Startup of the Month: Smartkarma, A Marketplace For Asian Investment Research

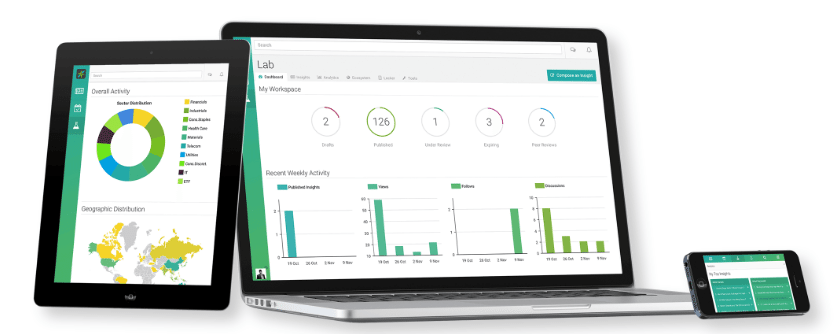

by Fintech News Singapore August 2, 2016For August’s startup of the month, we take a look at Smartkarma, a collaborative marketplace for Asian investment research and analysis that seeks to radically change the way market participants create, distribute and consume investment insights.

Founded in 2014, Smartkarma is a Singapore-based fintech startup that aims at being a trusted and unbiased information source, which combines intelligence from the world’s premier analysts, academics, data scientists and industry experts in one marketplace.

Smartkarma’s customizable platform helps investors optimize research spend and enhance returns while accessing the widest range of global analysis of the Asian markets available, allowing for global institutional investors to build their investment strategies.

With the “bold mission to change the way market participants engage with research,” Smartkarma has created a new model for investors to collaborate, add and extract value from tested and uniquely positioned global community.

“Our focus area is investment research, and we are on plan to completely reinvent how this multi-billion dollar industry operates by envisaging a whole new business and technology stack to match,” Raghav Kapoor, co-founder and CEO of Smartkarma, told Call Levels in an interview.

“In a short span, Smartkarma has become Asia’s largest independent and collaborative ecosystem for investment research. We can outrun any bank research model and do so at a fraction of the cost. This ensures fundamentally better outcomes for customers and brings unrivalled efficiency to a vast market.”

According to Daniel Liebau, founder of innovation research and advisory firm Lightbulb Capital, Smartkarma removes the agency problem in equities broking by unbundling cost for research from trade execution.

“In this context the Smartkarma team has built tools for independent equity researchers to dig deep into conglomerate structures and therefore create value for buy-side investment managers who in turn can use the researcher’s insights to make smarter investment decisions,” Liebau told Fintechnews in a recent interview.

Smartkarma has signed up about 80 institutions as contributors, including Morningstar Inc., and about 140 institutions as clients.

The startup has raised US$7.5 million in venture capital so far and is backed by Jungle Ventures and Wavemaker Partners LLC.

Smartkarma follows the likes of AIREX Markets in US and Electronic Research Interchange (ERIC), which are both providing online research products.

AIREX Market is a cloud-based marketplace for on-demand access to financially actionable applications, information and reports for investors. ERIC is a marketplace for substantive research for regulated institutions investors.

Other players that are providing financial data research, tools and analysis include YCharts, which focuses on the stock market; Rob Mundy’s Research Tree, an online investment research platform designed for private investors; as well as Stockopedia, an online stock market research service that offers stock ranking and portfolio grading tools.

Headquartered in London, Stockopedia has recently extended its coverage to Australia, New Zealand and key territories in Asia including India, Japan, Hong Kong, Singapore, Taiwan and South Korea.

—————————

you want to be featured as the Fintech Startup of the month? Make sure you have submited your Startup here