Open Banking’s Biggest Challenge to Global Acceptance is, Ironically, Regulation

by Fintech News Singapore January 7, 2019The World Payments Report by BNP Paribas and Capgemini highlights some interesting trends when it comes to key regulatory initiatives.

Despite general global interest in embracing open banking, we still have a fragmented ecosystem of regulations and frameworks. This is in part because of how they form as it’s the norm for regulatory frameworks to gradually spread from regional up to global levels. Logistically, all of this makes sense. However, the report recommends that someone must develop standards and interoperability measures to harmonise the fragmented global scene.

We can’t say there aren’t any trying right now, but getting a series of different companies and countries to adopt said standards is its own struggle.

Fragmentisation can serve as a problem, as the open banking focus has expanded beyond just the EU to encompass over 18 countries worldwide, like the USA, Australia, Singapore, Hong Kong, Canada, Japan, Nigeria and India.

With all of these nations at different stages of financial growth, and with their own approaches into fintech, a thoughtful implementation of regulatory framework initiatives becomes key.

Implementation of Standards Proves a Hurdle

Europe is seen as something of a benchmark for open banking, with many regions across the globe using the union’s PSD2 framework as a benchmark for their own open API efforts.

While there is a single entity that oversees regulations like PSD2 and NIS (network and information systems), the European Council level of implementations are subject to the inherent industries of each region, and the culture of each member state—which could result in a general banking direction that is just as bureaucratic as today.

In Asia Pacific, regulatory frameworks like Thailand’s Payment Systems Act, Singapore’s proposed e-payments user protection guidelines and China’s sanctions on new payment apps seem geared towards standards, industry governance and oversight of new players.

Regions like Singapore and Thailand again, along with Indonesia, China and Cambodia are looking at standards and rules to improve the systemic efficiency while safeguarding customers.

It should be noted that many of these systems are not yet at a level of interconnectivity.

As for concrete numbers, the European Payment Council’s SCT Inst scheme is a good example. It was launched in 2017 to help streamline the instant payment system implementation at a pan-European level, as before it, instant payment systems had been developed by certain banks to leverage the infrastructure of national clearing and settlement mechanisms (CSMs).

However, during the publishing of the report only 1,000 banks adhere to the SCT Inst rulebook—equating to only 20% of the region’s banks, though the European Central bank is moving to help fix this issue.

Then there’s conflicting regulatory standards, even though they may aim to achieve the same goals.

The conflict between the GDPR and PSD2 in Europe provides an illuminating example. Though they converge around five pillars: enhanced customer and data protection, enhanced data compliance (use must comply with the law), data quality (including accuracy, consistency, and lineage), enhanced user experience, and enhanced competitiveness, there may be inconsistencies during implementation.

The main difference between the GDPR and PSD2 is that while the former is a regulation, the latter is a directive and is open to interpretation by individual member states.

These conflicts could, if left to go on,impede industry participation, so a regulatory hand might be needed here to set things straight.

There is also issue behind trust. The Chinese government, for example, wants western countries to open up their markets to firms like Alipay and WeChat, but western countries in turn want access to the Chinese market before they would make a move.

All a Part of A Cycle Between Standardisation and Innovation of KRIIs

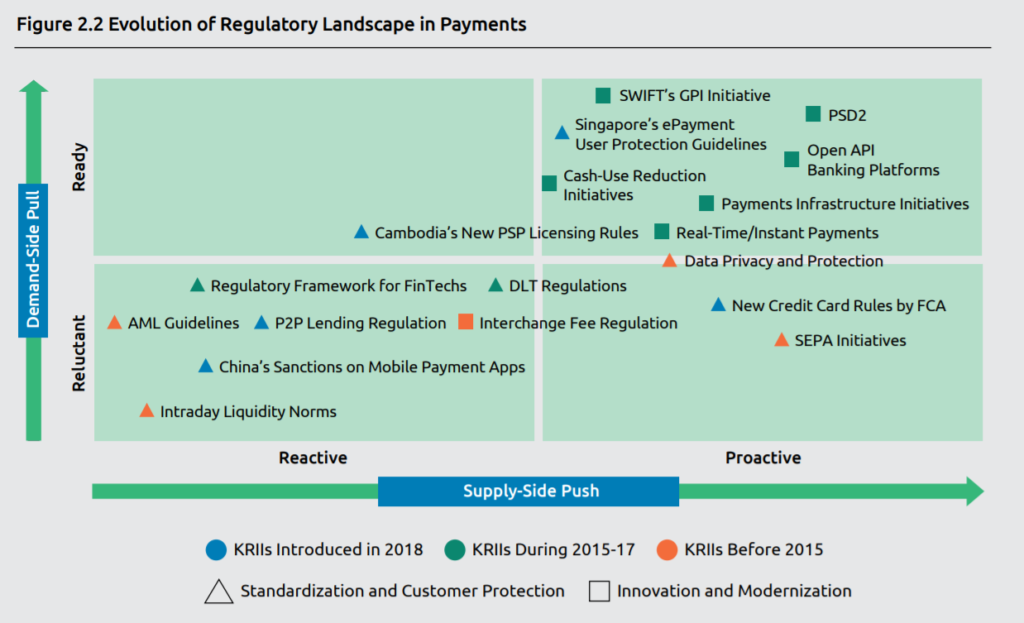

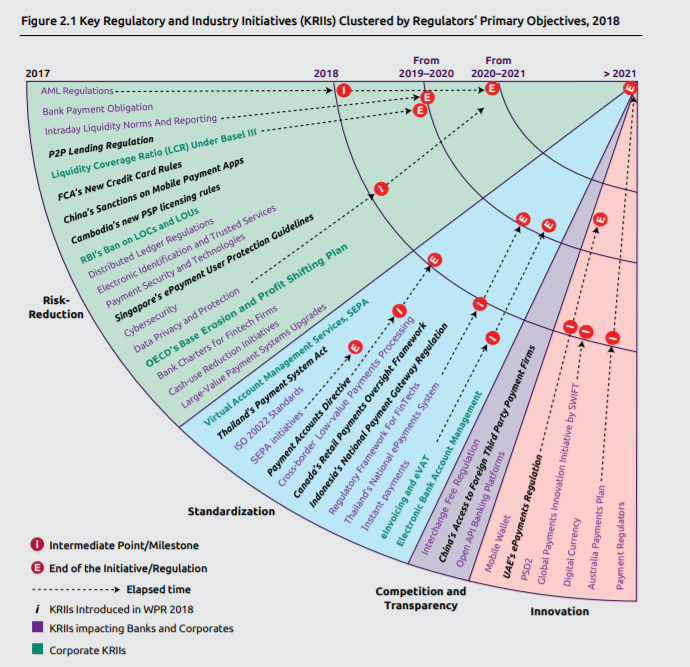

While observing the regulatory push and pull, the World Payments Report 2018 noted that we are simply in a phase of a cycle that shifts and ebbs between innovation and standardisation.

As it stands, we seem to be at the tail end of a trend towards innovation, and moving into standardisation.

Most of the regulatory frameworks announced in the 2017 and 2018 period focused on standards started in Asia Pacific, a trend that came from the spread of regulatory activity in the developed markets in the markets in the west.

To answer this trend, regulators in Asia Pacific countries also recognise the need for data privacy and protection to mitigate payments risk and boost digital payments volumes. As digital payments volumes and innovation continue to flourish in the region, they are introducing data protection regulatory frameworks that are based on initiatives in Western countries.

Following this an increasing number of standardization- focused regulatory frameworks are being introduced. While the earlier frameworkss were aimed at ensuring a level playing field, recently introduced ones facilitate a balance between regulatory supply and market demand. This is being seen in Asia Pacific where regulatory frameworks, such as Cambodia’s new PSP licensing rules, and China’s sanctions on mobile payments apps, have been developed for the mutual benefit of customers and financial institutions. Further, as new solutions introduced during ramp-up and consolidation phases need to be rationalised, regulators have to jump in to regulate the earlier initiatives where new demand appears.

Based on the figure, the report names the UK as the pioneer in banking and payments. Since the launch of FPS 2008 following the wake of the 2008 financial crisis, regulators focused on systemic risk reduction and financial stability that impacted upcoming regulatory frameworks.

Asia Pacific is witnessing much traction in regulatory activity and as the region’s regulators adapt and implement ideas they see from other countries.

Some reactive countries, such as Brazil and Thailand, have conservative regulators that have started few or no forward-looking initiatives and have reluctant demand-side institutions.

Meanwhile countries such as Singapore, Australia, the UK, and Sweden have proactive regulators and enthusiastic demand-side institutions ready to embrace regulatory initiatives. China is an interesting case; if the industry does not embrace the supply-side push from the government, the country will remain in a dormant space, like India. It is only when regulators are proactive and market participants are ready to embrace regulatory frameworks, that countries will exist in an ideal state.

Fragmentation Impedes on Developing Standards

Image Credit: World Payments Report 2018

The report sees an impact on the roll-out of ISO 20022 XML: the ISO standard for electronic data interchange between financial institutions describing a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content.

The standard is said to be progressing slowly throughout regions, despite European regulators making it mandatory domestic payments as the introduction of the Single Euro Payments Area (SEPA), large-value and cross- border payments continue to use legacy formats.

Meanwhile, in the USA, it’s the banks’ own formats that are dampening efforts to deploy the ISO 20022, and holding back the goal of a common messaging standard.

The report sees hope in further payments modernisation initiatives, IP systems and the adoption of ISO 20022 by corporates bringing the industry towards its global payment messaging goal though, despite these hurdles.