Insurtech Raising Plummets by 50% in Q1 2020 — Report Suggest COVID-19 As a Cause

by Fintech News Singapore May 5, 2020Despite the clear impact of COVID-19 on InsurTech investment worldwide during Q1, insurtechs saw a decline in funds raised compared to 2019.

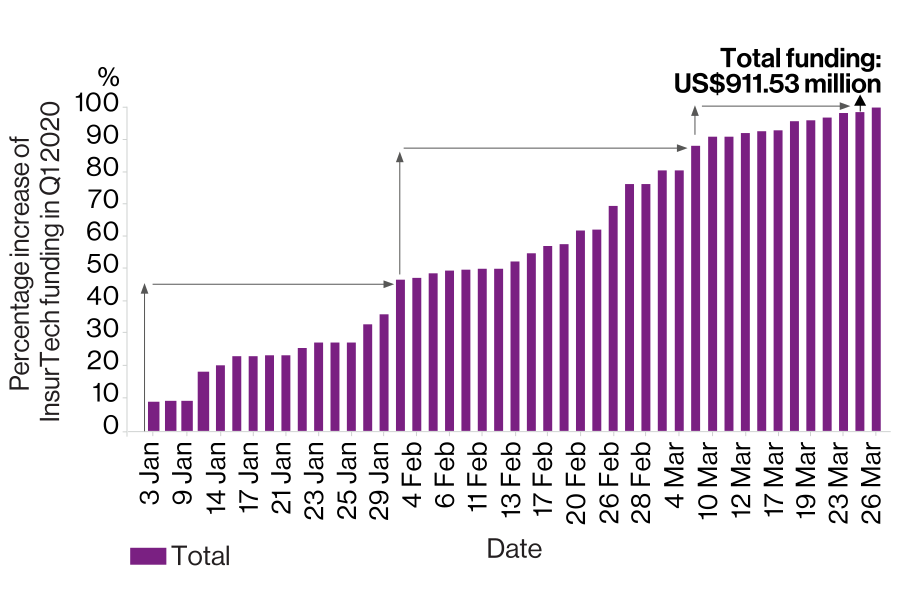

Insurtechs raised a total of US$912 million during the first three months of 2020, according to the new Quarterly InsurTech Briefing from Willis Towers Watson, a global advisory, broking and solutions company.

Deal count, at 96, was up 28% over Q4 2019, 10% more than the first quarter of that year. It is the highest number of investment rounds by transactional volume ever recorded by the Quarterly InsurTech Briefing.

Overall total funding was down by 54%, however, reflecting in part far fewer ‘mega-deals’ (US$100 million-plus deals) taking place in the year so far. In 2019, multiple unicorn-making rounds supported eight out of the ten InsurTech firms valued at over a billion US$ (giving five of them unicorn status in the process).

This most recent quarter, however, included no unicorn making rounds and only observed one mega-round — the US$100 million Series D issue by PolicyGenius.

Running total of funding decelerates/Total funding: US$911.53 million ; image via Willis Towers Watson

Seed and Series A financing was down 9% from the previous quarter, at US$223 million, but early-stage deal count rose three percentage points to 51% of all deals; as a percentage of all funding, early-stage deal investment was up 12 percentage points.

InsurTechs focused on property and casualty (P&C) insurance increased their share of total funding to 83%, the largest gap with life and health funding since Q3 2016. B2B-focused companies accounted for 55% of recorded deals in Q1 2020, a 121% increase from Q4 2019. The value of strategic investments by (re)insurers fell 8% from Q4 2019 and 43% from its highest point, reached in Q3 2019.

Andrew Johnston

Dr. Andrew Johnston, global head of InsurTech at Willis Re, said:

“This has been a particularly interesting quarter for global InsurTech. It is clear that COVID-19 has had a material impact on later-stage investments, and (re)insurers are holding back. Despite the very large percentage drop this quarter when compared with the last, we are still seeing a huge amount of activity in early-stage funding rounds, across a very large number of deals. The relative downturn of (re)insurer participation in this round would explain why we have seen fewer megadeals, affecting the overall amount raised significantly, which is not surprising as (re)insurers increasingly participate in later stages. Again, COVID-19 is a likely culprit for less engagement from industry capital as (re)insurers focus their attention on other, perhaps more pressing issues.”