Infographic: How Retail Banks Are Adapting to Fintech Disruption

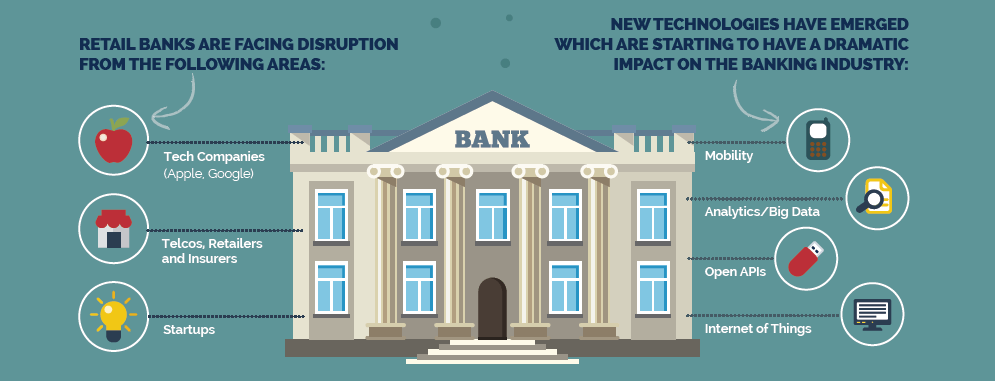

by Fintech News Singapore June 9, 2016Banks have ignored consumer demands for too long and their legacy infrastructure needs to be fixed thoroughly. The effect of disruption is very big across the banking sub-sectors, especially for retail banks. Retail banking segments such as lending, remittances and payments have undergone disruptions while the infrastructure supporting retail banking such as bank branches and ATMs are also undergoing a transformation, thanks to the millennials’ habit of using mobile devices.

Non-digital banks also face the threat of of losing customer relationships. Ease of use, fast service and positive customer experience are the advantages that FinTech companies see the opportunities in consumer adoption, referrals and trust.

Alternative lending models are transforming the banking sector, creating both competitive threats and evolutionary opportunities for financial institutions in Asia. But with an estimated 4,000 firms challenging banks in every product line, the level of disruption facing the financial industry has reached a tipping point, as this infographic shows:

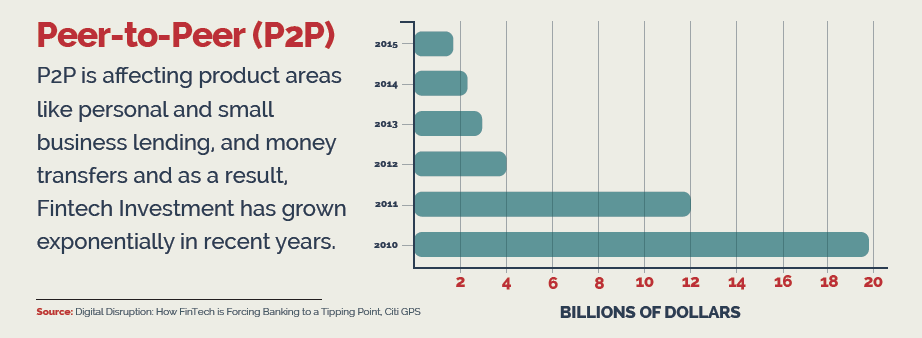

But it’s not just technology that is changing, disruptive business models are also emerging, most notably:

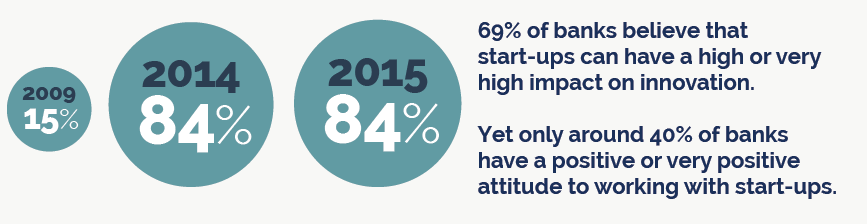

The infographic also shows the proportion of banks increasing their innovation investment from the previous year:

However, according to the banks themselves, there are many challenges involving working with startups, such as:

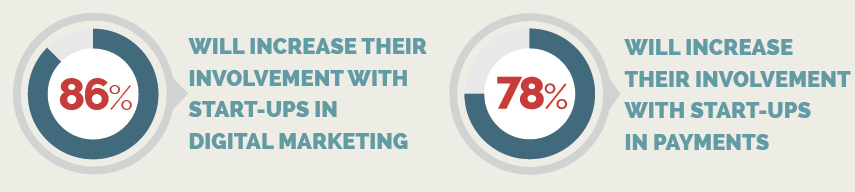

Despite these challenges, most banks said they expect to increase their involvement with innovative start-ups.

>> Download the full infographic: How Retail Banks are Adapting to FinTech Disruption HERE

Banks and FinTechs have strengths that are complementary and which should be leveraged to create a stronger central financial experience for customers. While FinTechs excel in agility, innovation and exploiting new technology, banks offer capital, deep customer bases and expertise in working with regulators.

Discover how to adapt to FinTech disruption at Asia’s only event focused on innovation in digital lending: Next Generation Lending Asia Summit 2016 in Singapore, this July.

Top industry leaders from banks, FinTech, lender institutions, and mortgage aggregators across Asia will gather at the summit to share their best practices in case studies, panel, round-table discussions, and workshops so that you can quickly implement the best strategy for your organisation.

>> Sign up now with code 27190.001_FTN10 to get 10% discount for event tickets!