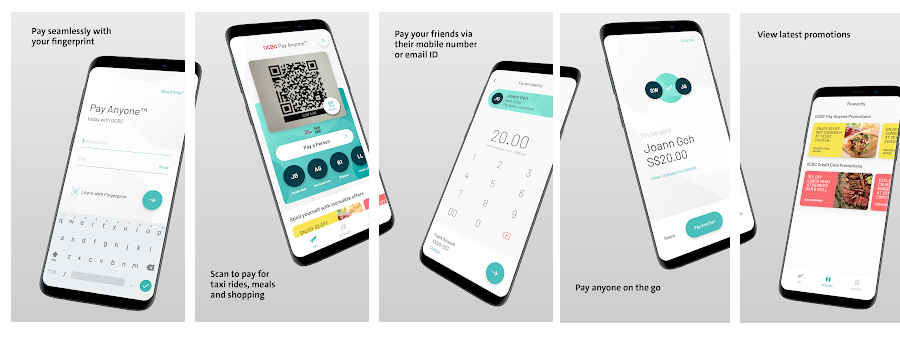

OCBC Introduces a More Seamless Checkout for Instant Mobile Payments

by Fintech News Singapore April 16, 2019Rapyd a payments focused fintech, announced a partnership with OCBC Bank to enable real-time bank payments for Singapore consumers and online retailers.

The partnership leverages PayNow, Singapore’s national peer-to-peer funds transfer service, enabling OCBC Bank customers to make digital payments using the OCBC Pay Anyone app powered by Rapyd. There are two key features to this new deployment and they are as follows.

Enabling instant mobile payment directly from your bank account

Many customers are increasingly adopting the option to pay retailers directly from their deposit accounts using their mobile phones.

Among OCBC Bank customers, such transactions have grown 4.5 times year-on-year, via QR code payments on the OCBC Pay Anyone app.

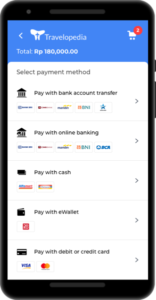

Today, most online retailers only give consumers the option to check out their online retail purchases using credit or debit cards.

There are very few online retailers that enable customers to directly pay from their bank account – and if they do, the process is very tedious, requiring the customer to exit the retailer’s app to perform an Internet Banking transaction before navigating back to the app.

The partnership with Rapyd Checkout will provide OCBC Bank customers with more payment options at online retailers’ checkouts, enabling them to directly access their bank account funds by simply choosing “Pay with OCBC Pay Anyone” within a retailer’s app.

Payment details such as the retailer name and amount to be paid will then automatically populate in OCBC Pay Anyone, which the customer simply needs to review and confirm before authenticating the transaction using biometrics.

Customers will not need to input any additional information to make an online payment, and do not need to navigate out of the retailer’s app, making the payment process completely seamless and convenient.

Retailers can receive payments instantly

With the number of real-time payments globally expected to grow from USD$6.8B in 2018 to USD$25.9B in 2023 according to research consultancy MarketandMarkets, digital retailers are actively looking to add more local payment options for customers.

With Rapyd Checkout, these retailers can receive payment immediately from OCBC Pay Anyone users, rather than waiting up to three days to receive money from card-based payments, giving merchants faster access to their working capital.

Mr. Pranav Seth, Head of E-Business, Business Transformation and Fintech and Innovation Group, OCBC Bank, said:

“Singapore’s eCommerce market is estimated to hit $5 billion this year. The partnership with Rapyd will benefit Singapore consumers and online retailers by expanding payment options for consumers while simultaneously increasing revenue opportunities for businesses. This partnership extends the ability of customers to directly access their bank account funds to pay more than 3,000 retailers via QR codes and PayNow at physical stores, to also access their bank account funds directly to pay online retailers on mobile apps seamlessly.

Featured image credit: OCBC PayNow