Note: We’ve update this report, the 2020 edition of the Fintech Report can be found here

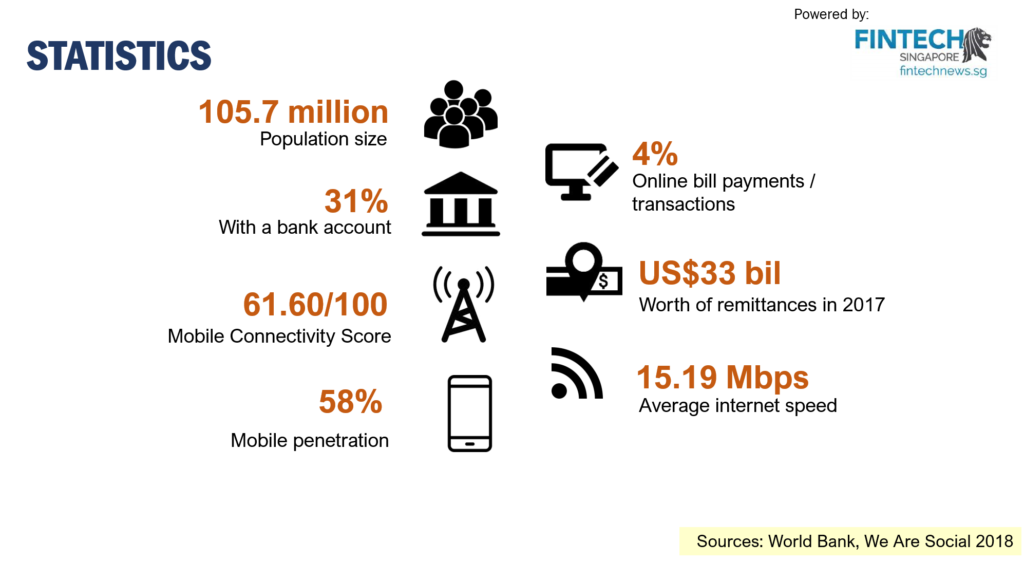

With a population of over 100 million, just 31% of adults having a bank account, and a mobile penetration of 58%, the Philippines is a fertile ground for fintech innovation.

Download the full Fintech Philippines Report 2018 here

Currently, only 4% of all transactions are made online in the Philippines, leaving considerable growth opportunities, according to our latest Philippines Fintech Startup Report.

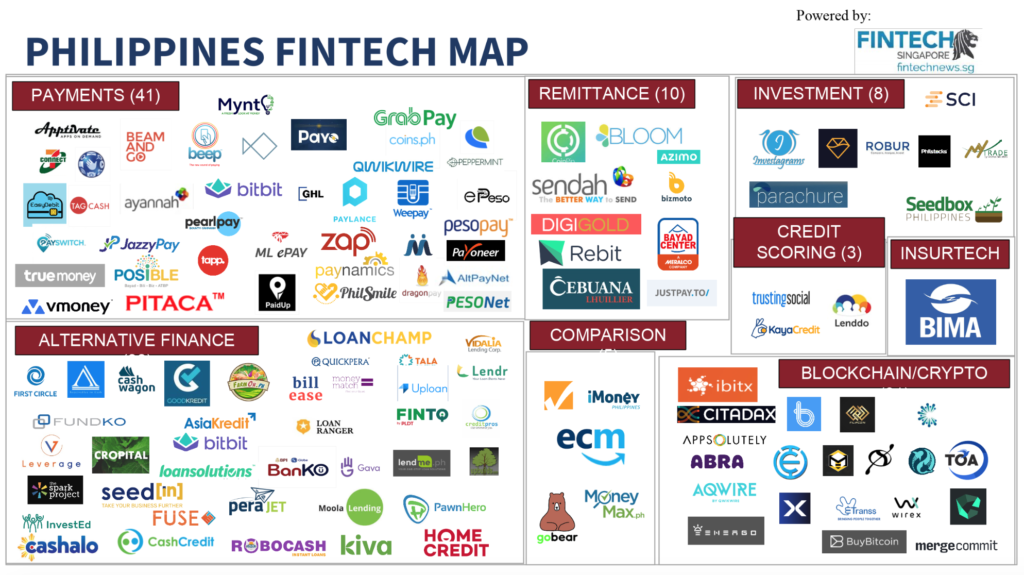

The Philippines fintech startup map

Download the full Fintech Philippines Report 2018 here

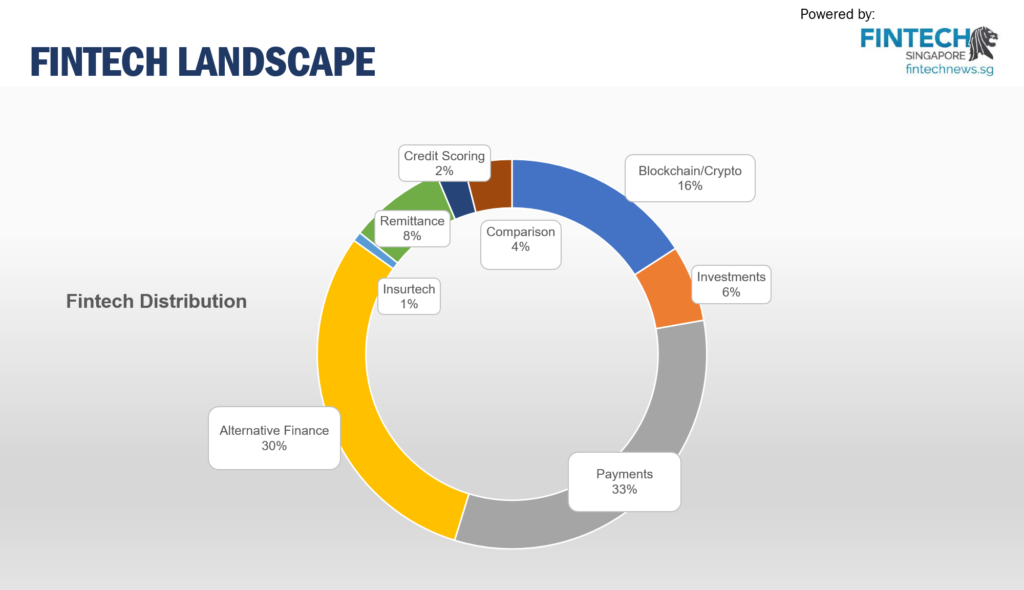

Fintech is growing steadily in the Philippines with payments currently standing as the most crowded segment, representing 33% of all fintech companies in the Philippines.

Download the full Fintech Philippines Report 2018 here

Payments startups in the Philippines include Ayannah, a leading provider of mobile commerce and payment services, Coins.ph, by Betur Inc., a money transfer platform with mobile devices powered by blockchain technology, GCash, a micropayments service offered by G-Xchange Inc., and Moneygment, by Togetech, a financial services app for remittances, loans payments, insurance payments and government taxes.

Payments is followed by alternative finance, accounting for 30% of all the Philippines’ fintech companies. The segment is represented by the likes of Acudeen, an online peer-to-peer marketplace offering discounted invoices, Banko, a mobile-based, microfinance-focused savings bank, Cropital, a social enterprise crowdfunding platform connecting investors to farmers, First Circle, a provider of short term financing to small and medium-sized enterprises, and Lendr, a end-to-end loans origination and loans management platform.

Finally, blockchain technology and cryptocurrency is growing in size and prominence. The segment now represents 16% of the fintech sector in the Philippines with solutions that include Citadax, a licensed cryptocurrency exchange by SCI Ventures, BuyBitcoin.ph, a bitcoin exchange platform, and MergeCommit, a software company providing blockchain-based products for businesses.

Fintech regulations

In recent years, the Philippines government has formulated policies to achieve greater financial inclusion and push innovation in the financial services sector.

Earlier this year, Bangko Sentral Ng Pilipinas (BSP), the country’s central bank, launched a new system that’s expected to bring the country closer to its goal of turning at least a fifth of the country’s payments into electronic transactions.

InstaPay, the second automated clearing house under the National Retail Payment System of the Bangko Sentral ng Pilipinas (BSP), is an electronic fund transfer similar to the Philippine EFT System and Operations Network (PESONet).

At present, 99% of all payment transactions in the country are still settled in cash, Nestor Espenilla Jr., governor of the BSP, said. The regulator hopes to rise digital payments adoption to 20% by 2020.

In 2017, the regulator signed a fintech agreement with the Monetary Authority of Singapore to foster fintech collaboration. That same year, it established the Financial Technology Sub-Sector (FTSS), a new unit to oversee local fintech companies.

The cryptocurrency and blockchain industry in the Philippines, which has significantly grown in recent years, has too seen a series of rules being implemented. In particular, the Circular 944 of February 2017 specifically defines a virtual currency and requires virtual currency exchanges to be registered with the BSP and put adequate safeguards to address money laundering risks and consumer protection.

Fintech companies in the Philippines raised US$78 million in funding in 2017, a 13 times increase year-on-year, according to a separate report by EY titled ASEAN Fintech Census 2018. The most active fintech investors in the Philippines are 500 Startups, Kickstart Ventures, and Spiral Ventures, to name a few.

As of August 2018, the Philippines had more than ten incubators and accelerators.

Fintech transactions in the Philippines are set to grow at a 16.4% annual growth rate, according to the FINTQ Inclusive Digital Finance Report for 2017-2018. By 2022, forecasters believe that transactions from the industry can reach the half-trillion-peso mark.

Interested to learn more about fintech in Philippines? Download our full Fintech Philippines Report 2018 here

Other resources you might be interested in

Curious about other Asian Fintech Startup Maps and Report? Here’s a handy guide looking at the fintech startup maps in Asia by country.

and the fintech startups report in Asia by country.