Grab Partners with NTUC Income to Launch Microinsurance Product for Critical Illness

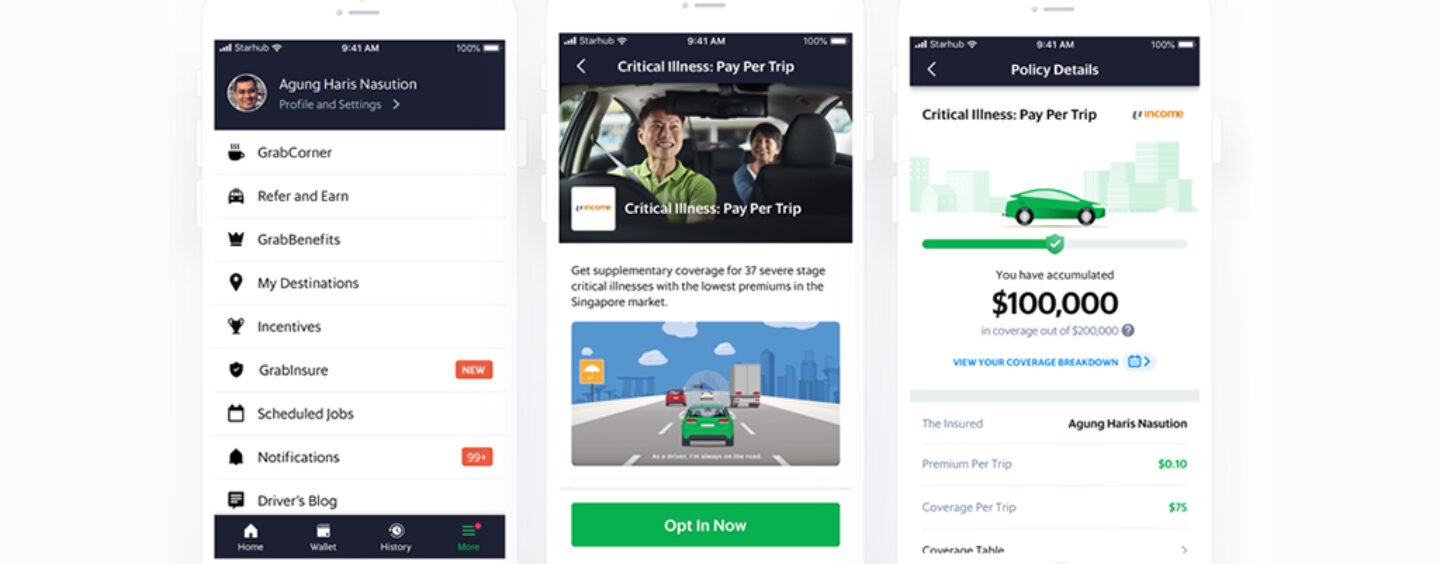

by Fintech News Singapore August 1, 2019Grab’s insurance arm, GrabInsure and NTUC Income jointly unveiled their micro insurance plan. “Critical Illness: Pay Per Trip (CIPPT)” in Singapore today. The parties involved stated that this microinsurance scheme is designed for Grab drivers better protect themselves against critical illnesses.

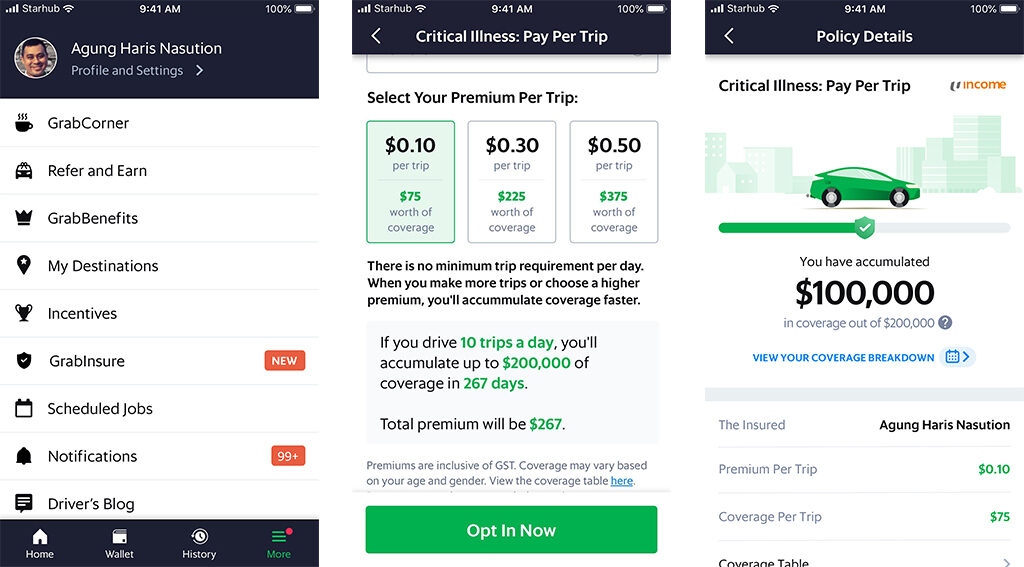

Grab drivers can choose to pay between S$0.10 and S$0.50 in premium for a fixed sum assured, and accumulate the corresponding insurance coverage with each trip they complete.

GrabInsure is a digital insurance marketplace set up by the joint venture between Grab and Chinese insurtech giant, ZhongAn Technologies, announced earlier this January.

Drivers can apply for the scheme by subscribing through the Grab app and with each completed trip, have the CIPPT premiums automatically deducted from their in-app cash wallet. The new plan will be rolled out to all Grab driver-partners progressively from today.

The plan is available to all Grab driver-partners who are 18 to 75 years of age. To sign up, driver-partners simply need to apply and choose from three premium rates (S$0.10, S$0.30 and S$0.50 per trip) on the Grab’s driver app.

NTUC Income has also been observed to be shopping for partners recently, as recent as July, NTUC Income teamed up with Singtel to help them launch their first insurance product.