, the judge ruled that Suharto and his family were not directly responsible for the embezzlement.

Transparency International described the actions of Former President Suharto as a demonstration of how corruption on such scale, “undermines the hopes… of developing countries”.

Organised Crime

Drugs, smuggling and organised crime account for over ¾ of all money laundering, thereby making effective AML practices pivotal in the fight against serious transnational crime. The successful detection of money laundering has the dual effect of not only interrupting the funding of criminal activities but also assisting law enforcement agencies in the arrest and prosecution of the criminals involved, as these following examples will demonstrate:

Perpetrator: Ruan Zhizhong

Country: China and Vietnam

In August 2009, Chinese law enforcement raided an underground bank and money laundering gang that had sent an estimated USD $1.46bn abroad in illegal transfers.

Chinese media reported that,

“During a raid of the gang’s headquarters in Guangxi’s Fangchenggang city, police seized 70 deposit books, 590 bank cards, two cars, six computers and 680,000 Yuan ($99,400) in cash”

as well as freezing 327 related bank accounts involved in the money-laundering case with a total value of 47.5 million Yuan (USD $7.6m).

According to a Guangxi police spokesman, Qin Yongjun, the gang had been opening legal bank accounts in in Guangxi as well as Guangdong and Fujian provinces. They then used the accounts to make illegal electronic transfers abroad, mainly to Vietnam.

Perpetrator: Unnamed Money Laundering Gang

Country: Australia

In January 2014, Australia’s biggest money-laundering investigation, Project Eligo, seized AUD $5.7m, (USD $5.3m) in cash from a location in Sydney. Investigators believe that money was being laundered through centres in the Middle East and Asia using techniques including but not limited to structuring, trade-based money laundering and informal value transfer systems. It is also suspected that part of the funds was being directed to Lebanese militant group Hezbollah.

Speaking of the incident, John Schmidt, Chief Executive Officer of AUSTRAC, Australia’s anti-money laundering agency said the remittance sector is recognised internationally as being at high risk of being exploited by serious and organised crime groups.

“Over the past two years AUSTRAC has taken regulatory action against 15 remitters. Importantly, the task force will continue to work with the alternative remittance sector and relevant industry bodies to build resilience and safeguard against such organised crime threats”

said Schmidt.

Since its establishment in December 2012, the Eligo Task Force has successfully uncovered 40 separate money-laundering operations across Australia, seized over AUD $586m, (USD $550m) worth of assets, drugs and cash and identified almost 128 serious organised crime activities previously unknown to law-enforcement agencies.

Perpetrator: The Yakuza

Country: Japan

The largest group in the Japanese Yakuza, The Yamaguchi-gumi, is involved in drug trafficking, human trafficking, extortion, prostitution, fraud and money laundering both in Japan and abroad. These activities are estimated to generate the group billions of dollars in illicit funds annually.

In order to combat such criminal activity, financial investigation units and financial institutions have begun putting pressure on the Yakuza and its affiliates by freezing its assets. In February 2012, President Obama identified the Yakuza as significant transnational criminal organization (TCOs) and charged the US Treasury Department with pursuing additional sanctions against their members and supporters.

The Treasury proceeded to designate the largest group within the Japanese Yakuza, the Yamaguchi-gumi and two of its leaders as targets of its sanctions authority. This action resulted in the freezing of any assets the designated persons had within the jurisdiction of the United States and prohibiting any transactions with them by U.S. persons.

The pressure against the Yakuza has since increased as Japan’s Financial Services Agency ordered Mizuho Financial, one of the wealthiest financial institutions in the world, to improve its compliance regarding suspected loans to known criminal organisations. Japan’s Police Agency estimates that due to this increased pressure from regulators, the membership of the Yakuza is steadily declining as it becomes increasingly difficult to launder money.

High Profile Businessmen and Fraudsters

The opportunity to misappropriate or divert funds in order to increase one’s personal wealth is too great for some people. Whilst they may consider themselves “under the radar” the examples below demonstrate that in the end, crime doesn’t pay.

Perpetrator: Wirapol Sukphol a.k.a “The Jet-Setting Monk”

Country: Thailand

Wirapol Sukphol came to international attention in 2013 when a video was released of him dressed in monk’s robes, travelling aboard a private plane, counting large stacks of US dollars and wearing designer accessories.

He is thought to have amassed an estimated fortune of THB 1 bn, (USD $32m) through a variety of illegal means including the embezzlement of funds donated to him for religious purposes by his followers. The charges against him include statutory rape, embezzlement and online fraud.

In order to avoid prosecution, Wirapol Sukphol fled Thailand and is suspected to be residing in the USA where he owns a Buddhist retreat some 75 miles south of Los Angeles. Authorities estimate that at least THB 300m, (USD $9.2m), disappeared from his bank accounts since he vanished.

However, in September 2013 Thailand’s Department of Special Investigation announced that it has discovered hidden assets worth tens of millions of Baht belonging to the jet-setting ex-monk himself.

“Over the years there have been several cases of men who abused the robe, but never has a monk been implicated in so many crimes,”

said Pong-in Intarakhao, the case’s chief investigator for the Department of Special Investigation.

“We have never seen a case this widespread, where a monk has caused so much damage to so many people and to Thai society.”

“I always wondered what kind of monk has this much money,”

said one of his regular pilots, Piya Tregalnon.

“The most bizarre thing is what was in his bag … It was filled with stacks of 100 dollar bills.”

Wirapol Sukphol remains at large to this day.

Perpetrator: Carson Yeung

Perpetrator: Carson Yeung

Country: Hong Kong

Carson Yeung was a Hong Kong businessman who made his fortune trading in penny stocks, eventually becoming the president of English football club Birmingham City F.C in 2009.

After years of high living, the charges brought against him included money laundering, totalling a value of HKD $720m (USD $92.8m) from entities including casinos and suspected criminals.

It was ruled that between 2001 and 2007, much of the money which went through five of Yeung’s bank accounts came from illicit sources in Macau. In his defence Yeung claimed that the funds were casino winnings, but was unable to convince the judge. He was sentenced to six years imprisonment.

“He did not care where the money came from, and he did not bother to ask,”

said Judge Douglas Yau, adding that Mr. Yeung had lied throughout his testimony.

“He was just making it up as he went along.”

Financial Institutions

Financial Institutions are legally obliged to conduct the necessary due diligence in order to detect and prevent money laundering and related illegal activities. However even the biggest name financial institutions have fallen fowl of AML standards, often resulting in enormous fines to prevent similar practices continuing.

Perpetrator: HSBC

In December 2012 HSBC paid a record USD $1.9bn in fines for money-laundering hundreds of millions of dollars for drug traffickers, terrorists and sanctioned governments such as Iran. The money-laundering occurred throughout the 2000s.

In December 2012 HSBC paid a record USD $1.9bn in fines for money-laundering hundreds of millions of dollars for drug traffickers, terrorists and sanctioned governments such as Iran. The money-laundering occurred throughout the 2000s.

“HSBC is being held accountable for stunning failures of oversight — and worse — that led the bank to permit narcotics traffickers and others to launder hundreds of millions of dollars through HSBC subsidiaries, and to facilitate hundreds of millions more in transactions with sanctioned countries,”

said Lanny A. Breuer, the head of the Justice Department’s criminal division.

The court charged HSBC with failure to maintain an effective anti-money laundering program, to conduct due diligence on its foreign correspondent affiliates, and for violating sanctions and the Trading With the Enemy Act.

In addition to the record-breaking fines, HSBC replaced many of its senior management, penalised some of its most senior anti-money laundering and compliance officers and deferred bonuses for its most senior officials. In response to the ruling, HSBC Chief Executive Stuart Gulliver stated,

“We accept responsibility for our past mistakes. We have said we are profoundly sorry for them, and we do so again”.

Perpetrator: Standard Chartered Bank

In December 2012, Standard Chartered was ordered to pay USD $330m to settle claims by United States government agencies that it had moved hundreds of billions of dollars on behalf of Iran. It was suggested that this practice exposed the international financial system to exploitation by to “terrorists” and “drug kingpins”.

In December 2012, Standard Chartered was ordered to pay USD $330m to settle claims by United States government agencies that it had moved hundreds of billions of dollars on behalf of Iran. It was suggested that this practice exposed the international financial system to exploitation by to “terrorists” and “drug kingpins”.

The estimated settlement payment came in addition to a $340m settlement the bank reached in August 2012 with the New York State Department of Financial Services, which charged Standard Chartered with scheming with Iranian companies and banks for nearly a decade to hide 60,000 transactions worth USD $250bn from regulators.

Since the incident Standard Chartered has implemented a variety of measures to prevent a similar incident happening again, including new rigorous training programmes for all its employees.

Article first appeared on asiafinancialcrime.iqpc.sg

As part of the 2018 Financial Governance, Risk & Compliance Week, join us at the 5th Annual AML & Financial Crime Asia Summit as we gather Asia’s leading AML and financial crime experts to share the latest financial crime threats in Asia and how effective mitigation strategies – offering insights on automating AML investigation, transaction monitoring, developing end-to-end customer on-boarding process, cyber risk and more.