In Asia Pacific (APAC), adoption of fintech applications including digital wallets is booming, according to a new study by Rapyd, a global Fintech as a Service company.

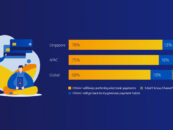

Rapyd, which surveyed 3,500 online consumers in APAC in March and April 2020, found that consumers across the region are rapidly embracing mobile fintech apps, with 77.6% of Indians, 77% of Malaysians, 70% of Indonesians, and 66% of Thai, having used a digital wallet app over the past month.

Financial application usage: eWallet versus card apps, 2020 State of Disbursements: APAC Outlook Report, Rapyd, May 2020

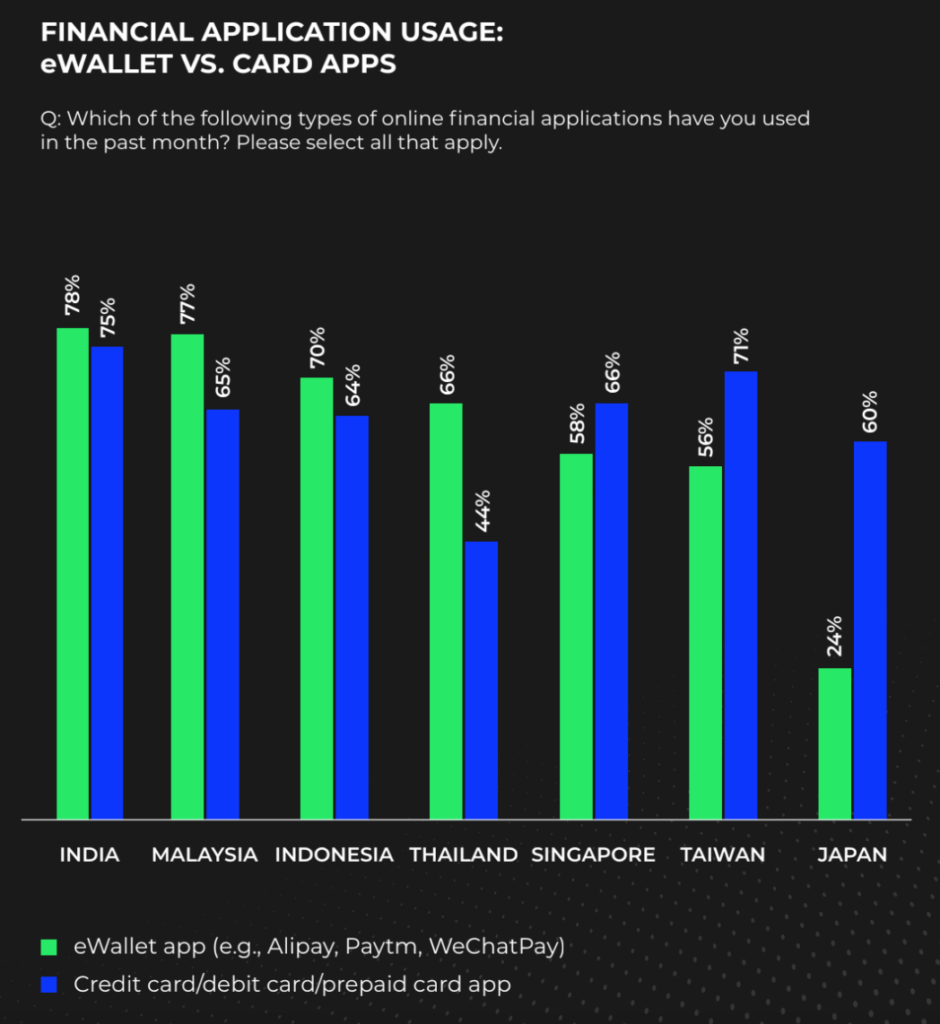

Breaking down the different categories, the research found that digital wallets are particularly taking off for personal transactions, such as personal repayments from family or friends, rebates, and sale of personal goods or services. 33.5% of Indians and 24% of Singaporeans chose it as their preferred option for peer-to-peer (P2P) transactions from friends or family members, and 38% of Indonesians prefer using a digital wallet to receive a product or service rebate.

Across the seven markets studied, India was found to the biggest adopter of digital wallet apps for both business-to-business (B2B) and P2P transactions, recording the highest usage rates with more than 50% of the Indians receiving regular payments or disbursements through e-wallet apps for self-employed contract work, the sale of personal goods or services, and allowances or remittances from relatives.

Disbursement methods, 2020 State of Disbursements: APAC Outlook Report, Rapyd, May 2020

Additionally, the research found that despite common belief that access to banking services and app usage is typically low in emerging markets, nearly every respondent (above 80% in most every country) said they had a savings account and debit card. In markets where cards are more dominant such as Singapore, Taiwan and Japan, consumers tend to more frequently visit their card app than independent digital wallet apps.

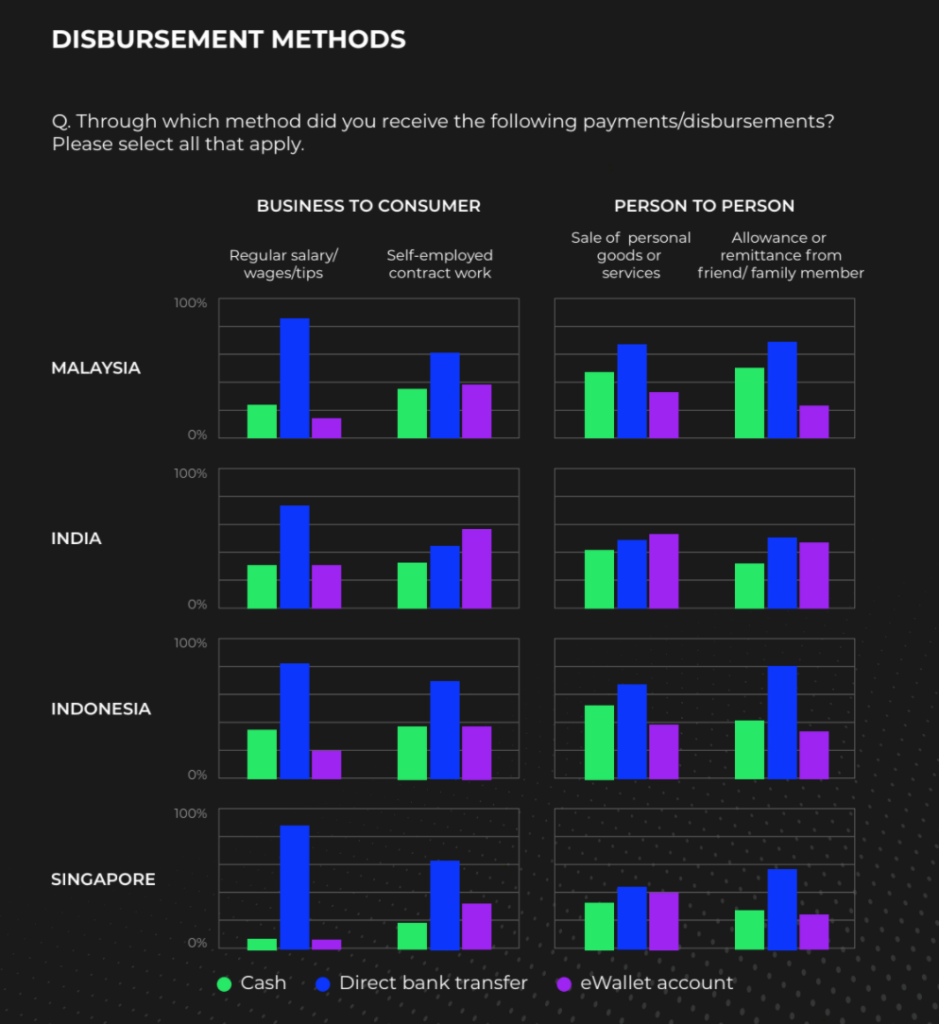

Across APAC, direct bank transfer was found to be the most popular transfer method and overall, the preferred one.

Top disbursement preference, 2020 State of Disbursements: APAC Outlook Report, Rapyd, May 2020

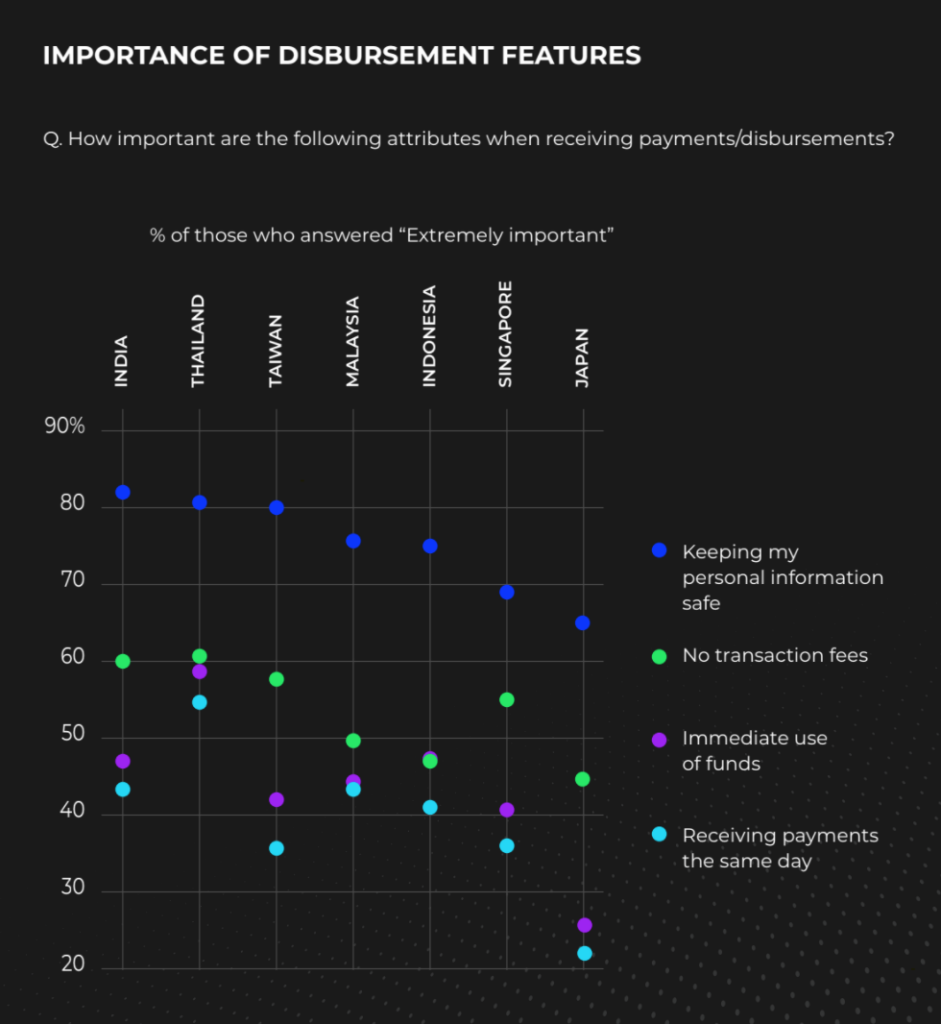

When asked about the most important features when choosing a disbursement method, users across APAC cited security, low fees, and speed. In India, 82% said keeping their personal information safe was extremely important, while about 80% of Taiwanese and Thais, and 68% of Singaporeans agreed.

The cost of disbursement was the secondary consideration with most respondents stating they didn’t want to be charged a transaction fee to receive funds.

Finally, respondents across most APAC countries cited speed with same-day or the ability to immediately use the funds as the third most important feature, implying that today’s consumers in APAC are demanding real-time payments.

Importance of disbursement features, 2020 State of Disbursements: APAC Outlook Report, Rapyd, May 2020

The findings from the Rapyd study coincide with a research released earlier this year by mobile app marketing company AppFlyer, which found that financial apps are surging in use around the world for digital banking, lending, investing and other needs.

Between 2018 and 2019, finance apps had jumped almost 90% in global market share, the research found. Finance apps represented about 4.5% of worldwide installations in 2019, compared with about 2.4% the prior year.

According to the study, the highest level of year-over-year growth is in emerging markets in APAC, Latin America, and Africa and the Middle East, where millions of unbanked and underbanked consumers are embracing mobile finance.

“The finance app industry is in the midst of staggering growth in global adoption, from 16% in 2015 to 64% in 2019,” said Shani Rosenfelder, head of content and mobile insights at AppsFlyer.