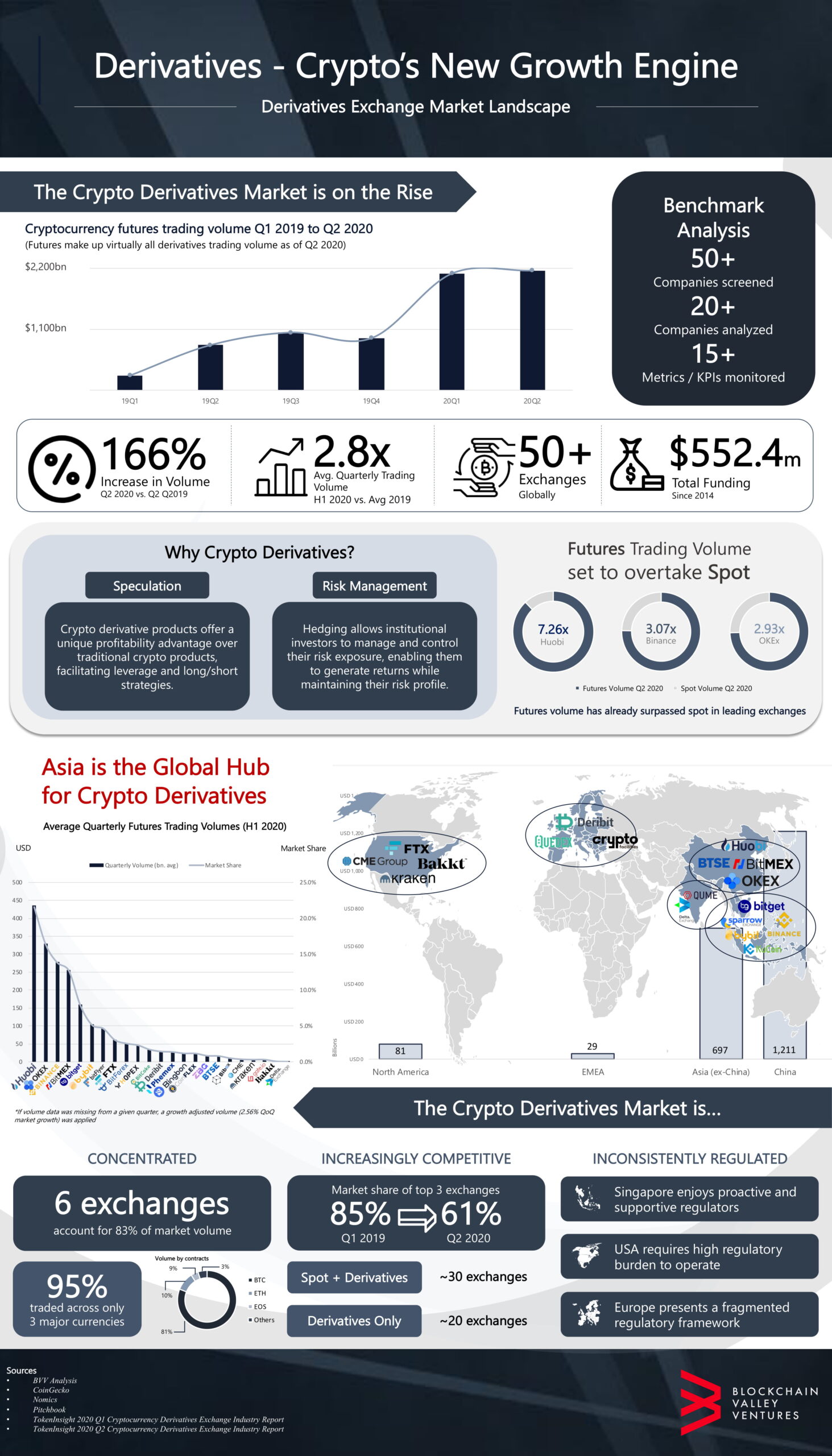

Asia’s Crypto Derivatives Market Overview and Infographic 2020

by Luca Burlando, Director at Blockchain Valley Ventures August 11, 20202020 has seen a major surge in product offerings catering to sophisticated and institutional investors in the crypto space. Exchanges around the world have recognised the importance of services such as institutional-grade custody, research & data analytics, prime brokerage and derivatives to institutional investors.

Derivatives specifically satisfy two of the core needs of institutional investors – increased profitability and risk management capabilities, and have therefore received a lot of interest from investors. Most notably, derivative exchanges have received the largest amount of institutional investment since 2014, comprising approximately 45% of total sector investment.

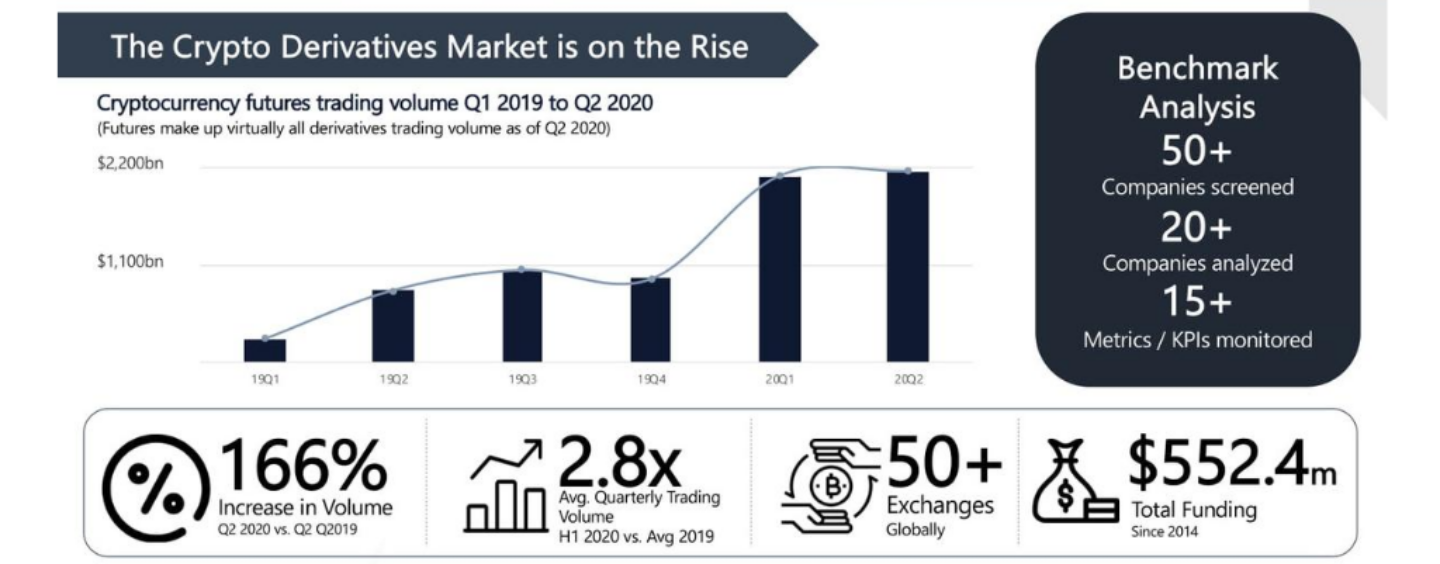

Blockchain Valley Ventures (BVV) conducted an analysis of top global derivatives exchanges, screening 50+ exchanges and conducting an in-depth analysis on the largest 20.

The crypto derivatives market is experiencing exponential trading volume growth, with Q2 2020 trading volume reaching USD 2’159b, a 166% increase from Q2 2019.

It is expected that the crypto derivatives market will continue its rapid growth and ultimately overtake the spot market in trading volume, as is the case in the traditional stock market. Market-leading exchanges (Huobi, Binance and OKEx) already experience higher trading volumes in the futures market compared to spot.

Derivatives market is concentrated on 3 main currencies and few large exchanges – but this might change

95% of trades in the crypto derivatives market happen across futures based on 3 main crypto currencies: BTC, ETH and EOS. At the same time, the top 6 exchanges currently take approximately 83% of all derivatives trading volume. This dominance by large exchanges is however increasingly challenged by new market entrants that specialise on new products such as options and derivatives on alternative crypto currencies.

Asia is the main trading hub for derivatives

Unlike in traditional finance, where most volumes are concentrated in Western economies, crypto derivatives are overwhelmingly traded on exchanges based in Asia. Singapore especially has been chosen by many companies as its operational base due to its reputation in the financial industry and its openness for innovation by regulatory bodies.

We will see a lot more product innovation in the coming months

We are just at the beginning – the pace of innovation is at an all-time high. With the market continuing to mature, we expect new products based on a new set of underlying assets to be announced in the future.

For more information, download the Crypto Derivatives Exchange Report.