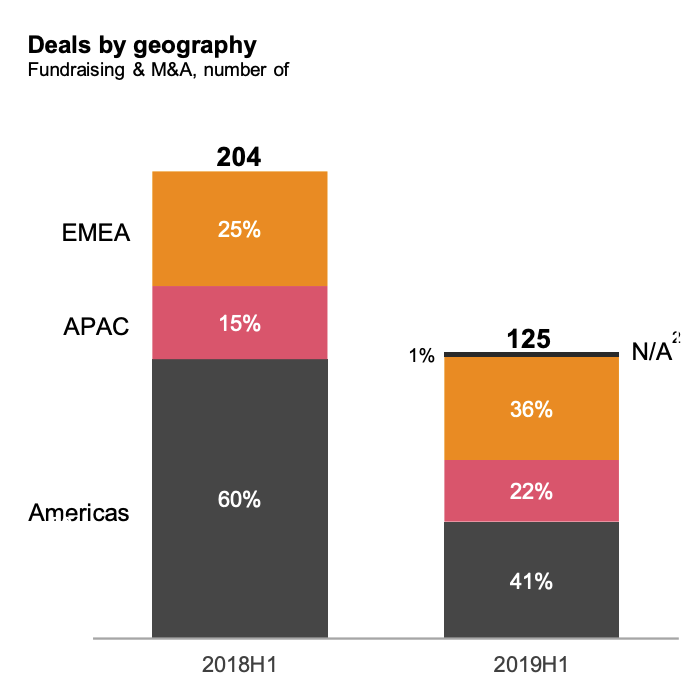

Year 2019 has witnessed a major shift in crypto-related fundraising and merger and acquisition (M&A) activity. While in 2018, the majority of crypto deals took place in the Americas, this year, Europe, the Middle East and Africa (EMEA) and Asia Pacific (APAC) are driving the activity, according to a new report by PwC.

Among the 125 crypto deals that took place in the first half of 2019, 58% were in EMEA and APAC, while 41% were in the Americas. In comparison, in the first half of 2018, the Americas represented 60%, against 50% for EMEA and APAC.

Crypto deals by geography, PwC, September 2019

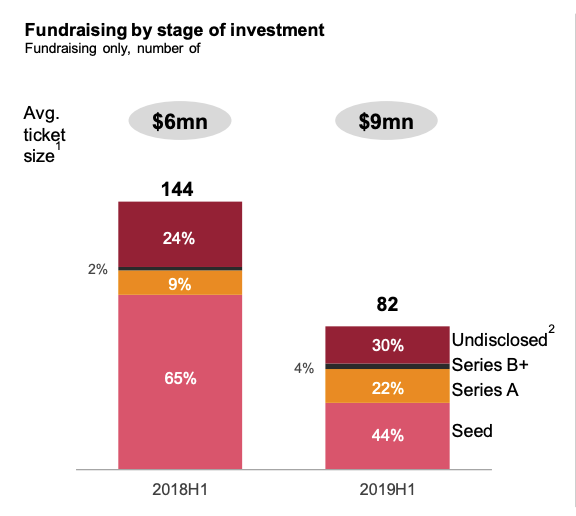

Crypto industry matures

The crypto industry is maturing and one indication of that is the evolution of deals size. While in H1’2018 seed rounds represented most of the funding rounds at 65%, seed rounds percentage decreased to 44% in H1’2019, the report says. Additionally, the average ticket, though still small, grew from US$6 million in H1’2018 to US$9 million in H1’2019.

Fundraising by stage of investment, PwC, September 2019

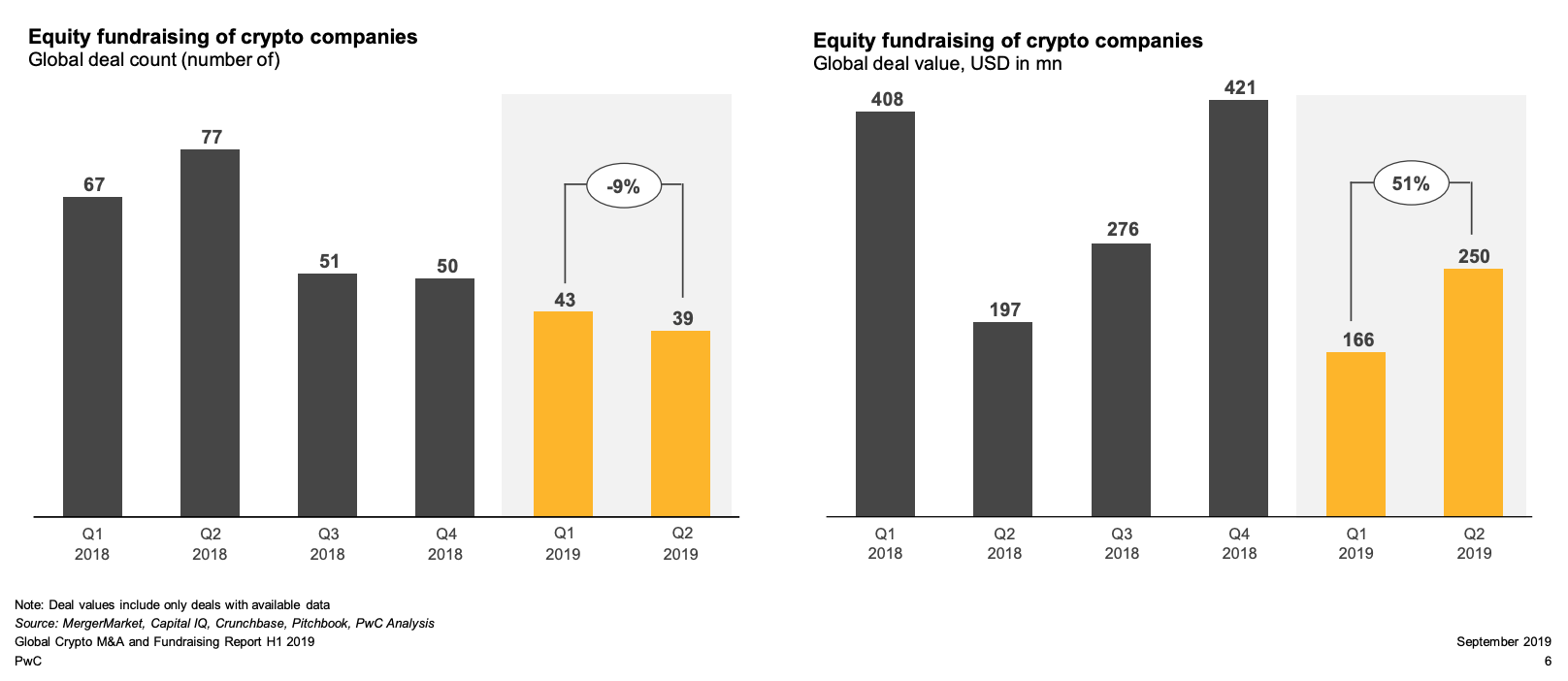

According to the report, though the number of equity fundraising deals for crypto-related companies decreased by 9% from 43 in Q1’2019 to 39 in Q2’2019, the value of fundraising deals increased by 51% to US$250 million over the same period, implying that crypto startups are actually raising more money.

Equity fundraising of crypto companies, PwC, September 2019

Notable fundraisings this year include Celo’s US$30 million funding round led by Andreessen Horowitz’s crypto fund and Polychain, and Anchorage’s US$40 million funding round led by Visa and Blockchain Capital.

According to the PwC report, crypto fundraising activity remains diversified across different sectors of the crypto ecosystem, with companies in blockchain infrastructure, crypto exchange and trading infrastructure continuing to gain traction. The report, however, notes a fall in deal activity in crypto mining.

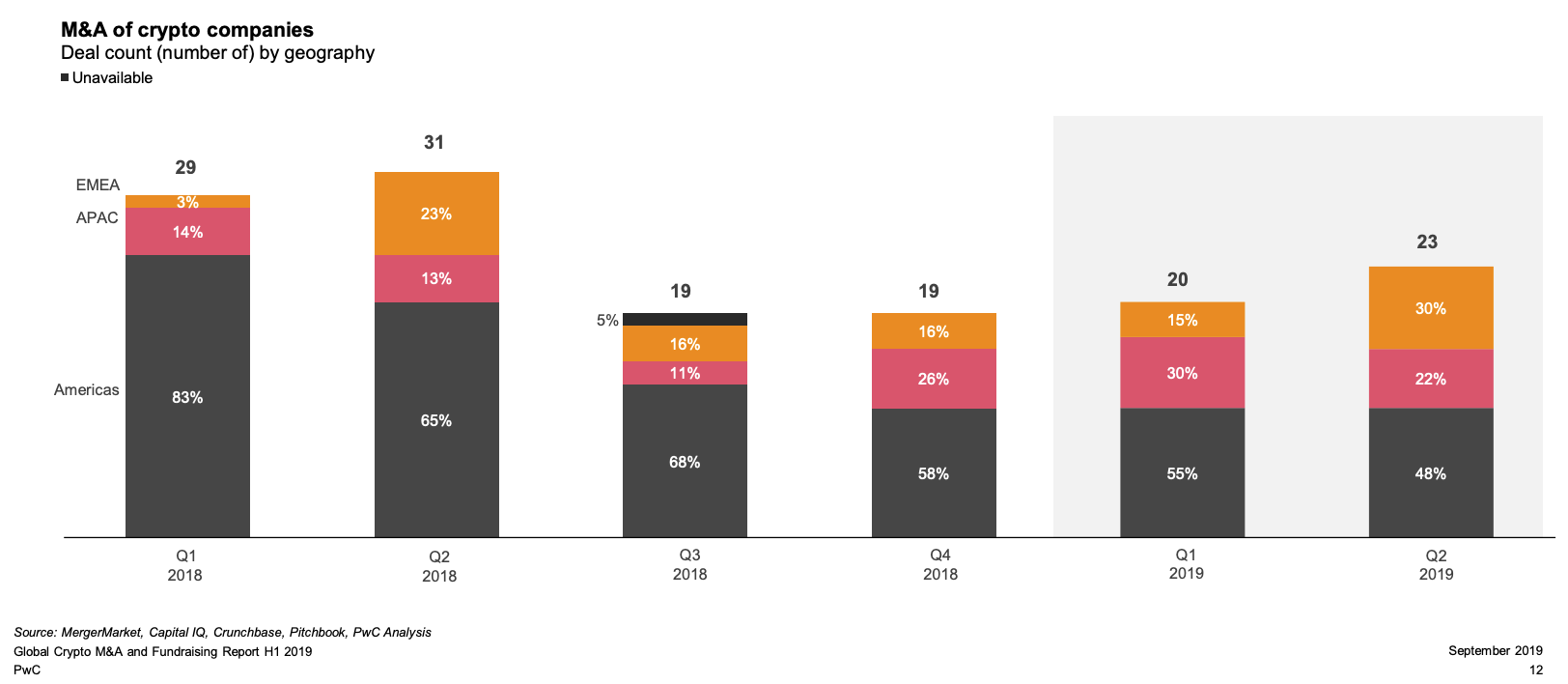

Crypto M&A activity

In terms of M&A activity, H1’2019 saw 43 crypto deals, the majority of which taking place in the Americas.

M&A of crypto companies, Deal count by geography, PwC, September 2019

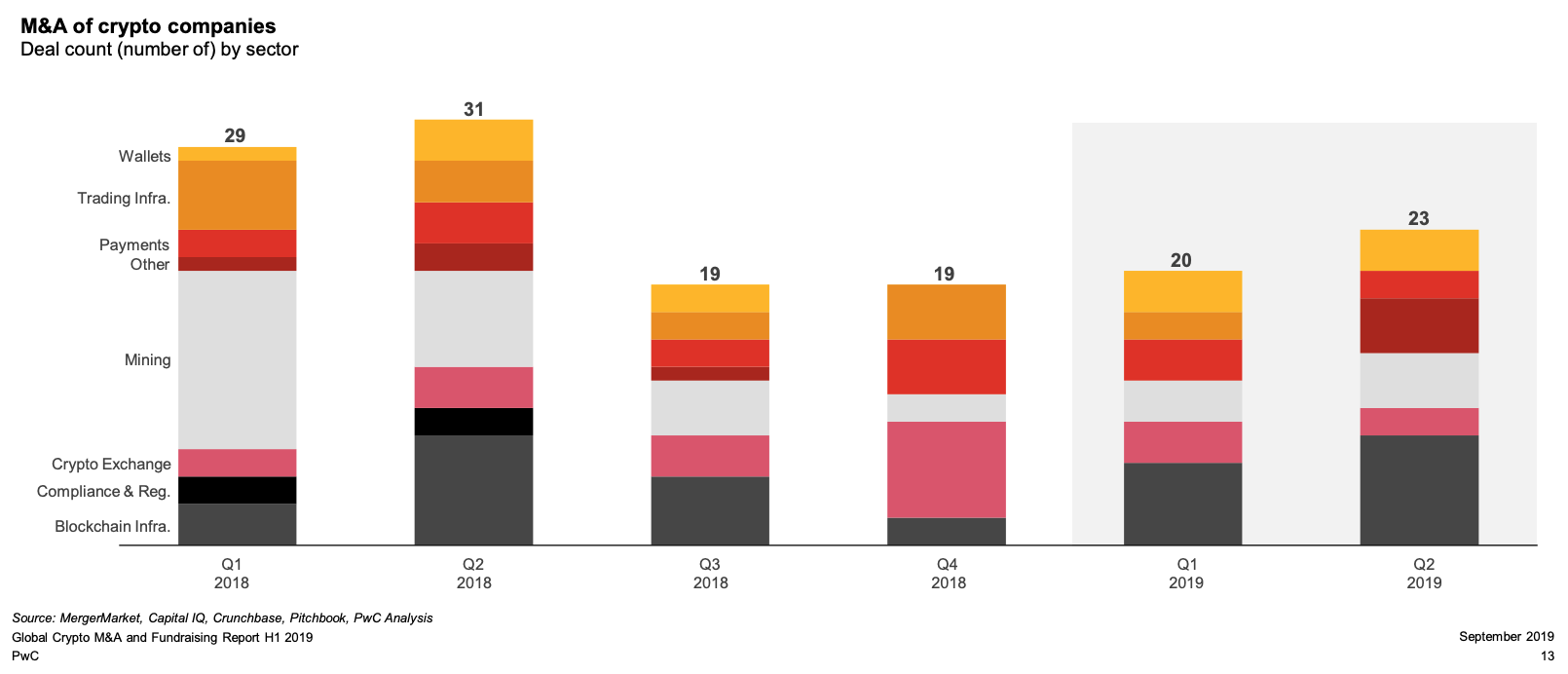

Besides the crypto mining sector, which has consolidated with numerous M&A deals in H1’2018, the report says that activities in other sectors remain largely unchanged.

M&A of crypto companies, Deal count by sector, PwC, September 2019

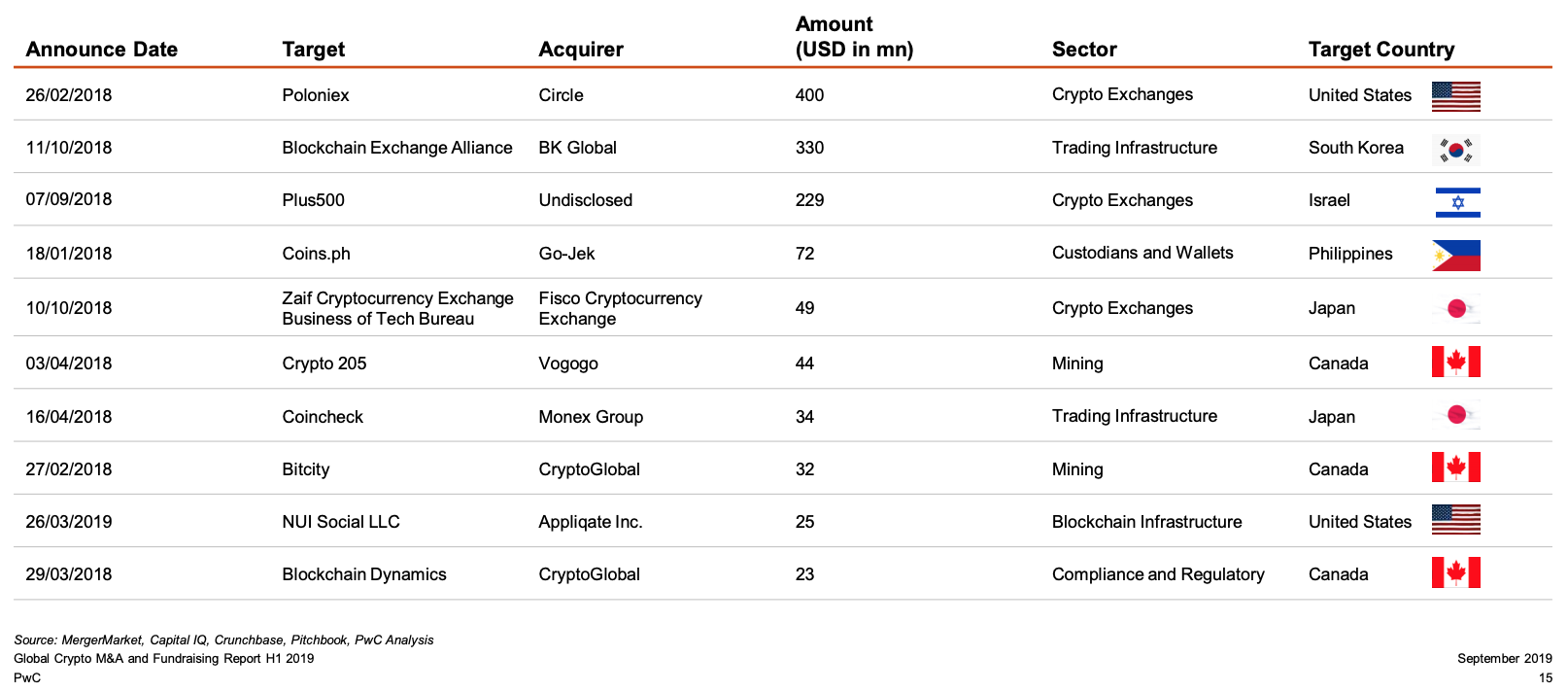

When it comes to M&A deal size, crypto exchange and trading infrastructure account for five of 2018’s ten largest crypto M&A deals. These are Poloniex, acquired by Circle for US$400 million, Blockchain Exchange Alliance, acquired by BK Global for US$330 million, Plus500, acquired by an undisclosed entity for US$229 million, Zaif, acquired by Fisco Cryptocurrency Exchange for US$49 million, and Coincheck, acquired by Monex Group for US$34 million.

Top 10 Crypto M&A Deals, PwC, September 2019

M&A deals that took place in H1’2019 include several acquisitions by crypto exchanges companies aimed at allowing them to expand more easily. Examples include Kraken’s acquisition of Crypto Facilities, an exchange registered with the UK’s Financial Conduct Authority by Kraken, as well as Coinbase’s acquisition of Neutrino, an Italian blockchain intelligence startup.

Among the major trends to watch for in H2’2019, PwC says it expects a surge in M&A activity as the price of bitcoin and cryptoassets have started going up.

“Recent market rally has brought confidence and firepower to some of the large industry players like crypto exchanges who may look to acquire and expand,” the report says.

PwC also foresees an increase in crypto fundraising activity as investors may aim to get exposure to crypto markets by backing institutional-grade companies.

The crypto industry should also witness further institutionalization, driven by recent macro events such as the forthcoming launch of Facebook’s Libra stablecoin project.

According to a CB Insights report, while 2018 was a year of reckoning for blockchain, 2019 is showing signs of a rebound. Total market capitalization of cryptocurrencies has doubled since January 2019, and the space has seen a resurgence in corporate and institutional interest.

Bakkt, the subsidiary of the Intercontinental Exchange, is about to launch its bitcoin futures exchange and digital assets platform, and just this week, Santander announced that it has become the first institution to use a public blockchain to settle both sides of a US$20 million bond trade.