Korea’s $2 Billion Unicorn Toss Join Forces With CIMB Bank Vietnam For In-App Banking Solution

by Fintech News Vietnam August 14, 2020Alongside big names like China and Singapore, South Korea is a rising star in the Asian tech giant battlefield. This nation of 50 million people is known for its tech-savvy population and general wealth – unsurprising for a country that is home to global brands Samsung, LG and Hyundai, etc. In 2019, it also became the world’s first to offer 5G network to smartphones. The fintech industry, as a result, has witnessed outstanding growth in recent years.

The expansion of the Korean start-up wave in Asia

South Korea is at the forefront of technological development with some of the world’s fastest and most extensive networks, making this country ideal for future digital growth opportunities. In fact, South Korea is the most digitally connected population today based on Euromonitor International’s Digital Connectivity Index, placing it just ahead of tech-savvy neighbors like Singapore and Japan

2019 also marks a breakthrough in the Korean start-up ecosystem, especially fintech startups, as Toss became Korea’s first fintech unicorn, confirming the country’s position as one of the leading tech hubs in the region and the world. Since its launching in February of 2015, Toss garnered over 48 million app downloads and processed over USD$10 billion in P2P payment in Korea and started to expand its business to Vietnam since 2019. In an emerging market like Vietnam, the unicorn had a different strategy to win over the young generation.

Toss deep push into financial services with Toss Card powered by CIMB

Toss is a South Korea-based mobile financial service platform operated by fintech start-up Viva Republica. Navigating away from the core business in Korea as a peer-to-peer payment service to effectively penetrate the Vietnam market, Toss launched the Step Counter app in September 2019 and has achieved 1 million users since then.

CIMB Bank, meanwhile, is one of Asia’s leading banks with extensive experience and expertise in the region. With new digital bank business as well as financial technology model, CIMB Bank Vietnam has been recognized as the Best New Digital Bank Vietnam 2020 by Global Banking and Finance Review.

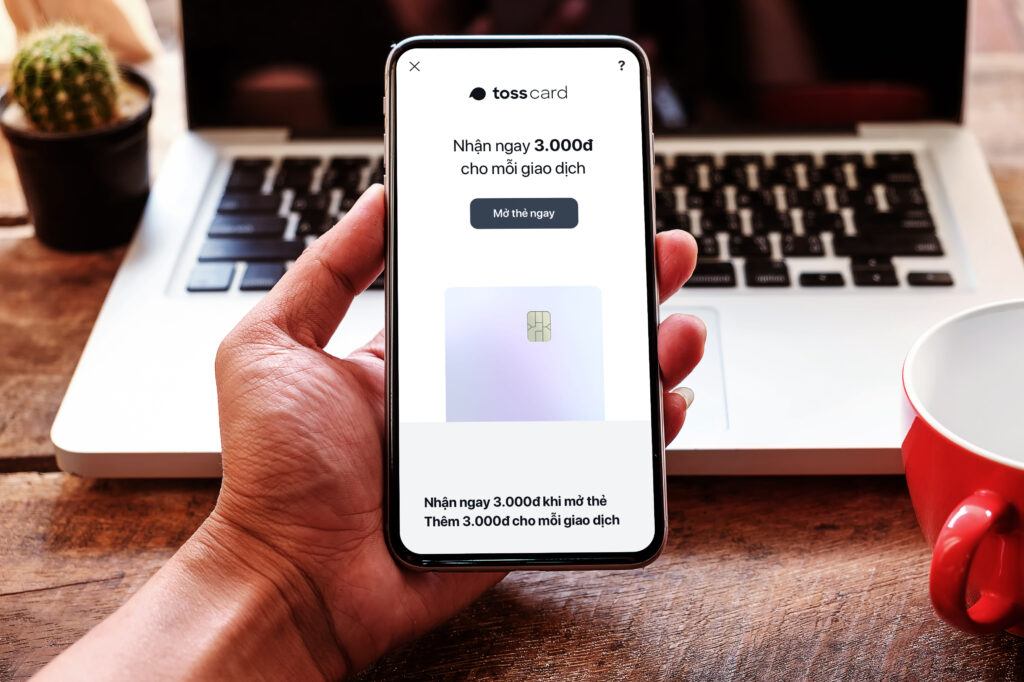

Toss Card powered by CIMB offers not only convenience but also a bunch of benefits for users

On the way to upgrade the Toss Step Counter app to a truly Fintech product, the collaboration between CIMB Bank Vietnam and Toss – “Toss Card powered by CIMB” has given birth to the country’s first-ever bank account that can be opened and maintained straight from the non-bank app!

Toss users in Vietnam will be able to open a ready-to-use virtual card right on Toss app with eKYC solution provided by CIMB, then after a few steps, users can top up money, manage card & enjoy their daily activities with REWARDS on ONE platform only. The integration of different utilities on the same platform creates high convenience for users.

Seung-gun Lee

“We’re very excited to launch this new service in Vietnam through the partnership with CIMB, and looking forward to provide more services to make easier financial lives in Vietnam.”

according to Seung-gun Lee, a founder and CEO of Viva Republica Ltd.

This is a case study of bank-tech partnership, a successful combination of banking expertise and technology platform plays, and the opportunities that allows both parties to access. By this partnership, CIMB and Toss being able to access established customer segments that are loyal to financial institutions, and lean on the bank’s experience of working in a highly regulated environment — leads to sustained growth and relevancy in a crowded, competitive market.

“We realized that FinTech collaboration is even-more essential for banks. Most banks understand that a positive last-mile experience and an engaging front end are critical to keeping customers happy and loyal. However, bringing back-end operations up to speed is absolutely another long story and require extended journey. That’s why we decided to join forces with mature FinTech like Toss to map, co-create products and innovatively enhance our most-critical comprehensive digital financial ecosystem”

Mr. Thomson Fam Siew Kat, CEO of CIMB Bank Vietnam said.

About Viva Republica (Toss)

Viva Republica delivers a full range of consumer finance services within its Toss mobile app launched in 2015, South Korea. From a P2P money transfer service that revolutionized the way people transfer money and created the P2P money transfer market, we now offer a full suite of personal financial platform services through our Toss app. Toss is one of the world’s fastest growing mobile P2P payment services, valued at 2.4 bil$ and handles more than $4 billion in monthly transactions. We design services that are simple, logical and intuitive to use without compromising security. For more information, visit https://toss.im/en.