Fintech Firms In Southeast Asia Show Strong Growth Aspirations Amid Funding Challenges

by Company Announcement March 14, 2018A strong 87% of financial technology (FinTech) firms in Southeast Asia are planning to expand their footprint beyond their current markets, according to the Asean FinTech Census 2018 study by EY, which surveyed 170 Southeast Asia-headquartered FinTechs across 16 key subsectors including payments, blockchain, money transfer, data analytics and robo advisory.

The survey found that 61% of FinTechs are planning to achieve revenue growth as their immediate future goal within the next 12 months with 46% of respondents expecting to achieve a compound annual growth rate (CAGR) of 30% for their revenue.

About three-quarter (77%) of the FinTechs believe that they will be able to compete internationally. 87% of the respondents are planning to expand outside their home or current market in the next 12 months. Outside of Southeast Asia, their preferred destinations for growth and expansion are US, UK and China. They see their biggest competitors being traditional financial services providers (33%) and other FinTech players (32%).

Mr. Liew Nam Soon, Managing Partner, EY Asean Markets at Ernst & Young Advisory Pte. Ltd. says:

Liew Nam Soon

“FinTech is seeing a visible ascendance in the region and around the world. Southeast Asia offers an attractive play for both FinTech players and investors.

Rapidly expanding economies; young, urban and digitally savvy populations; increasing mobile and internet penetration; and largely underserved small- and medium-sized enterprises and consumer markets, are factors that have led to the rapid adoption of FinTech innovation in the region.

“Our experience in operating FinTech hubs globally shows that access to customers, technology, and understanding the regulatory and compliance requirements are key to the success of FinTech firms.

As such, we see the importance of helping to bridge the gaps between FinTech firms, traditional financial services providers and regulators, by providing local knowledge on the market landscape and the fund-raising channels and government support schemes available.”

Funding challenges create growth barriers

Funding remains an issue for the FinTech firms surveyed. With most of the firms in the earlier stages of development, more growth-stage equity and capital is needed, and 60% of the respondents expect their next round of funding to be more than US$1m.

However, over two-thirds (68%) of the respondents have a runway of less than a year to plan and raise funds for growth. In fact, 45% of the respondents rely on self-funding. While most (76%) of respondents agreed that there are enough funding channels available, 52% still found it difficult to obtain funding on their own.

Mr. Liew explains:

“As with most start-ups, FinTech firms may find themselves limited by funding options. Venture capitalists and banks are often the first port of call for fund-seekers, although most will not take on the credit risk of companies with a track record of less than three years.

That said, there are many incubator and accelerator programs, and even government channels that FinTech firms can leverage for seed funding. More importantly, they should look to access the wider network of business opportunities and investors such as venture capitalists who can help them to scale and also be a source of funding.”

Talent and government support are key to growth of sector

The study revealed that Fintech firms find talent shortages an acute issue, with over half (60%) saying that there was a lack of start-up or FinTech talent in the markets they operate in. The skills gaps are in technology and software, product management, and sales and marketing. Most of the FinTech firms are still relying on personal connections (57%) and recommendations (48%) to hire talent.

Respondents also believe that the government can do more to enable the growth of the sector. Particularly, increasing tax incentives for angel investors in early stage investment (78%) and policy reforms to make it easier to hire employees (78%) are the two top areas that they are looking for.

Mr. Brian Thung, Managing Partner, EY Asean Financial Services, Ernst & Young LLP comments:

Brian Thung

“The availability of talent and skills needed to run FinTechs at the different stages of their growth can make or break success. Governments play a vital role in shaping a conducive FinTech ecosystem that helps to attract and develop the right talent pool, and promotes innovation and collaboration and healthy competition.

It is heartening to see that governments across Southeast Asia have taken steps, such as establishing the Financial Innovation Network to facilitate the development of the sector. The continued evolution of the FinTech ecosystem will help to drive growth and greater financial inclusion of Southeast Asia as a region.”

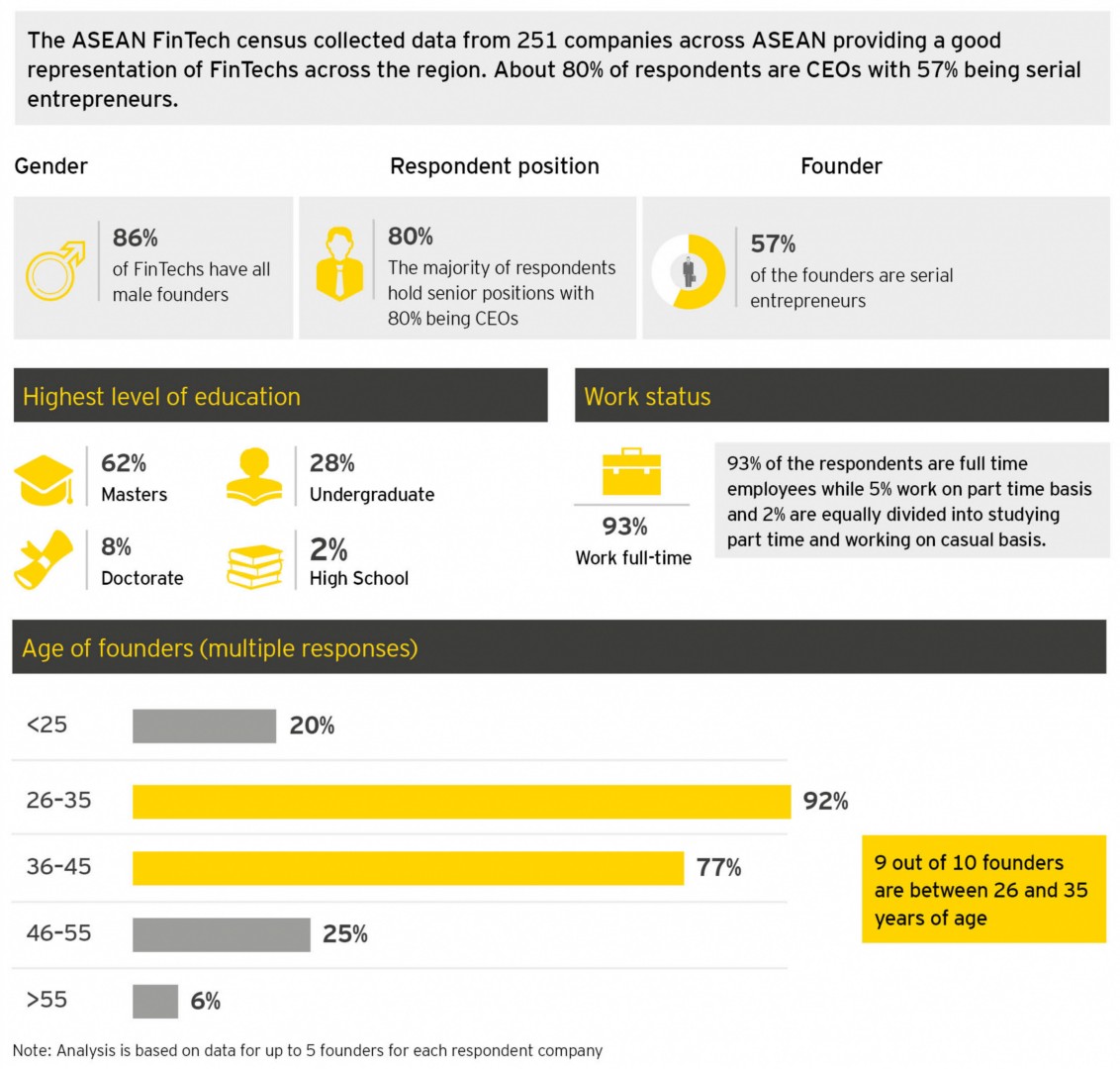

Respondent Profile:

Featured image via http://ey.com/sg/eyaseanFinTech