IDC Financial Insights unveiled a list of fintech companies in Indonesia that are expected to mature faster than others.

As the number of fintech startups are at rise in Indonesia, the list of fintech startups announced are based on extensive analysis of the observed fintech within the country.

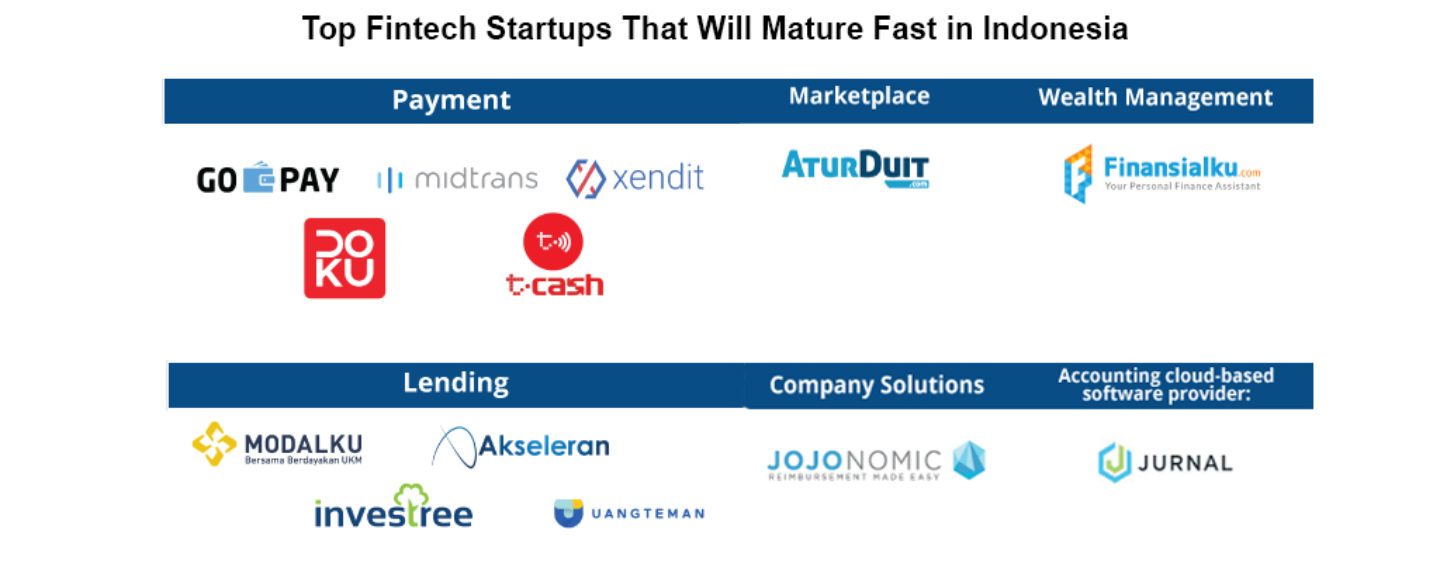

Indonesia is the fourth largest population country in the world and is an attraction for global players such as Google, Alibaba, Tencent and others to take part in the fintech development as a player or investor. IDC witnessed entries of new and non-traditional vendors into financial services. Payment and Lending categorized fintech startup companies dominate the overall Indonesia fintech landscape in terms of maturity level, followed by marketplace, wealth management, company solution and accounting based software provider.

Handojo Triyanto

“The collaboration between fintech and traditional institutions (banks) becomes mandatory for now and in the future. There are several Indonesia banks that have done collaboration actions either in operation aspect or in investment fund.

We believe that speed to dominate the market is the key to win for fintech especially in payments category,”

said Handojo Triyanto, Senior Research Manager, IDC Financial Insights.

This list published provides information of fintech startup companies to invest and collaborate from investor and technology buyer’s perspective. IDC performed analysis based on five levels or stages to measure the maturity levels of the listed companies. The top Fintech startups companies in 6 categories are shown in the graphic table below:

“In the future, Indonesia fintech market will have consolidations by collaboration, merger, and acquisitions between the players.

It has already happened as Go Jek (Go Pay) acquisitioned Midtrans, Kartuku, and Mapan. The driver is the need to penetrate consumer market as soon as possible in middle of many players, not only to grab higher market share, but also to attract more investors”

added Triyanto.