DBS announced today the launch of a digital solution called “Map Your Money” which features an interactive dashboard whic can project a customer’s future retirement needs based on their current finances.

Alongside the new tool, DBS is also introducing a retirement planning portal that helps customers to better understand estate planning topics, with access to relevant services such as CPF nomination, will writing, and setting up a Lasting Power of Attorney (LPA).

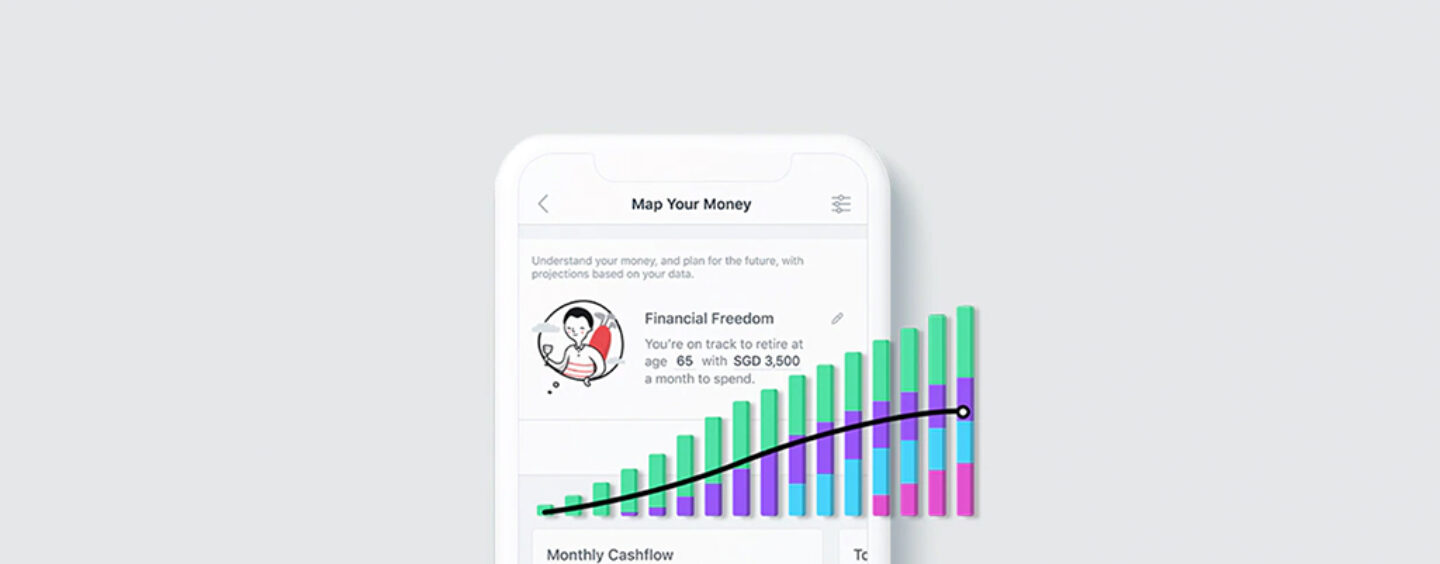

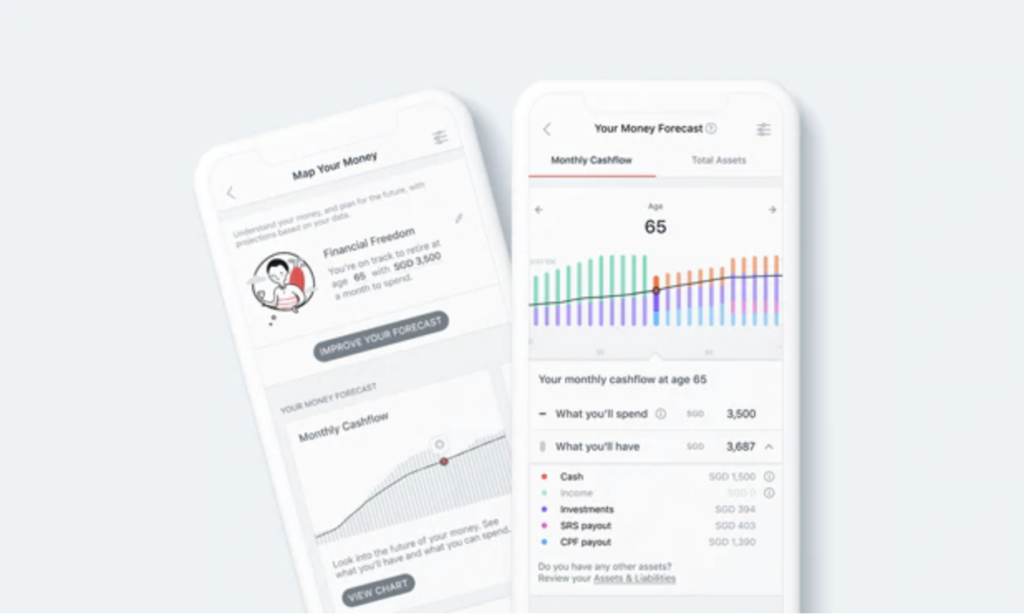

The “Map Your Money” function, which will be progressively rolled out from 2 August, pulls together customers’ existing assets held within and outside DBS, and projects their future income based on pre-defined assumptions, so they can better visualise their future cashflow situation via an integrated chart.

“Map Your Money” also integrates baseline CPF and SRS rules to provide a more convenient experience for customers when assessing their financial future. They can then choose from a menu of investment solutions, designed to be accessible to all, to boost their investment portfolios.

In a first-of-its-kind collaboration between the Central Provident Fund (CPF) Board and a bank, DBS and CPF are also working together to train the bank’s Wealth Planning Managers and loan specialists on CPF schemes.

DBS’ new solutions will help customers and their Wealth Planning Managers identify and address any blind spots or gaps in their retirement planning lifecycle. According to DBS’ data, a third of DBS’ customers presently have negative cash flow.

While most DBS customers know when they want to retire, they are less certain about how long their nest egg will last. They also do not know how to supplement their cash and CPF savings with investments.

Jeremy Soo

Jeremy Soo, Head, Consumer Banking Group, DBS Singapore, said:

“During these uncertain times when people are worried about declining incomes and outliving their savings, DBS has an even greater responsibility to extend our expertise in managing money and simplifying retirement planning for Singaporeans. Coupled with our partnership with CPF, we are offering Singaporeans an industry-first holistic retirement proposition that provides greater clarity around their financial future based on the assets they have, including those held under government schemes such as CPF and the Supplementary Retirement Scheme (SRS).”

Featured image credit: DBS