Fintechnews.PH picks every Friday for you the top 5 Fintech Philippines News of the week:

Follow the Fintech Philippines Facebook or Twitter channel to stay updated.

Also, you can subscribe to our monthly Fintech PH Newsletter here.

Here we go:

Philippines to Welcome First 10 Crypto Operators

Ten blockchain and virtual currency companies are set to become the first cryptocurrency operators in the Philippines that will run in an economic zone to take advantage of tax perks while generating employment, Reuters reported.

Regulators legalised their entry into the country in February, in contrast to neighbouring countries which have not allowed such entities.

The companies should invest at least $1 million (717,468 pounds) over two years and pay up to $100,000 in licence fees.

“We are about to licence 10 platforms for cryptocurrency exchange. They are Japanese, Hong Kong, Malaysians, Koreans,” Raul Lambino, chief of the Cagayan Economic Zone Authority (CEZA), told Reuters. “They can go into cryptocurrency mining, initial coin offerings, or they can go into exchange.”

Lambino, however, added the exchange of fiat money into virtual currency, and vice versa, should be done offshore to avoid infringing Philippine regulations.

BSP Launches InstaPay, Aims to Boost e-Payment Transactions to 20%

The Bangko Sentral ng Pilipinas (BSP) has formally launched InstaPay, the latest automated clearing house (ACH) under the National Retail Payment System (NRPS) Framework, and expects to increase the share of electronic retail payments to at least 20 per cent by 2020.

InstaPay’s launch came following the introduction of the first ACH, PESONet last November 2017, led by BSP Governor Nestor A. Espenilla Jr. There are currently 20 InstaPay participating institutions and the number is expected to increase in the coming months as more institutions respond to customer demand.

Through InstaPay, businesses, and government institutions will be able to send and receive funds or make payments in real time of up to P50,000 per transaction, without limit, in a day. The transferred funds are instantly received in full as no fee is charged for the electronic crediting of funds to the receiving party’s account in InstaPay participating institutions. Charges may however apply to sending parties. Recipients may also be charged for cash withdrawals.

Insurance Body Cautions Public vs Cryptocurrency

The Insurance Commission (IC) has warned the public and its regulated entities against cryptocurrencies, citing the risks involved in using these digital assets.

“While recognizing the value of technological advancement on the use of cryptocurrencies, the IC likewise recognizes the corresponding risks involved in (their use),” IC commissioner Dennis Funa said in a statement.

“The apparent increase in the demand for cryptocurrencies and their popularity in terms of usage as a medium for payment and remittances worldwide makes (them) prone to being used for facilitating illegal activities, such as scams, money laundering, and terrorism financing,” he added.

Despite the caution, Funa said the IC will “keep an open mind” to the potential of cryptocurrencies in its regulated industries.

Philippine HR-Payroll Startup Sprout gets $1.6m Funding

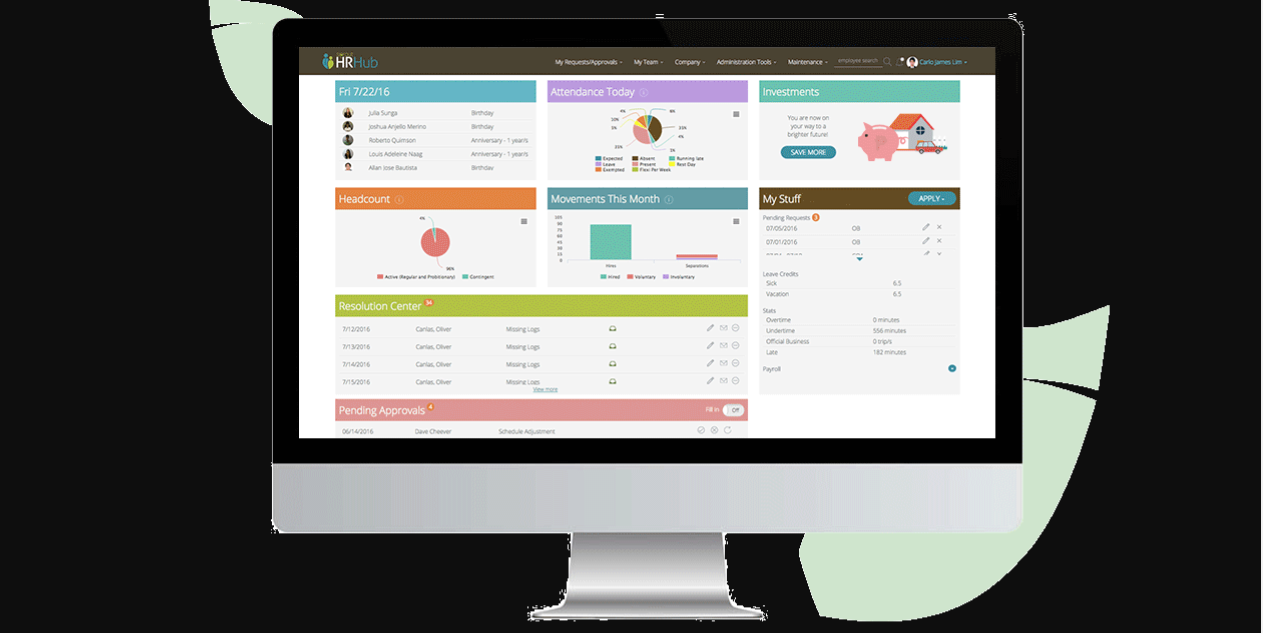

Sprout Solutions, a Philippine-based Human Resource and payroll systems startup, has raised $1.6 million in a seed round led by Kickstart Ventures, along with Wavemaker Partners, Beenext, and one private investor. The company plans to use the proceeds to further expand its artificial intelligence (AI) products for enterprise-level companies.

Co-founded in 2015 by husband and wife Patrick and Alex Gentry, Sprout bootstrapped its way to more than 200 clients, including some of the largest ones in the Philippines.

Kickstart Ventures president Minette Navarette, cited Sprout’s potential in becoming a global HR systems and payroll management firm.

“We’re committed to helping the Sprout Solutions team drive growth in the Philippines, and beyond,” Navarette said, noting as enterprises move into the digital age, HR systems should, as well, create a more accurate, responsive, and efficient experience for companies, HR professionals and employees.

Lendr Records Double Digit Growth in Philippines, Over $500 Million

Digital lending platform Lendr recorded a double-digit growth in the first quarter from the same period last year, claiming to have disbursed over $500 million in loans.

This brings the total volume of loans booked and released through the platform to over Php30 billion (approx 500 Million USD) since Lendr was launched in 2015. Lendr has posted over 60% compounded annual growth rate in loans booked.

Lendr is developed by Voyager Innovations’ financial technology arm FINTQ. Its total loan portfolio mainly comprised of salary, personal, microfinance, mSME, and agricultural loans.

Lendr was also previously listed as the top 10 Fast growing fintech companies in the Philippines by IDC.