58% Singaporeans Don’t Think They Can Go Without Cash for 3 Days

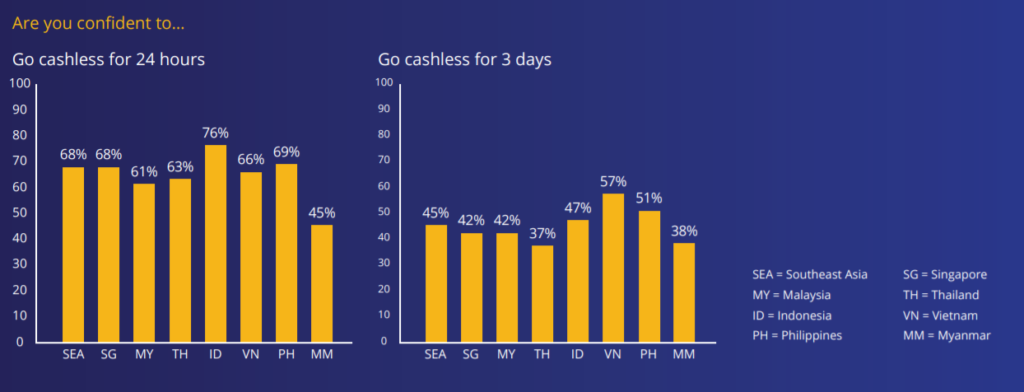

by Fintech News Singapore April 9, 2019Despite being known internationally as a fintech hub here, it seems like Singapore is starting to fall behind on cashlessness in Southeast Asia. For example, only 68% of Singaporeans are confident in going cashless for a day, as opposed to Indonesia’s 76% or Philippines’ 69%.

When respondents are asked about staying cashless for a full 3 days, the numbers drop dramatically to 42% in Singapore, though other regions surveyed showcase similar drops in confidence.

Overall, this means that in Southeast Asia, while quite a high number of Singaporeans are exposed to cashless methods and availability, less than half think it’s feasible to stay completely cashless long-term—not even more than 3 days.

Since Singapore is much smaller compared to many other Southeast Asian regions—many of them almost too big and disjointed for their own good (Indonesia and Philippines come to mind)—this is a notable development.

Singapore’s size means that it should theoretically be much easier for Singapore to more systematically upgrade its operations, which implies there are other roadblocks in Singapore’s way stopping it from achieving higher ranks of cashlessness that even disjointed nations can better circumvent.

The same Visa report finds that only 50% of Singaporeans are even aware of QR code payments which may provide the answer why. Singaporeans are more comfortable with cards, but one cannot deny the inhibiting impact of the cost of getting a card terminal. Higher ubiquity of e-wallets may not stop Singaporeans from making big payments with cards, but it will allow smaller merchants to enable cashless payments without having to bite the bullet on a card terminal.

Featured image via Visa